Asset Allocation – Page 36

-

News

NewsVBV Vorsorgekasse shifts to defensive strategy in challenging markets

The scheme moved away from risky assets, especially credit and equity, which were gradually reduced

-

News

NewsLucerne proposes funding review of city’s Pensionskasse

Parliament of the city of Lucerne – Grosser Stadtrat – is expected to discuss proposals put forward by the city council on 27 October

-

News

Pension funds ratchet up search for private market alternatives

At the same time new searches for listed equity and bond managers fell to new lows, with the exception of EM

-

News

NewsSwiss Pensionskassen continue to bump up infrastructure investments

More than a quarter of pension funds plan to increase allocations to infrastructure and 69% plan to maintain their current strategic allocation intact

-

News

AP7 sticks with emerging markets overweight despite drag in H1

Swedish national pension fund’s product loses 11.6% between January and June – but still beats private-sector options

-

Features

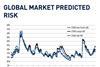

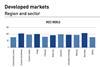

FeaturesQontigo Riskwatch - September 2022

*Data as of 29 July 2022. Forecast risk estimate for each index measured by the respective US, World and Emerging Markets Qontigo model variants

-

-

Features

IPE Quest Expectations Indicator - September 2022

The war in Ukraine is characterised by a build-up for the battle for Kherson. The result of that campaign is likely to have great political influence on both sides. Neither is capable of a surprise win, but time works against Russia. In the US, Trump’s legal troubles are serious and mounting, but any Republican successor may be even more destructive. The EU is running against time to prepare for winter. Both optimists and pessimists are over-estimating the ability of technicians to predict the future. Russia has lost the EU as a primary customer for its oil and gas. It must make up for higher distribution costs by offering significant discounts.

-

News

NewsGrowing alternatives portfolio saves PFA from worse H1 fate

Danish commercial pensions heavyweight suffers DKK214m business loss in six months, says mainly due to volatile financial markets

-

News

Varma neck and neck with Ilmarinen as hedge funds pay off in H1

Finnish pension insurance company joint number one in AUM terms with €56.7bn

-

News

Dutch agri fund sells lower-rated govvies

By reducing or eliminating its allocation to countries such as France and Italy, BPL Pensioen wants to prevent excessive exposure to highly indebted countries

-

News

Icelandic pension fund foreign allocations shrink after H1 rout, stronger krona

Pension funds hit by 5.4% investment loss in first half of 2022, with foreign assets alone losing 14%, central bank data show

-

News

NewsFondazione Enasarco to invest €500m in Italian bonds

One of the goals of the new strategy was is to cut real estate and increase exposure to liquid asset classes such as bonds and equities

-

News

NewsGeneva pension fund invests CHF100m in green bonds

CPEG also bought its first social bond issued by the canton of Geneva for CHF50m to finance projects with a positive social impact

-

Opinion Pieces

Opinion PiecesViewpoint: Trustees should treat biodiversity as important as carbon emissions

Biodiversity loss carries the same level of existential threat as carbon emissions

-

News

NEST appoints HarbourVest as part of £1.5bn private equity push

New mandate will play an important role in helping NEST invest around 5% of its portfolio in private equity

-

News

NewsValida introduces inflation-linked bonds with new strategy

Pensionskasse and Vorsorgekasse both increase its equity allocation but made cuts to euro zone government bonds, among other things

-

News

Sampension pushes on with inflation-linked bonds, real assets build up

Danish pension fund uses perceived mispricing, systematic rebalancing tactics to add extra returns

-

News

Migros Pensionskasse cuts CO2 footprint to reach 2030 target

The scheme adopted a Paris Aligned Benchmark to its foreign equity portfolio

-

News

Dutch physiotherapist scheme goes passive with custom-made ESG benchmark

The fund has swapped €400m in fund investments for a passively managed ESG mandate