Asset Allocation – Page 31

-

Features

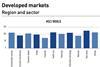

FeaturesIPE Quest Expectations Indicator May 2023

Russian air superiority over Ukraine is coming to an end due to lack of equipment. Destroying civilian targets is counterproductive and consumes ammunition. Bakhmut is eating into Russian resources, while Ukraine is being re-armed. History teaches that better technology, rather than numerical superiority, wins wars. But even a lopsided Ukrainian win would not automatically mean peace.

-

Features

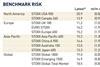

FeaturesQontigo Riskwatch – May 2023

*Data as of 31 March 2023. Forecast risk estimate for each index measured by the respective US, World and Emerging Markets Qontigo model variants

-

-

Interviews

InterviewsOn the record: A new role for alternative investments for Veritas

The degree of diversification that alternative portfolios typically provide can be less than many institutions think. Veritas has reorganised its alternatives portfolio to deliver better diversification

-

Features

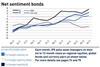

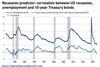

FeaturesFixed income, rates & currency: Chill winds prompt caution

Although 2022 was a remarkably bad year for bonds and equities, any hopes that 2023 might illuminate a brighter path have already been dispelled as rapidly changing narratives – from recession to boom to fears of a banking crisis – all tossed and turned stock and rates markets. The result was a remarkably turbulent first quarter.

-

News

NewsPrivate markets overtake public in financing the real economy, says Partners Group

Partners Group concludes that private markets will attract new entrants, including major established financial groups

-

News

NewsEvonik pension scheme to hike fixed income investments

The scheme plans a 10% increase in bond investments to 30%

-

News

NewsAP7 to invest 20% of total assets in alternatives

The buffer fund is looking into private equity, infrastructure and real estate

-

News

NewsNorway’s SWF balloons as forex effects, oil revenue outpace returns

NBIM reports 5.9% investment return for Q1 as equities gain 7.4% – but unlisted assets languish

-

News

NewsAP4 slashes transport holdings after green-shift fundamental analysis

Swedish state pension fund divests airlines, shipping, and traditional lorries while buying into US rail and niche players in truck freight

-

News

NewsFondenergia invests further €55m in alternatives

The scheme has allocated €20m to Azimut Libera Impresa’s infrastructure fund and €35m to Neuberger Bergman’s private equity fund

-

News

NewsNorwegian government moves towards adding unlisted equity to SWF

Annual white paper on SWF includes call for more analysis from NBIM on unlisted shares

-

Features

FeaturesIPE Quest Expectations Indicator April 2023

With new, superior equipment, the Ukrainian military is set to start an offensive soon. Meanwhile, Yevgeny Prigozhin, leader of the Wagner Group, is jockeying to become Russia’s next kleptocrat on the back of the Russian army. Donald Trump’s candidacy is increasingly beleaguered by defeats in court. The trade agreement on Northern Ireland between the EU and the UK is a significant boon for both as well as for Prime Minister Rishi Sunak, not because the trade flows are so important but because the issue blocked co-operation in many other fields. While the winter has been mild and beneficial, there are early signs of a dry spring, quite possible in view of climate change setting in. If that materialises, harvests, therefore food prices, will be affected in autumn.

-

Features

FeaturesQontigo Riskwatch – April 2023

*Data as of 28 February 2023. Forecast risk estimate for each index measured by the respective US, World and Emerging Markets Qontigo model variants

-

-

Features

FeaturesAhead of the curve: Introducing the concept of a carbon risk-free curve

As global investors and companies progress towards their net-zero emissions targets, the concept of a carbon risk-free curve becomes increasingly relevant within the fixed-income market. In our view, this curve should provide a reference for evaluating the risk levels of bonds in relation to their issuers’ CO₂-equivalent (CO₂e) emissions and can therefore help investors to assess the impact of changes in CO₂e emissions on the yield spread of fixed-income bonds.

-

Features

FeaturesFixed income, rates & currency: Optimism fades on mixed data

January’s market optimism has been subsiding, as forecasts for inflation and US Federal Reserve policy shift the outlook further to the hawkish side. However, the macro picture is not clear. Markets hang on to every new piece of data to clarify the outlook, be it non-farm payrolls, the consumer price index (CPI) or the US Job Openings and Labor Turnover Survey (JOLTS).

-

Opinion Pieces

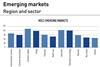

Opinion PiecesEmerging market investors should take the long view

For institutional investors, investing in emerging markets is a true test of fiduciary duty. The asset class – if it can be defined as such – has enormous potential, yet it is also risky, not just in terms of volatility but also of reputation.

-

News

NewsAlecta’s board orders immediate strategy probe after US bank losses

Swedish occupational pensions giant says its First Republic Bank investment risks being completely lost too

-

News

NewsAlecta says it’s solid despite losing €1.3bn on US banks in days

Silicon Valley Bank, Signature Bank collapses erase 1% of Swedish pensions giant’s portfolio