Asset Allocation – Page 11

-

News

NewsLPFA allocates £250m to pool’s new environmental solutions fund

The investment will go into a newly launched private markets fund focused on decarbonisation

-

News

NewsFunding resilience and strategic reallocation drive German pensions

WTW estimates that DAX companies faced a combined cost of €250m in 2024 to adjust pensions for inflation

-

News

NewsLocal Pensions Partnership launches climate solutions fund

Local government pension plan investment pool sees ‘secular tailwinds’ for climate solutions investing

-

News

NewsSOKA-BAU tweaks strategy as new investment rule comes into force

Construction industry pension fund will increase allocations to infrastructure, private equity, equities, and ‘riskier’ fixed income

-

News

NewsVelliv to shift more equities exposure to Europe, after €500m US sell-off

Denmark’s fifth-largest pension fund targets smaller European firms which don’t depend on exports to US

-

News

NewsStronger focus on transition alignment among UK pension schemes

Consultancy also finds that credibility of net zero targets has improved

-

News

NewsPension fund for German auditors and accountants eyes 5% infrastructure new foray

Move is a step in the right direction to having a uniform set of rules across Germany, says WPV

-

Podcast

Podcast#15 Leaders in Investment podcast: Conversation with Tracy Blackwell CBE, Chief Executive Officer of PIC

Tracy Blackwell CBE, Chief Executive Officer, PIC, in conversation with IPE Editorial Director Liam Kennedy.

-

News

NewsInvestors must rethink private markets allocations, says bfinance

Report from consultancy suggests investors ‘must rethink private asset modelling and allocation strategies’

-

News

NewsUS equity value funds must remove more holdings to meet ESG standards

New analysis finds that, on average, value funds face greater challenges in aligning with ESG criteria than growth funds

-

Analysis

AnalysisSweden: What you need to know about the changes to the AP funds

Sweden’s SEK2trn buffer funds system is set for major change as the number of funds shrinks to three

-

Interviews

InterviewsAlecta CEO: ‘It’s taken a lot of blood, sweat and tears, but we are on the right track’

Peder Hasslev’s has made a variety of investment strategy changes, including increasing the holdings in its equity portfolio

-

News

NewsDutch construction sector scheme ups exposure to high-yield credit

The change in allocation is taking place in the run-up to the fund’s transition to a DC arrangement as of 1 January 2026

-

News

NewsKåpan Tjänstepension makes first investment in IFAD sustainable bond

The proceeds of the issuance – SEK900m in total – will be used to finance IFAD’s development projects throughout the world

-

News

NewsSwiss federal railway scheme ups investment in equities while reducing bonds

Last year the pension fund achieved returns of 6.9% and a funding level of 110.8%

-

News

NewsDenmark’s PFA reduces equities overweight ahead of Trump’s tariffs

Copenhagen-based pension fund still sees global economy as strong enough this year to support positive stocks development

-

News

NewsIIGCC launches climate resilience framework consultation

The framework aims to help investors mitigate potential financial losses from climate impacts while leveraging sustainability and resilience opportunities

-

Features

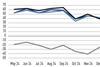

FeaturesIPE Quest Expectations Indicator - April 2025

Since 1900, the US has waged numerous wars but has won only three without allies. This is the sobering background for recent US geopolitical policy moves: changing sides from Ukraine to Russia, interfering in German elections and behaviour at the NATO ministerial meeting.

-

Features

FeaturesIPE Quest Expectations Indicator - March 2025

Political risk has risen to boiling point. Donald Trump’s talks with Russia to end the war in Ukraine, without as much as a Ukrainian presence, left the US without allies or credibility, especially in Europe.

-

Interviews

InterviewsE.ON: All charged up to build resilient investment portfolios

Stefan Brenk, head of asset management and pension finance at E.ON, tells Luigi Serenelli about the German utility’s approach to managing its pension assets