Active investing – Page 5

-

News

NewsSwedish funds agency launches first tender worth SEK11bn

New agency established to procure funds for premium pension platform kicked off long-awaited tenders on Friday night

-

Asset Class Reports

Asset Class ReportsPortfolio strategy – Equities

Our report shines a light on investors’ thought processes when it comes to choosing active, passive or a combination of the two. We surveyed CIOs and senior portfolio managers to get an insight into how they construct their equity portfolios. Our report also features an investigation into the fall in listings on the UK equity market, at a time when listing domicile is increasingly consequential aspect of portfolio construction.

-

News

NewsNedlloyd finds combining engagement overlay with active management ineffective

The Dutch pension fund of shipping company Maersk has therefore ended its engagement overlay service contract with Columbia Threadneedle Investments

-

News

NewsBig bets against market drive excess returns at Norway SWF

‘Contrarian thinking was shorter duration, underweight equities, overweight energy, underweight IPOs,’ says former hedge-fund manager Nicolai Tangen

-

News

NewsPensionDanmark cites ‘very active’ equities management for avoiding worse losses

Danish labour-market pension fund posts negative returns of 6.5% and 4.3% for under-46 and 67-year-old profiles

-

Special Report

Special ReportActive ETFs: five myths debunked

Demand for exchange-traded funds (ETFs) has grown rapidly in Europe in recent years. While much of this growth has been driven by passive funds, research shows that investors are increasingly looking at active ETF strategies. Nevertheless, there are still lots of common misconceptions that are hindering the take-up of active ETFs. Here, we debunk the the most common myths about active ETFs.

-

Special Report

Special ReportGlobal emerging markets index investing: the case for an active component

Emerging market (EM) equities have an important role to play in broadly diversified institutional portfolios. Our data analysis shows that for investors who have a buy-and-hold strategy, an active component is needed to stay close to the benchmark because of trading costs and, more importantly, because of higher slippage costs by passive managers in downward markets.

-

Special Report

Special ReportActive ETFs: mixed fortunes

Tax efficiency and regulatory change have been the key drivers of the development of active exchange-traded funds in the US. As there are no similar tax benefits nor regulatory change in Europe, growth in this region has been limited.

-

News

SNS Reaal fund ditches EM fossil fuel producers

The move is part of the €4.2bn pension fund switch from mostly passive to fully active management in EM equities

-

News

New thematic ETFs seen increasingly as active investment vehicles

Investors also keen to see more focus on social issues, according to poll

-

News

NBIM’s London-based equities chief quits for job in SWF’s Oslo HQ

CEO Nicolai Tangen says Petter Johnsen’s move to Oslo in senior portfolio manager role is ‘perfect fit’ with NBIM’s plans to expand active management there

-

News

NewsNorway doubles SWF’s scope for unlisted renewable infra to €25bn

Finance Ministry publishes annual white paper on Government Pension Fund

-

News

NewsUkraine war wake-up call for Dutch passive investors, say consultants

The Russian invasion of Ukraine should catalyse the trend towards bespoke ESG indexes, it is thought

-

News

AP1 chief says mandate ‘encourages us to see past short-term noise’

Smallest of Stockholm AP buffer funds takes first place for returns with 20.8% 2021 gain

-

News

Norway’s SWF should get clear target for active return, say experts

Academics tell government that unlisted real estate should be part of benchmark again, if the asset class is deemed important for diversification purposes

-

News

Norway’s SWF backs aim of long-term net-zero goal

NBIM reveals in talks with Climate Action 100+ on signing up

-

News

NBIM unveils first steps in sustainability pre-screening project

Manager of SWF hopes to add to returns in long-term with new approach

-

News

NewsSwiss pension funds almost triple assets invested to cut CO2 emissions

Schemes have this year invested 22% of their assets based on active strategies leading to a reduction of CO2 emissions

-

News

Norway picks Dutch, Danish, Norwegian trio to weigh SWF management

Finance Ministry initiates new review of SWF’s management; panel to scrutinise basis for strategies Norges Bank uses

-

News

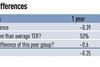

NewsIn-house funds weigh on Robeco pension fund returns

Despite last year’s poor returns, the fund’s active approach has still yielded slightly better results than passive investing