Asset Allocation – Page 33

-

Features

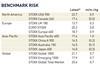

FeaturesQontigo Riskwatch - February 2023

*Data as of 30 December 2022. Forecast risk estimate for each index measured by the respective US, World and Emerging Markets Qontigo model variants

-

Features

FeaturesIs the US heading for a soft landing?

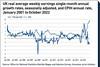

Rare though they are in history, a soft landing for the US economy seems to be the consensus forecast, a view aided by news of a sharp contraction in the Institute of Supply Management (ISM) Services Purchasing Managers index in December. The jobs market also looks like it is slowing down and there are signs of a cooling off in wages, with lower-than-expected average hourly earnings reported in December’s non-farm payroll report.

-

Interviews

InterviewsImpax rides the sustainability wave

One investment analyst sums up Impax Asset Management as a “pure sustainability play”. And certainly, according to founder and CEO Ian Simm, the core thesis of Impax is to “make the most of the investment opportunities offered by the transition to a more sustainable economy”. These are “on the scale of the Industrial Revolution”, Simm believes.

-

News

NewsNorway SWF loses 14% on assets in 2022 but stages a rebound in January

For first time, NBIM outperforms in a loss-making year

-

News

NewsPublica looks for real estate equity managers to invest in US, Canada

The pension fund plans to bolster its international allocation to real estate, adding Canada as a new market

-

Opinion Pieces

Opinion PiecesViewpoint: Climate-related scenario analysis – part of the problem or part of the solution?

‘I’ve yet to see a board of trustees that has made significant changes to its asset allocation as a result of scenario analysis,’ says Julis Pursaill at Cushon

-

News

Nordic pension funds tilt equity portfolios to value amid high inflation

Persistent high inflation could cause headaches for some providers, due to inflation-linked benefits - but hopes are high for slower price rises

-

News

NewsCompenswiss holds strategy as first pillar reform gives room for illiquid investments

It will receive additional funds through an increase of the VAT rate

-

News

NewsIndustriens boosts commitment to US climate venture fund

Danish labour-market pension fund cites good collaboration with manager DCVC as reason for committing more

-

Opinion Pieces

Opinion PiecesViewpoint: Escape from Flatland

A two-dimensional, return-and-volatility view of investments may not allow you to see important risks

-

Features

FeaturesIPE Quest Expectations Indicator - January 2023

Better air defence and the ground freezing over are steadily improving the outlook for Ukraine’s forces, now locked in stalemate. A series of blunders haunts US Republicans in general and Trump in particular. If Biden’s stimulus package is enacted, it will counteract Fed policy, possibly prolonging the series of interest rate increases. The EU seems to have bought too much gas. It has agreed to take border measures against some products from climate change laggard countries.

-

-

Features

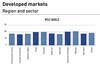

FeaturesQontigo Riskwatch - January 2023

*Data as of 30 November 2022. Forecast risk estimate for each index measured by the respective US, World and Emerging Markets Qontigo model variants

-

Features

FeaturesAhead of the curve: Is small cap the next mean reversion trade?

By now, most investors have noticed a rebound in value relative to growth in equity markets. After underperforming growth over the past decade, value stocks are experiencing strong mean reversion and outperforming significantly.

-

Country Report

Country ReportCentral & Eastern Europe: Kosovo Pensions Trust’s journey to maturity

10% contribution rate is low for the Balkans and changes could be afoot

-

Features

FeaturesFixed income, rates & currency: Inflation strengthens its grip

Whereas news of the hostilities in Ukraine may be losing their potential to shock and dislocate the world economic order, inflation news has maintained its powerful hold over financial markets across the world throughout 2022, with many economies recording their highest inflation levels for decades.

-

Interviews

InterviewsDutch medical specialists: focus on healthy pensions

Marcel Roberts (right), CIO, and Ravien Sewtahal, investment manager of SPMS, the Dutch pension fund for medical specialists, talk to Carlo Svaluto Moreolo about risk management and sustainability

-

Features

FeaturesResearch: Pension investing in an inflation fuelled world

Monica Defend and Amin Rajan highlight the big upheavals facing pension investors

-

News

Dutch pension giant ABP to cut investments by half in net zero drive

Hollands largest pension fund will focus on companies making committed pledges to decarbonisation

-

News

Norway’s SWF encourages contrarianism in new three-year strategy

NBIM to consider insourcing more in securities lending, technology, but believes external investment managers reduce its risk in some regions