Asset Allocation – Page 45

-

-

-

Features

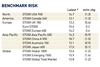

FeaturesIPE Quest Expectations Indicator - September 2021

The delta variant has caused a new COVID-19 wave in many places but it is different in character from previous ones. New hospital admissions are typically from among the unvaccinated. The average age of COVID patients has also come down significantly. In western Europe, the current wave seems largely under control, albeit at higher levels in the old EU member states.

-

Features

FeaturesFixed income, rates, currencies: Market signals cloud the picture

From preliminary data, Europe’s second-quarter growth appears to have been surprisingly strong, seemingly led by services, such as strong retail sales. Supply-side problems are still constraining the goods sector generally, hitting the German economy especially, with industrial production falling more than one percentage point over the second quarter.

-

Asset Class Reports

Asset Class ReportsOutlook: Inflation naysayers versus the Comeback Kid

The effect that even moderate levels of inflation can have on investments means its possibility should not be treated lightly

-

Asset Class Reports

Asset Class ReportsInflation report – Pension funds riding the wave

As the outlook for inflation becomes increasingly cloudy, European institutional investors try to focus on long-term trends

-

News

ATP cautious on H2 prospects after first-half investment gains

Work on track for formation of new portfolio by 1 January 2022, says CEO

-

News

NewsSweden’s AP7 boosts diversification with more risk premia, PE

AP7’s premium pension default product beats private-sector competitors with 17.6% H1 return

-

News

NewsUK’s NEST launches private equity procurement for £1.5bn allocation

Government-backed DC scheme looking for ‘innovative’ ways to access private equity, with focus on growth segment

-

News

Varma’s equities reach record 51% allocation after surging prices in H1

Finnish pension insurer sees solvency capital rise to €14.7bn from €11.5bn in six months

-

News

Tyne & Wear scheme committee proposes restructure in 2021-2024 plan

The transfer of assets to Border to Coast will exclude all assets in passive indexed investment vehicles

-

News

Gains on big tech stocks power Norway’s SWF to 9.4% H1 return

NBIM says biodiversity to become ‘area of priority’ for its ownership work

-

News

NewsIcelandic pension funds see 7.3% H1 returns; private savings hold up

Almenni reports 4.1% to 8.3% returns for balanced pension options

-

News

Nordic pension investors unruffled by China regulatory jitters

PBU says market developments have temporarily dented its expose to Asia

-

News

P+ CIO bullish as post-merger Danish PF hits assets milestone

Pension fund gets access to more attractive investment opportunities as its assets grow, says Kåre Hahn Michelsen

-

News

NewsSigTech paper foresees rise of custom in-house equity portfolios

By applying the concept of alternative indexing methods, investors can gain exposure to various risk factors that are optimal for them

-

News

Akademiker CIO rejects tilting portfolio to equities, despite inflation

Danish pension fund reports 5.69% return for H1 2021

-

News

NewsAMF says H1’s 8.5% return boosts conditions for shift to unlisted

Swedish blue-collar pension fund sees January-June group profit lifted by discount rate changes

-

News

NewsGrowing foreign assets make Danish pensions an ‘export engine’, says IPD

Statistics show bigger swing to foreign assets for market-rate pensions than for average-rate side

-

News

NewsAP1 thanks its ‘constructive view of risk-taking’ for 11% return in H1

Swedish national pensions buffer fund narrowly beats AP4 with first half investment return