Asset Allocation – Page 47

-

News

Border to Coast raises further £2.7bn in private markets commitments

£3bn of commitments from pension funds deployed so far since private markets programme launched

-

News

NewsATP creates new unit to invest €807m in domestic direct equity

ATP Long Term Danish Equity kicks off with IT, MedTech, pharma and renewables firms with DKK250m-plus turnover

-

-

-

Features

FeaturesIPE Quest Expectations Indicator - June 2021

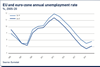

The UK experience with vaccination suggests that COVID-19 case numbers start falling when about half the population is immunised. The US will soon reach that level. The EU is over the 30% mark while Japan is at 3%. Taking the BRIC countries as a proxy for emerging markets, Brazil scores 16%, while Russia and India have reached about 10%. China has not published its vaccination figures. Meanwhile, new strains remain a source of concern.

-

Features

FeaturesFixed income, rates, currencies: Still missing the target

Most would agree that one data release from an important but volatile dataset – employment figures – should be read with caveats. However, the scale of the forecasting ‘miss’ for April’s US job numbers was hard to dismiss as just noise.

-

News

Dutch hedge fund exodus a risk, say consultants

PMT, PME, PFZW, Fysiotherapeuten, Provisum and the staff pension fund of pension asset manager APG have all said goodbye to the asset class

-

News

NewsSwiss pension fund swaps hedge funds, commodities for gold

Its 2020 funding ratio stood at 71.4%, above the 67.3% set for its recapitalization path, but below the 72.3% number for 2019

-

News

Mandate roundup: ERAFP adds mid-caps to US equity strand

Plus: AP7 reappoints ISS, seeks help with upcoming treasury process review

-

News

NewsBest-performing UK fiduciary managers took more risk, says survey

‘Trustees should hold fiduciary managers to account. It is easy to assume the managers will run the journey plan, but the trustees are still responsible’

-

News

Wandsworth adds renewable fund amid decarbonisation start

Public pension fund adopts policy to progressively decarbonise its investments and seek investment opportunities that will outperform in a 2°C scenario

-

News

ABP exits hedge fund investments

The pension fund paid €331m in performance fees to hedge fund managers last year

-

News

NewsPMT reduces government bond allocation, ups real estate and infra

The €97bn pension fund’s new strategic asset allocation is supposed to have a lower risk profile

-

News

NewsDenmark’s IPD says 2020 showed why pensions need more risk exposure

Guaranteed pension savings now make up just under half of all Danish pension assets, association says

-

News

DSM pension fund invests 5% in gold

The fund said it invests in physical gold which is stored at a Swiss bank

-

News

Swiss schemes expand real estate allocations

Real estate allocations peaked at 20.6% in 2020, while equity allocations stood at 30.7%

-

News

NBIM gets more picky about buying index newcomers

Tangen says ESG data ‘most certainly financially relevant’

-

News

Norway’s domestic SWF sells NOK23bn equities in ‘challenging’ rebalance

Folketrydgfondet carries out biggest asset rebalancing since financial crisis, as shares produce 7.5% Q1 return

-

News

Varma reports record solvency, as Q1 returns also shore up Elo, Veritas

Finnish pension insurer reports first disability pension applications for long COVID

-

News

ATP’s bond losses wipe out equity gains in Q1

Current investment strategy relatively heavily exposed to interest rates, says CEO