All articles by Carlo Svaluto Moreolo

-

Interviews

InterviewsLazard Asset Management 's Jeremy Taylor: “The shape of the market has completely changed”

Lazard Asset Management makes a strong case for fundamental research and active management, Europe co-CEO Jeremy Taylor tells Carlo Svaluto Moreolo

-

Opinion Pieces

Opinion PiecesPension funds are under the spotlight – it should be seen as an opportunity

Global policymakers are looking to pension funds to be part of the solution to many problems

-

Interviews

InterviewsScenarios at the ready: How APG’s chief economist views political risk

Thijs Knaap, APG Asset Management’s chief economist, discusses political risk and how it could affect institutional portfolios

-

Opinion Pieces

Opinion PiecesPension funds may see merits in owning few stocks, but concentrated equity strategies carry undue risk

When a small but influential group of pension funds, mostly located in the Netherlands, signals a clear shift away from broad equity diversification and towards more concentrated strategies, it does not go unnoticed.

-

Asset Class Reports

Asset Class ReportsConcentrated portfolios: How investors are challenging common wisdom by reverting to old-fashioned stock picking

For equity investors of all kinds, the clear trend of the past few decades has been a shift away from stock picking and towards broadly diversified portfolios, managed through passive index exposure or, at most, passive-enhanced or quantitative strategies.

-

Features

FeaturesAsset managers face questions over ESG staffing strategies

Is the slowdown in ESG recruitment by global asset managers a symptom of a bigger crisis?

-

Interviews

InterviewsPension funds and physical risks: NEST, PFA Pension and PME Pensioenfonds on climate resilience

As the effects of climate change materialise, European pension funds are increasing their focus on physical climate risks

-

Opinion Pieces

Opinion PiecesThree years on from the LDI crisis, has the UK pension industry learned its lesson?

This issue of IPE goes to press almost exactly three years after the UK pension industry was thrown into disarray by what many remember as the ‘LDI crisis’. On 23 September 2022, then British chancellor Kwasi Kwarteng announced sweeping tax cuts that prompted a frenzied sell-off ...

-

Asset Class Reports

Asset Class ReportsEmerging market debt investor profile: T Rowe Price

That time I hugged our Russia analyst: T Rowe Price’s Samy Muaddi talks about probing EM sovereign credits during the “the biggest inflection point for the industry”

-

Asset Class Reports

Asset Class ReportsEmerging market debt investor profile: PGIM Fixed Income

Tight spreads show the maturity of EMD. Cathy Hepworth at PGIM Fixed Income says EMD offers something for every investor

-

News

NewsIPE exclusive: European pensions funds break the €10trn barrier

Assets held by European pension funds grew above trend for the second consecutive year, adding 6.2% of assets in 2024

-

Special Report

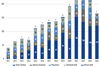

Special ReportIPE Top 1000 2025: European pensions break €10trn barrier

Europe’s retirement savings pool grew by 6.2% in 2024, well above the 10-year average

-

Special Report

Special ReportItaly: Mandatory pensions on the cards for new labour market entrants

Government sees urgency in granting early retirement options but some representatives have put forward bold proposals for expanding supplementary pension coverage

-

Opinion Pieces

Opinion PiecesItalians must raise awareness about second-pillar pensions

Giorgia Meloni’s government has failed to revitalise the Italian second-pillar pension system. But credit to the pragmatic right-winger who in 2022 became Italy’s first female head of government – at least she tried.

-

Asset Class Reports

Asset Class ReportsFive trends to watch in private credit

From the rise of secondaries and capital solutions funds to the trend of concentration among scale players, private credit is experiencing an intense and rapid phase of development

-

News

NewsIPE Top 500 Asset Managers: leading managers outpace the rest in a year of record AUM growth

Global AUM tops €129trn and the ‘trillion club’ widens as 25 managers alone report assets over €1trn

-

Special Report

Special ReportIPE Top 500 Asset Managers 2025: Record growth in a winners-take-all asset management market

The world’s asset managers have enjoyed three straight years of robust growth, but a transformative trend is gaining momentum – AUM growth is increasingly concentrated at the top.

-

Opinion Pieces

Opinion PiecesThe ‘active versus passive’ investment debate should be over

Perhaps there should never have been a debate about whether stock picking is appropriate for institutional portfolios.

-

Features

FeaturesThe scarce commodity of active management skill

Active management skill remains elusive but it can be identified by means of effective analytics, with common attributes such as trading skill and concentrated portfolios

-

Interviews

InterviewsPenSam CIO Claus Jørgensen on the fund's focus on low-risk, high-quality pensions

Claus Jørgensen, CIO at PenSam, talks to Carlo Svaluto Moreolo about the Danish pension fund’s efforts to maximise pension payouts