Asia-Pacific: Pensions and Investment News and Analysis – Page 4

-

Opinion Pieces

Opinion PiecesAustralia: Political risk on the agenda for super funds

Australia’s cash-rich super funds allocate more to international equities than to their domestic counterparts. International equities are the largest single allocation.

-

Features

FeaturesFixed income, rates & currency: disappearing safe havens

Risk markets have been having a torrid time of late. ‘Risk-free’ government bond markets are not providing any safe havens in these storms, with curves steepening and considerable volatility in longer rates.

-

Features

FeaturesYen’s swift dive surprises market

For several decades, the Japanese yen has not been in the limelight too often. However, earlier this year it became headline news as the currency began to depreciate rapidly against the US dollar. Although investors were not overly surprised that the yen would weaken, the speed of its decline was certainly startling. Over the course of about 15 months, between the start of 2021 to early April 2022, the yen has lost about 25% of its value against the dollar, with nearly half the move occurring in that final month.

-

Features

FeaturesAhead of the curve: China treads a careful path

Since the Tiananmen Square protests in 1989 the Chinese Communist Party has not put a foot wrong domestically. It has pursued economic growth alongside social cohesion, entrenching its prime objective of staying in power.

-

Opinion Pieces

Opinion PiecesAustralia: A new sense of unity over superannuation funds

Australia’s leading political parties appear to have called a truce over often-politicised issues in the superannuation sector in the lead-up to this May’s Federal election.

-

Asset Class Reports

Asset Class ReportsEmerging markets: Investors stay positive on Chinese investments

Many Western investors are staying put in China. But Russia’s invasion of Ukraine has given them pause over what might change their stance

-

Asset Class Reports

Asset Class ReportsEmerging markets: Global or local?

For emerging market strategies, it is difficult to establish a clear link between performance and local presence

-

Asset Class Reports

Asset Class ReportsPortfolio strategy – Emerging markets

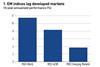

It is no secret that while investments in emerging markets promise to deliver superior returns, thanks to their exposure to faster-growing economies, actual performance has been volatile and, at times, disappointing. Over the past decade, emerging market indices have outperformed, as have fund strategies.

-

Features

FeaturesInvestors sceptical on Tokyo equity market reforms

In April, the Tokyo Stock Exchange (TSE) implemented its biggest overhaul in over 60 years in an attempt to attract foreign investors. However, many industry experts see the move as largely symbolic and believe more needs to be done to create a roster of high-quality companies with strong corporate governance practices.

-

Opinion Pieces

Opinion PiecesLetter from Australia: Trustee accountability in focus

Despite having billions of assets under management, Australia’s superannuation funds have share capital ranging from as little as A$12 (€7.9) to A$100 (€66.2).

-

News

Pension funds in Nordics stick with China exposure but alert to risks

KLP’s Koch-Hagen says geopolitical shifts could make China a greater source of diversification - or else a riskier investment

-

Features

FeaturesJoseph Mariathasan: India’s NPS reaches $100bn in assets

India’s state-run voluntary defined contribution New Pension Scheme (NPS) has reached a milestone of $100bn (€88bn) in assets and is likely to double in size every five years, according to renowned economist Ajay Shah. There are many lessons to be learnt from the success of the NPS, particularly for developing countries seeking to create pension safety nets for their populations from scratch.

-

Opinion Pieces

Opinion PiecesLetter from Australia: Global firms circle last bank-owned super fund

Several global firms, including private equity giant KKR and asset manager Vanguard, have thrown their hat in the ring to buy one of the last Australian bank-owned superannuation businesses.

-

Opinion Pieces

Opinion PiecesLetter from Australia: Superfunds focus on retirement income

When you’ve spent as much time around superannuation as I have, you get to see a lot of eggs,” says senior corporate regulator Helen Rowell. “Images of eggs, usually in nests, often painted gold, frequently laying on a bed of $100 notes.”

-

Opinion Pieces

Opinion PiecesLetter from Australia: Private gain as Australia’s infra assets change hands

Australian superannuation funds are playing a key role in the largest takeover yet of an Australian infrastructure asset, Sydney Airport, for A$23.6bn (€15bn) in cash.

-

Opinion Pieces

Opinion PiecesLetter from Australia: In need of a broader asset pool

With a market cap of just A$2.7trn (€1.75tn), Australia’s ASX stock market is increasingly overshadowed by a rapidly growing pool of super savings which now exceed A$3trn.

-

Book Review

Book ReviewBooks: How a small island helped shape modern China’s world view

The Gate to China: A New History of the People’s Republic & Hong Kong by Michael Sheridan, HarperCollins, 2021

-

Features

FeaturesStrategically speaking: IFM Investors

When IFM Investors and its fellow consortium members cracked open the bubbly last month on their successful bid for Sydney Airport following a third revised offer, it marked a bet on a vigorous and sustained recovery in passenger aviation. After all, airports globally, including Sydney, had come to resemble “parking lots for planes”, in the words of IFM Investors CEO David Neal.

-

Opinion Pieces

Opinion PiecesLetter from Australia: Super funds: shame in a name

Named and shamed! Thirteen Australian superannuation funds have been forced to inform their million-plus members that they have failed an inaugural superannuation performance test mandated by the financial regulator, the Australian Prudential Regulation Authority (APRA).

-

News

European pension players turn to Asia to drive climate ‘breakthroughs’

Aviva, BMO, Fidelity, LAPFF, LGIM, and PGGM are founding members of new engagement platform