Asset Allocation – Page 19

-

Country Report

Country ReportCDC pension fund benefits from a steady stream of young members

The Cassa Dottori Commercialisti (CDC) is one of the most sustainable casse di previdenza, the Italian privatised first-pillar funds for professionals, thanks to prudent asset allocation and the CDC’s policy to attract young Italians to the chartered accountancy profession.

-

Country Report

Country ReportPrevimoda fine tunes for better results

In 2023, Previmoda, the pension fund for the fashion and textile sector, rejigged the strategic asset allocation of its sub-funds Smeraldo Bilanciato, which has a higher exposure to fixed-income, and the equity-focused Rubino Azionario.

-

Country Report

Country ReportENPAM looks to preserve cash flow

In February 2024, the board of ENPAM, the first-pillar pension fund for doctors and dentists, approved plans for the fund to transition to an asset liability management (ALM) model that will focus on liability-driven investment (LDI).

-

News

NewsPFA hails 27% gain on domestic equity portfolio, cites stock picking

Danish pensions heavyweight describes its level of home bias as ‘strong’

-

News

NewsHöchster Pensionskasse VVaG targets direct bond investments, avoids real estate

The pension fund expects real estate valuations to fall in 2024, which could impact dividends from indirect real estate investments

-

News

NewsNestlé pension fund launches new investment strategy

Under the new strategy, the scheme is reducing its exposure to real estate by 2 percentage points, while increasing its allocation to parallel bonds and listed equities

-

News

NewsSwedish church pension fund defends real estate surge, after FSA fine

Kykans Pension’s CEO says it doubled its holding in Stenvalvet — in the face of an SBB takeover attempt - purely to protect scheme members’ interests

-

News

NewsIIGCC finalises update to key net zero guidance for investors

‘NZIF 2.0’ brings together net zero investor guidance based on three years of implementation experience

-

News

NewsCredit Suisse Pensionskasse reviews strategic investment guidelines

The fund’s bonds allocation was increased, and the duration was extended

-

News

NewsNest Sammelstiftung freezes threshold for private markets allocation

‘The performance was not good compared to listed stock markets due to illiquidity,’ the scheme’s CIO says regarding its private markets portfolio

-

News

NewsAvon Pension Fund backs small caps as outperformance expected

Small caps will outperform S&P in the next 20 years, according to head of pensions at the Avon scheme

-

News

NewsDenmark’s IPD slams EU red tape as pensions money picks US over EU

Allocations to US equities now three times the size of EU ex Denmark weightings for Danish pension funds

-

News

NewsBVV invests €2.5bn in high investment grade bonds to strengthen portfolio

While its allocation to illiquid investments remained unchanged in 2023, the fund’s exposure to equities was cut

-

News

NewsPFZW sells €600m in gambling stocks

The Dutch healthcare scheme decided to divest from the sector following a member survey

-

News

NewsClimate remains core ESG focus for institutional investors, Morningstar finds

Climate, biodiversity, water, and reporting around Scope 3 emissions emerging as material factors in driving investment policy

-

News

NewsDutch construction sector scheme halves emerging market equity exposure

Beijing’s ‘excessive control’ on management of large companies has increased investment risk in emerging markets and depressed share prices in China, says BpfBouw

-

Features

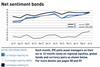

FeaturesMarket predicts US soft landing - June 2024

A combination of Federal Reserve chair Jerome Powell’s press conference and a slightly weaker-than-expected US April non-farm payrolls outcome succeeded in flipping the market back to a soft-landing narrative for the US economy. US Treasury bonds rallied sharply, taking other markets with them, while the yen weakened significantly against the dollar before recovering.

-

Features

FeaturesIPE Quest Expectations Indicator - June 2024

Trump and Biden are both losing to undecided voters, a group that is now unusually large and may be sensitive to Trump’s legal troubles. Biden’s approval rate is below his score in presidential polls, while Trump’s score is the same in presidential polls and those measuring voters’ opinion of him. In the UK, the Conservatives took another drubbing in the local elections.

-

Features

FeaturesWhy investors should focus on Scope 3 emissions

The investment industry is preoccupied with reducing Scope 1 and 2 emissions in portfolios to meet net-zero commitments. However, this focus will not provide a way to effectively manage climate transition and physical risk.

-

Country Report

Country ReportSweden’s AP7 adapts by expanding asset classes and boosting staff numbers

Under new leadership, Sweden’s default fund in the premium pension system is expanding asset classes and personnel