The debate over institutional investors’ increasing role in providing finance for long-term projects has “steered in the wrong direction”, according to Andrew Bosomworth, managing director at PIMCO Germany.

He said the term ‘shadow banks’, used for these investors by some critics and regulatory authorities, was an “exaggeration” and argued that institutional investors bore no resemblance to the unregulated banks for which it was coined decades ago.

Austria’s finance minister recently repeated criticism voiced by the International Monetary Fund that unregulated institutional investors risked “distorting” the lending market.

PIMCO’s Bosomworth, however, pointed out that, because banks could no longer provide capital on the same scale as they did before, “someone else has to step in”.

He also warned that asset managers were facing increased scrutiny from regulators, as the authorities feared that some products might suggest a liquidity that did not really exist.

A similar concern was voiced at the Swiss Pension Conference outside Zurich a few weeks ago.

However, Joachim Fels, managing director and global economic adviser at PIMCO, warned that, while the banking system had become “much more stable” in recent years, it was now more vulnerable when it came to liquidity shocks, as banks were holding more capital in reserve.

According to the results of PIMCO’s latest Secular meeting held on the long-term economic outlook each May, institutional investors are likely to continue to have to search for alternatives to traditional bonds in the years to come.

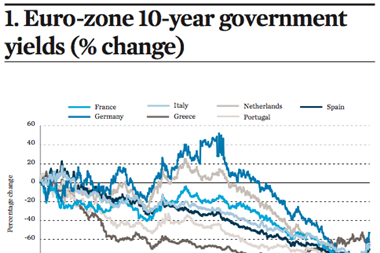

PIMCO’s analysts predicted that the neutral, real base rate for government bonds in developed countries would hover around 0% over the next 3-5 years, once central banks found the “right level” to balance out investments and savings.

“We have probably seen the bottom of the trough regarding interest rates in Europe now,” said Bosomworth.

PIMCO’s analysts estimated that basic yield would only be increased by an inflation premium, most likely the 2% set by the European Central Bank as target inflation, and a duration premium of 0.5-1% for 10-year-bonds on average.

Nevertheless, Fels said he did not anticipate a “great rotation” from bonds into equities, predicted by many in the current low-interest-rate environment.

“Some investors shifted a part of their portfolios into equities, but volatility remains a problem for many,” he said.

Bosomworth added that not all companies could “get money on the stock markets”, while governments had to continue to issue bonds.

He pointed out that, even with low interest rates, there was still demand for government debt.

Fels added: “Government bonds with low yields can be compared with an insurance premium, [where] investors pay for the low default risk.”