Asset Allocation – Page 44

-

News

NewsGermany plans pension assets transfer to Euronext ESG index by 2022

The government will allocate 65% of total equity investments to the S&P index, and 35% to the Euronext index

-

News

City of Zurich Pensionskasse reshapes investment strategy

PKZH has assets worth CHF20.8bn (€19.4bn), a funding ratio of 123.1% and recorded returns on investments of 6.4%

-

News

KLP promotes Aziz to RI chief; plans to step up RI partnerships

Norwegian municipal pensions heavyweight pinpoints future areas of focus for its responsible investment work

-

News

Storebrand takes €170m Øygarden municipal pensions contract from KLP

Municipal director recommended choosing Storebrand because it offered lowest comparison price in the competition, local authority says

-

-

-

Features

FeaturesIPE Quest Expectations Indicator - October 2021

The much-feared post-summer holiday effect on COVID-19 contaminations did not materialise. The current wave started earlier and statistics are already trending down in the US, EU, UK and Japan, although still at a high level. Full vaccinations are over 60% in the EU and UK, with Japan catching up fast. Emerging markets are still significantly behind in tackling the pandemic.

-

Asset Class Reports

Asset Class ReportsAsset Allocation: Mixed prospects emerging

COVID and political risks may have affected EMs in different ways but there are still many opportunities in such a diverse asset class

-

Features

FeaturesFixed income, rates, currencies: Not quite back to normal

As the world struggles to get back to pre-pandemic conditions, with schools and offices open, economic forecasting seems even less predictable than ever. Take August’s US payrolls report, which again confounded most forecasters. Analysts scrambled to explain why the headline job gains were so weak, particularly after the huge (forecast-beating) gains the previous month.

-

Opinion Pieces

Opinion PiecesConsultants’ education role in net-zero world

Investment consultants play a crucial role within the savings and investments arena. They provide strategic advice to asset owners (pension funds, sovereign funds, endowments, insurers, and others) relating to strategy, asset allocation, asset manager selection and – now more importantly than ever – investment beliefs.

-

Special Report

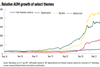

Special ReportTheme regime: thematic investing and asset allocation

Portfolio construction has come a long way from the early work of Markowitz back in the 1950s. In the late 1990s and early 2000s, investors found more sophisticated quantitative methods to assess risk, expected return and the associated investment opportunities through mathematical machinery such as factor modelling.

-

News

AkademikerPension’s board ramps up climate investment plan

Danish labour-market pension fund nearly doubles 2030 target for ‘climate-friendly’ investments

-

News

Iceland PFs’ currency ceiling should rise, says ex-central bank chief

In official report, Már Guðmundsson addresses many issues around the position of pension funds in the economy

-

News

NewsGerman pension schemes often opt for Masterfonds mandates

Unpublished figures point to a 75-80% estimate of assets managed via Masterfonds

-

News

Danish pension funds have room for yet more alternatives: Central bank

Higher allocations to unlisted equity, infra, direct credit, RE could tighten liquidity in rising interest-rate scenario, warns Danmarks Nationalbank

-

News

IPE Top 1000: Top funds shift assets to equities and alternatives

European pension assets top €9trn

-

News

ERAFP tackles discount rate for best use of investment freedoms

French pension fund is gradually adding more equities and alternatives

-

News

NewsPME dumps fossil fuel investments

The pension fund for the metals sector and the technological industry is the first large Dutch scheme to divest entirely from fossil fuels

-

News

AMF backs ‘Swedish treasure’ investing SEK200m in ABBA comeback

Swedish blue-collar pensions firm takes 12% stake in Benny Andersson-founded Goldonder Investors

-

News

Pension fund for Dutch harbour pilots ditches factor portfolio

Loodsen has converted its equity portfolio to four passive regional funds