Asset Allocation – Page 25

-

News

NewsInarcassa’s new strategy sees cuts to equity in favour of bonds, infrastructure

Assets under management for first-pillar pension schemes, according to pension regulator Covip

-

News

NewsPension funds view private equity as ESG compatible asset, says Apex Group

Private equity and private debt have grown in popularity for pension fund allocators, with alignment to ESG principles gaining attention

-

News

NewsInvestment associations push Germany on separate infrastructure category

Current rules represent at times a ‘massive restriction’ to alternative investments, says German alternative investments association BAI

-

News

NewsNOW: Pensions increases investment with sustainable objectives to 82%

A total of 23 green, social or sustainable bonds now make up over 15% of NOW: Pensions’ portfolio, up from 13% last year

-

News

NewsUK’s NEST looks to add to illiquid assets

As at 31 March 2023, NEST was managing £29.6bn on behalf of scheme members

-

News

NewsSampension sticks to cautious equity tactics, with central banks in a bind

Danish labour-market pensions firm regrets early roll-back of equities exposure

-

News

NewsAustrian VBV increases fixed income exposure

The group’s Pensionskasse and Vorsorgekasse will also expand private markets investments

-

News

NewsInarcassa considers higher exposure to illiquids, infrastructure

The next strategic asset allocation could lead to wiping out liquid alternative investments from the scheme’s portfolio

-

News

NewsSpanish pension funds mirror global market surges with 2.3% return to June 2023

Asset allocation figures show that fixed income still dominates portfolios, although in declining proportions, with an average 55.3% allocation at end-June

-

News

NewsItalian pension fund quartet boosts private equity investments

Asset manager Neuberger Berman will invest in buyout and growth strategies, and mainly in companies operating in Italy

-

News

NewsPension funds to continue alternatives buying spree

Pension schemes believe infrastructure and natural capital investments such as forestry are best placed to deliver sustainability and impact objectives

-

News

NewsKPN pension fund to invest up to €700m in private debt

The €10bn pension fund considers the asset class a vehicle for impact investing

-

Features

FeaturesInversion anxiety: what’s up with yield curves in 2023

For over half a century, each time the spread between US 10-year and three-month yields turned negative, indicating an inverted yield curve, a recession followed, sooner or later. In 2023, the yield curve has been more than just a little inverted.

-

Features

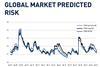

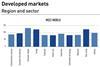

FeaturesQontigo Riskwatch - October 2023

*Data as of 31 August 2023. Forecast risk estimate for each index measured by the respective US, World and Emerging Markets Qontigo model variants

-

-

Features

FeaturesIPE Quest Expectations Indicator - October 2023

The Russian war in the Ukraine is still stalling, with the prelude of the US elections coming closer. Trump’s self-destructive utterings keep his followers unmoved but do nothing to convince independents.

-

Interviews

InterviewsIceland’s LV: Coping with disruption

Arne Vagn Olsen, CIO of Lífeyrissjóður verzlunarmanna (LV), Iceland’s Pension Fund of Commerce, talks to Carlo Svaluto Moreolo about strategy and the prospects for financial markets

-

Features

FeaturesFixed income, rates & currency: Lean times to follow good summer?

The macro-economic news in the third quarter has been good, with better growth than expected and better inflation data than feared. In the final few months of the year, however, markets may have to deal with the potential for some softer economic news and possibly more negative inflation data, and not just from seasonal factors.

-

News

NewsSOKA-BAU ploughs through strategic allocation targets

The scheme expects AUM growing to invest fresh money in all asset classes

-

News

NewsUniversal Investment to advise schemes through Alumia minority stake

Luxemburg-based Alumia advises institutional investors including asset managers and asset owners, corporates and family offices