All Alternatives articles – Page 4

-

News

NewsPensionDanmark and Lærernes told to correct alternatives valuation processes

Danish pension funds handed orders from FSA to improve valuation methods for private equity, infrastructure and illiquid credit investments

-

News

NewsBlackRock to acquire private markets data provider Preqin

Deal marks strategic expansion of asset manager’s Aladdin tech business into fast-growing private markets data segment

-

News

NewsTPT Investment Management launches two alternative investment funds

The funds provide pension schemes with access to real assets and secure income investment opportunities

-

News

NewsLaborfonds invests €80m adding four alternative investment funds

The scheme’s ‘Linea Bilanciata’ sub-fund returned 6.57% net on assets invested

-

Country Report

Country ReportSweden’s AP7 adapts by expanding asset classes and boosting staff numbers

Under new leadership, Sweden’s default fund in the premium pension system is expanding asset classes and personnel

-

News

NewsAlternatives exposure drags on returns for Dutch metals schemes

PME has been increasing its exposure to private equity, real estate and forestry

-

News

NewsNBIM backs simpler targets to achieve long-term sustainable investments

NBIM climate lead said the fund’s long term views enables it to step out of certain ‘highly politicised discussions’.

-

News

NewsDanish pension fund trio invests $160m in US nature restoration fund

Sampension, AP Pension and Lærnernes Pension contribute nearly a quarter of Ecosystem Investment Partners V’s total capital

-

Features

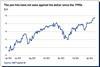

FeaturesUS economy continues to surprise

The resilience of the US economy continues to confound observers. The Federal Reserve’s 11 hikes in interest rates over the course of 2022 and 2023 were implemented to rein in economic strength and to stifle inflation. Scroll forward to the second quarter of 2024 and both inflation and economic activity are still higher than expected.

-

News

NewsCassa Forense seeks asset managers for investment vehicles worth €4bn

The lawyers scheme is creating the two vehicles to streamline investments and administration of its assets

-

News

NewsAP3 CEO wary of social media manipulation in election year

Staffan Hansén gets up close to US forestry asset while staying aware of 2024’s potential for global political change

-

News

NewsDAX company schemes continue alternatives expansion, says WTW

Total pension assets increased in 2023 by 4.9% to €257bn

-

News

NewsVER chief welcomes private markets pause, but warns on costs

Finnish pension fund CEO says weaker performers will be pushed out of the race with halt of private markets growth

-

News

NewsATP agrees with critics that illiquids weighting is too high

Danish pensions heavyweight defends guaranteed model, saying it remains what lawmakers want

-

News

NewsGerman church pension scheme sets up alternative investments division

Allocations to real estate, private equity and infrastructure make up 40.6% of EZVK’s €13bn assets

-

Features

FeaturesContrasting global economic growth fortunes

Economic growth patterns across the world paint a picture of contrasts, ranging from surprisingly robust in the US to soft and struggling in China, with the stagnant euro area narrowly avoiding a technical recession after posting zero GDP growth in the fourth quarter of 2023, following a 0.1% decline the previous quarter.

-

Opinion Pieces

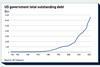

Opinion PiecesUnder the spotlight: US pension plans and their use of leverage

Does US public pension funds’ use of borrowed money and derivatives pose systemic risks to global financial markets? That is the concern of global regulators, which have recently stepped up scrutiny of the practice, according to a recent article in the Financial Times (FT). But senior executives interviewed by IPE seem less worried.

-

News

NewsVER private assets target unlikely to rise, says CEO

State Pension Fund of Finland grapples with investment strategy implications of new phase of higher outflows

-

News

NewsCometa proposes FoF with protection mechanism for direct investments in Italy

the fund is ready to pilot a project with Cassa Depositi e Prestiti to channel capital to support the real economy

-

News

NewsBlue Owl, Lunate sign private markets JV

Partnership to target minority stakes in mid-sized private market managers