Top stories

UK launches ‘game changing’ Pension Schemes Bill

DWP says new bill will create a more ‘efficient, resilient pension landscape’, and lay the foundation for the upcoming Pensions Review

Italian fund overhauls strategy, awards €1.6bn in mandates

Latest round of manager appointments follows a broader decision by BCC CRA to diversify portfolios via new ‘specialist and balanced world mandates’

Finnish FSA rapped for overreach in draft pensions reform rules

Pensions lobby group TELA adds plea for disability risk management to be defined in law

PensionsEurope and EFAMA warn against slashing sustainability rules

Omnibus process should be fully wrapped up before the Commission continues with its work on redesigning SFDR

Pensions regulator calls on trustees to consider new options for endgame planning

TPR says it is ‘critical’ that trustees take advice and undertake an appropriate level of due diligence

PKG Pensionskasse appoints CIO to drive private markets expansion

The fund will look to increase its allocations to illiquid asset classes, including infrastructure, private equity and real estate

Reforms to boost UK growth will take several years to show results, says PPI

Institute says that if government policy reforms have their desired effect, data should start to reveal higher allocations to private markets and to UK assets

Heavyweight blended finance initiative to launch service provider

The public-private Hamburg Sustainability Platform, rebranded as SCALED, is backed by Allianz, AXA, CDPQ and Zurich Insurance Group

Swedish agency reveals specs for this autumn’s €11bn tech funds procurement

FTN says it will invite tenders for global active technology equity funds in late September, early October at the earliest

Norway defends legality of SWF’s Palestine-linked investments

UN rapporteur says 6.9% of GFPG invested in firms backing ‘egregious violations of international law’ in occupied Palestine

PME picks Candriam to manage European equity portfolio

Candriam will manage a concentrated equity portfolio initially worth €1.5bn, which is half of the €57bn fund’s existing allocation to European equities

PKG Pensionskasse appoints CIO to drive private markets expansion

The fund will look to increase its allocations to illiquid asset classes, including infrastructure, private equity and real estate

People moves: NEST creates chief technology, operating officer role

NEST, M&G Investments, ASIP, Fondaereo, Fondo Pensione Byblos, La Française, Axyon AI, Alter Domus, Stafford

Danish fraud squad drops charges against former Velliv CEO

Case around Steen Michael Erichsen closed, say police, two years after firing following breach of pensions firm’s internal rules

Viewpoint: How should institutional investors insulate from poor private equity performance?

2024 was by many measures another poor year for private equity. Against the backdrop of flat industry assets under management and falling capital raised, annual exits have now fallen to 50% of the levels seen in 2022. Cash distributions, aided by a range of financial engineering techniques rather than true ...

Viewpoint: Beyond the ESG backlash – what next for European asset owners?

European asset owners should seize the US retreat from ESG as a moment to evaluate and recalibrate their manager mandates, argues Colin Melvin

Viewpoint: Why Europe must adapt to the new geography of capital

In its attempt to attract investments from within and from beyond its borders, the EU cannot retreat to ‘defensive regionalism’

Nordic pension funds hold off on dialling down strategic US exposure

Danish pension funds favoured European equities in Q1, central bank data shows

IPE DACH Briefing: Pension funds retreat from the US while looking at Asia

Corporate pension funds are lowering their exposures to equities, the dollar and US Treasuries, and hesitating to commit new capital to private markets in the US

DACH pension funds adapt to US trade policies

US trade and tariff policies are prompting corporate pension funds in Germany and wider DACH region to review strategic asset allocation assumptions

ISSB grapples with biodiversity data deficit, human capital insights

The nature and impact of human capital risks and opportunities vary significantly by industry and regional circumstances

Systematica Investments CEO Leda Braga on the hedge fund's strategy

‘Ten years ago, we were the nerds, the geeks, and nobody was interested’

PenSam CIO Claus Jørgensen on the fund's focus on low-risk, high-quality pensions

Claus Jørgensen, CIO at PenSam, talks to Carlo Svaluto Moreolo about the Danish pension fund’s efforts to maximise pension payouts

TPT’s quest to support UK DB pension schemes

Peter Smith, investment director at TPT, the consolidator of UK DB pension schemes, talks to Pamela Kokoszka about the latest developments in investment management at the organisation

Claudia Wegner-Wahnschaffe: Public sector pension funds are a force for good

We have to protect our common European values, says EAPSPI chair

IPE Magazine May/June 2025

Read the latest issue of IPE Magazine

Browse the digital edition and find highlights from this month's issue below

Digital edition of IPE magazine

May/June Highlights

Get dirt rich to save the earth: Soil as an asset class

Nature can provide almost 40% of greenhouse gas reductions needed by 2030, according to research published in 2017 by the Nature Conservancy.

The scarce commodity of active management skill

Active management skill remains elusive but it can be identified by means of effective analytics, with common attributes such as trading skill and concentrated portfolios

European pension funds review global weightings in face of US turmoil

As global markets react to the threat of US tariffs, many European pension funds are looking to rebalance their portfolios and reset their investment policies

Italy’s Enasarco in talks to offer asset management services to third parties

The €9.3bn first-pillar pension fund for sales representatives seeks to expand the role of its own asset management company, Miria Asset Management

UK court cases spell trouble for passive shareholders

In the Allianz vs Barclays case, passive investors have been denied damages related to investments in companies releasing misleading information

The scarce commodity of active management skill

Active management skill remains elusive but it can be identified by means of effective analytics, with common attributes such as trading skill and concentrated portfolios

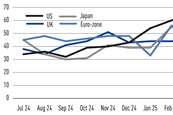

IPE Quest Expectations Indicator - June 2025

At last, we have some clarity about the nature of ‘Trump risk’ – it is about uncertainty and growth. Markets are signalling that the US president’s on-again-off-again policies are a threat to growth and stoking inflation even if his threats are not implemented.

- Previous

- Next

- Previous

- Next