Asset Allocation – Page 35

-

Features

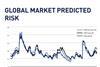

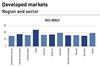

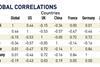

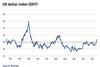

FeaturesQontigo Riskwatch - November 2022

*Data as of 30 September 2022. Forecast risk estimate for each index measured by the respective US, World and Emerging Markets Qontigo model variants

-

Features

IPE Quest Expectations Indicator - November 2022

In general, political risk remained the same, except in the UK. The Russian offensive against Ukrainian civil infrastructure is useless. If it should succeed, Russia has no means to exploit it militarily. Ukraine is set to recover Kherson. In the EU, France is trying to cope with a vicious strike that blocks petrol deliveries, but its side effect is a push towards hybrid and non-petrol cars. Japan is worried over implicit North Korean nuclear threats. In the UK political risk has increased fast with a crisis caused by government tax plans that has sapped trust on several levels. The data indicate that analysts believe that the wave of interest rate increases is near (if not over) its top and that bonds are now becoming more attractive than equities for the first time in many years.

-

-

Features

FeaturesAhead of the curve: Beefing up guardrails as risks rise in private credit

For US and European private credit firms, storm clouds are gathering.The recent rate hikes by the Federal Reserve, European Central Bank (ECB) and the Bank of England (BoE)have numbed activity in the leveraged loan and high-yield spaces.

-

Features

FeaturesFixed income, rates & currency: The return of extreme volatility

The emergency measures swiftly enacted by policymakers and central banks in March 2020, as we locked our communities, schools and businesses down, unsurprisingly created huge volatility in financial markets.

-

Country Report

Country ReportPortugal: Pension funds navigate uncertain times

Schemes are employing defensive measures to protect against portfolio risk

-

Country Report

Country ReportSpain: Industry gives a partial thumbs up to pension proposals

Can Spain’s new workplace pension system work well without auto enrolment?

-

News

NewsCapital markets having to get to grips with new status quo, says Keva CIO

Finland’s biggest pension fund reports 6.4% investment loss for year so far

-

News

NewsAustrian Pensionskassen cut equities, up alternative investments in H1

Austrian Pensionskassen returned -8.78% in the first half of this year, down from 7.63% recorded in 2021

-

News

Veritas manages slim positive return in Q3 despite plunging equities

Finnish pensions insurer thanks alternatives for counteracting listed equities decline in January to September

-

News

Danish pension funds’ global equity losses doubled in Q2

Financial watchdog expects more pension providers to impose withdrawal penalties on guaranteed products, depending on how buffers are faring

-

Features

FeaturesQontigo Riskwatch - October 2022

*Data as of 31 August 2022. Forecast risk estimate for each index measured by the respective US, World and Emerging Markets Qontigo model variants

-

-

Features

FeaturesFixed income, rates & currency: Central banks act tough

This year’s Jackson Hole Symposium, an annual high-level event sponsored by the Reserve Bank of Kansas, yielded relatively little policy news. But the fighting talk from the US Federal Reserve and others was striking. Fed chair Jerome Powell’s speech was markedly more hawkish than expected, while Isabel Schnabel, board member of the European Central Bank, referred to the need for central banks to act ‘forcefully’ because “both the likelihood and the cost of current high inflation becoming entrenched in expectations are uncomfortably high”.

-

Features

FeaturesAhead of the curve: Clearing up the ‘scaling’ confusion in carbon intensity

Today, a company’s carbon intensity is typically measured in one of two ways – scaling by revenue, or by EVIC (enterprise value including cash). The choice an investor makes can lead to differences in portfolio characteristics.

-

Book Review

Book ReviewBooks: How liquid are liquid assets?

Amin Rajan speaks to Pascal Blanqué about his latest book

-

Features

FeaturesIPE Quest Expectations Indicator: monthly commentary

Political risk has decreased. An attack in the north-east of Ukraine took the Russian army by surprise but did not cause collateral damage in Russia. Russians’ resistance to the war is mounting but far from a critical level. It looks like the EU will survive the winter without major energy disruption and caps on energy prices are falling into place.

-

News

AP4 actively seeking companies planning sustainable energy change

Swedish pensions buffer fund explains work with thematic investments focusing on resource-intensive sectors

-

News

NewsDutch pension funds’ private equity investments exceed €100bn

The rise comes as funds’ public equity investments have dropped to a multi-year low of €405bn

-

News

Investment Association members’ AUM reaches £10trn

UK continues to be leading centre for investment management, second only to US internationally