All Briefing articles – Page 6

-

Features

FeaturesBriefing: Active ways to prosper in EMs

On the battlefield on which active managers fought their passive enemies for investors’ custom, there was one patch of higher ground that seemed easier to defend – emerging market equities.

-

Features

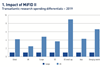

FeaturesBriefing: The sum of all fears

Three years on from the onset of MiFID II, market participants, governments and regulators are assessing its outcomes and considering adjustments.

-

Features

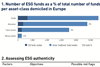

FeaturesBriefing: Tide turning for ESG fixed-income

The supply of ESG-aligned bonds is increasingly underpinned by regulatory pressures and client demand for products targeting non-financial objectives. As the investable universe grows, so the number of funds and assets will increasingly find their way towards fixed-income ESG solutions. However, to strike the right balance between financial and non-financial returns investors should look for ESG-authentic leaders with good risk-return capabilities

-

Features

FeaturesBriefing: Japan emerging from its invisible lockdown

Japan is all too often portrayed as being different from other countries. Not just distinctive in the obvious sense that every country has its own national peculiarities. Instead, somehow unique in a way that makes it stand out from every other country.

-

Features

FeaturesBriefing: Still a strong case for US stimulus

The next awaited US stimulus programme remains a mystery. Congress must agree on funding specifics, but the final composition of the Senate will be unknown until this month. Republicans and Democrats have been battling over spending priorities since COVID-19 struck last spring, with competing priorities.

-

Features

FeaturesBriefing: An unfortunate lack of ambition

The second Capital Markets Union (CMU) Action Plan of the EU Commission lacks ambition. This at a time when the EU Commission wants to set an industrial policy for the EU to bolster competitiveness in key sectors. It also comes shortly before the UK’s departure from the EU. Yet a vision of what the EU wants to achieve, by when and how, is missing.

-

Features

FeaturesBriefing: Feast or famine

With the end of the COVID-19 pandemic still out of sight, any forecast of the size of economic damage it will inflict has to be viewed with caution. Yet there seems to be a consensus that default rates on leveraged loans will stay elevated throughout 2021 and beyond.

-

Interviews

InterviewsInterview: Sorca Kelly-Scholte on the future of RPI

Sorca Kelly-Scholte, JP Morgan Asset Management’s (JPMAM) EMEA head of pension solutions and advisory, discussed with IPE.com editor Venilia Amorim how she thinks pension funds can plan for the road ahead, in light of the uncertainty over the future of RPI and whether or not it gets fully phased out.

-

Features

FeaturesBriefing - ILS: resilience despite the thrills

Institutional investors have piled into insurance-linked securities (ILS) with the goal of adding reliable returns and a touch of diversification to their investment strategies.

-

Features

FeaturesBriefing: Tail-risk hedging lessons from the corona crisis

The coronavirus crisis illustrates that equity collar strategies may still have a place for pension funds

-

Features

FeaturesBriefing: Growth beyond COVID

The outlook for institutional investors may be gloomy, with the global economy in recession and interest rates stuck at extremely low levels.

-

Features

FeaturesBriefing: Which way will inflation blow?

Investors pondering the future course of inflation are scratching their heads – faced as they are with a powerful array of deflationary factors, opposed by a potent lineup of inflationary factors.

-

Features

FeaturesBriefing: Germany finally issues green bonds

There was little doubt that the German finance ministry would eventually tap the green bond market. Germany is committed to reaching net zero greenhouse emissions by 2050.

-

Features

FeaturesBriefing: A time to be calm and focused

The corona pandemic has become an emotional rollercoaster for investors. First, came the market collapse, followed by panic sales. Then, hot on the heels of the turmoil, normalisation and new stock-market highs.

-

Features

Briefing: Timing is everything in distress

After an extended period in the wilderness, distressed debt funds – bereft of opportunities because of ultra-low interest rates and economic buoyancy – are back in the spotlight with large players coming to the market.

-

Features

Briefing: The long march to deleveraging

Global debt reached a new record during the first quarter of this year, reaching 331% of GDP, or $258trn (€229trn), according to the Institute of International Finance, the global association of the finance industry.

-

Features

Briefing: The unbearable lightness of investing

Open the newspaper. Any newspaper. Read the front page and then the money pages. Absorb, assimilate, repeat. After half a dozen goes, a pattern is clear.

-

Special Report

Special ReportSWFs: Never waste a good crisis

Despite pressure on revenues from oil and gas, Arab sovereign wealth funds are taking opportunistic bets in foreign markets in the face of global economic turmoil

-

Features

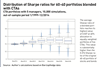

FeaturesHedge funds: ‘Real life’ portfolio evaluation

Outlining an equal volatility-adjusted approach to hedge fund management

-

Features

FeaturesThe Renminbi: A matter of trust

Only a few years ago, there was much hype about the renminbi becoming the next significant reserve currency and potentially even threatening the dominance of the dollar.