Asset Allocation – Page 15

-

Features

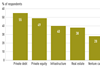

FeaturesIPE Quest Expectations Indicator - December 2024

Bond expectations falling, equity mostly flat

-

Country Report

Country ReportSweden's buffer fund AP4 considers doubling allocation to defensive equities

An overhaul of buffer fund’s dynamic normal portfolio is already under way in a bid to adapt to greater global uncertainty

-

Features

FeaturesThe effect of behavioural biases on active investment portfolios

It has been become apparent in recent years that behavioural finance has important things to say about how investors make decisions.

-

Features

FeaturesFixed income, rates, currencies: All eyes on Trump’s return

With the Republican Party now in control of both Senate and House, the leeway that President-elect Donald Trump will have to enact his pre-election policies could be considerable.

-

Analysis

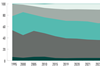

AnalysisNew research sees private markets investing entering a new era

New research charts the emerging and varied demands of private markets investors

-

Interviews

InterviewsHypoVereinsbank pension funds: Searching for sustainability in private markets

Markus Schmidt, director of asset management for the pension funds of Germany’s HVB, talks to Carlo Svaluto Moreolo about the schemes’ combination of strict liability and risk management with a broad growth portfolio and sustainability focus

-

News

NewsGeopolitical conflict tops concerns list for pension funds

To hedge against this risk, funds want to further diversify their portfolios, for example by increasing investments in private assets

-

News

NewsLGPS Central launches sterling investment grade credit fund

The fund was developed in response to discussions with West Midlands Pension Fund, which provided £650m in seed investment

-

News

NewsItaly’s CDC scheme to invest €1.1bn across equities, bonds, alternatives

The scheme will invest 72.4% of the €1.1bn planned for next year in bonds, 4.5% in equities, and 23.1% in illiquid alternatives, including real estate

-

News

NewsFondo Espero picks Eurizon to run new ‘Dinamico’ sub-fund

The pension fund has set up the new ‘Dinamico’ option for riskier investments, in addition to a life cycle investment option

-

News

NewsDutch pension funds increase short-term holdings

The increased liquidity reserves risk negatively impacting long-term returns, signals regulator DNB

-

News

NewsFondenergia picks UBS AM to invest sub-funds assets

Credit Suisse Italy is replaced by UBS AM in Garantito’ sub-fund and government bonds (excl euro) in its ‘Bilanciato’ sub-fund

-

News

NewsTrump wins: US ‘looking golden’ over the long term, says GAM

Trump returning to the White House raises questions about the fate of the sustainability agenda

-

News

NewsFirst UK pension fund allocates to bitcoin

Adviser Cartwright says it has ‘opened the door for risk-averse pension schemes to benefit from bitcoin’s potential growth’

-

News

NewsItaly’s pension fund for notaries ponders first move into private debt

Cassa Nazionale del Notariato currently has 3-4% invested in private equity and infrastructure funds

-

Country Report

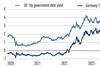

Country ReportSpanish country report 2024: Pension funds eye a new rate environment

Buoyed by strong returns, pension funds have been lengthening the duration in their fixed-income portfolios

-

Features

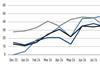

FeaturesIPE Quest Expectations Indicator - November 2024

Donald Trump has profited from climate change, which he believes unimportant, as this year’s hurricane season has so far seen more storms over a wider area.

-

Opinion Pieces

Opinion PiecesIs it time to add a new layer to strategic asset allocation?

For years, strategic asset allocation (SAA) has been a cornerstone of investment for pension funds and other institutional investors. Is sustainability a missing ingredient?

-

Country Report

Country ReportLower interest rates see Swiss pension funds adjust asset allocations

Lower rates are nudging Swiss pension funds to rethink their approach to fixed income and private markets

-

Features

FeaturesSoft landing likely again for US economy

It has been more than a year since the attacks by Hamas in Israel and tensions in the Middle East remain high, with a rising impact on financial market sentiment.