Asia-Pacific: Pensions and Investment News and Analysis – Page 7

-

News

NewsESG roundup: BlackRock backs IFRS standards board proposal

Plus: TCFD looks into ’implied temperature rise’ metric, investors engage with miners on indigenous community rights

-

News

Norway’s oil fund council hires US non-profit to probe forced labour

Verité wins two-year contract to investigate SWF holdings possibly using bonded labour

-

News

Investors seek audience with Indonesian government over draft law

Investors fear Omnibus Bill on Job Creation will weaken environmental protection

-

Opinion Pieces

Opinion PiecesLetter from Australia: ESG stirs some ancient ghosts

In May this year, Rio Tinto blew up one of Western Australia’s most significant Aboriginal heritage sites.

-

News

Asset management roundup: ASI, BNPP create risk mitigation index

Plus: Man AHL, Baillie Gifford increase China access

-

News

AkademikerPension suspends Macquarie again amid new concerns

ATP quit dialogue with Australian bank at end of last year, following lack of answers

-

Opinion Pieces

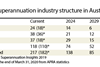

Opinion PiecesLetter from Australia: Pooling for savings and strength

The government, the regulator and economic fallout from COVID-19 have combined to pressure Australia’s large and unwieldy pool of super funds towards consolidation.

-

Special Report

Special ReportChina: Just a pit stop on the BRI journey

China has taken its foot off the pedal of its Belt and Road Initiative temporarily to deal with domestic issues and COVID-19

-

Special Report

Special ReportChina: ESG with Chinese characteristics

Pressure from international and domestic investors is driving an upsurge in ESG adoption by Chinese companies

-

Special Report

Special ReportChina: First in, first out

China is focusing on a new long-term growth strategy after the success of its tough measures to contain the coronavirus outbreak

-

Special Report

Special ReportChina: Western firms rethink their options

Many expect the disruption caused by the COVID-19 pandemic to prompt western companies to distance themselves from China

-

Interviews

InterviewsInterview: Dambisa Moyo on the geopolitics of global debt

When asked a simple question about global debt, economist and author Dambisa Moyo introduces a far more complex discussion about geopolitics.

-

News

NewsMacquarie brings Australia DC-tested ‘True Index’ strategy to UK

Asset manager sees UK market beginning to resemble countries long dominated by DC schemes

-

Opinion Pieces

Opinion PiecesLetter from Australia: Paltry pickings in the political pie

As deficits mount in a post-COVID-19 world, politicians and bureaucrats are again eyeing national pension savings – hundreds of billions of dollars they can capture at the stroke of a legislative pen.

-

Features

FeaturesAhead of the Curve: The trade war and Asia

The rivalry between the US and China looks set to dominate Asian affairs in the future and cannot be ignored by responsible investors. The escalation of tensions at the start of Donald Trump’s presidency led to an increase in trade barriers and impacted growth; now a temporary truce has been agreed but uncertainty remains, as do tariffs on Chinese exports to the US. The new bilateral agreement is a positive step, but investors should take a long-term view; the economic and strategic rivalry looks set to continue and some sectors are better placed than others to adapt to this landscape.

-

News

NewsAustralia supports universal super with A$41bn tax money

‘Our current tax and benefit treatment of retirement incomes is a mess’

-

News

Natixis: Korean asset owners seek higher returns abroad

Korean pension funds have become ‘very aggressive’ in their hunt for returns

-

Opinion Pieces

Opinion PiecesModi’s India: The red lights are flashing warnings

Under Prime Minister Narendra Modi, India is facing an existential issue that is polarising the nation

-

News

Japan’s GPIF focuses on social bonds

GPIF joins forces with Islamic Development Bank to target green and sustainable sukuk

-

News

GPIF suspends stock lending on equity portfolio

The move is to better ‘fullfill its stewardship responsibility’