All articles by Carlo Svaluto Moreolo – Page 14

-

Interviews

InterviewsHow we run our money: Cometa

Maurizio Agazzi and Oreste Gallo of Cometa, one of Italy’s largest pension funds, talk to Carlo Svaluto Moreolo about the fund’s evolving strategy

-

Features

FeaturesAsset management faces systemic risk questions

When will the next financial crisis hit? Over 80% of respondents among a sample of 500 institutional investors surveyed by Natixis Investment Managers expect a crisis to take place within the next five years.

-

Features

FeaturesPerspective: Carlo Cottarelli

Carlo Cottarelli, the Italian economist and former IMF director, says fixing the European economy will mean taking difficult decisions

-

Interviews

InterviewsHow we run our money: Xerox UK Final Salary Pension Scheme

Jeffrey McMahon, head of pension investment and risk at Xerox UK, tells Carlo Svaluto Moreolo about the plan to make the company’s legacy DB scheme self-sufficient

-

Interviews

InterviewsOn the Record: Retirement income

IPE asked three pension funds how they help members to ensure investment returns are turned into good retirement outcomes

-

Opinion Pieces

Opinion PiecesSystemic risk may be underestimated

Underestimating the scale of systemic risk within the asset management industry is a mistake. For several years, macroprudential authorities including the International Monetary Fund, the European Central Bank and the Bank of England have argued that asset management activities are becoming systemically more risky.

-

Opinion Pieces

Factor strategies should be based on scientific consensus

Investors should take note of the debate taking place within the factor investing industry. On one side, are those who support a purist approach to the definition of factors, arguing that factor strategies should be built using factor proxies that undergo rigorous scientific tests. Scientific Beta, the organisation linked to EDHEC Business School, is a vocal supporter of this approach.

-

Interviews

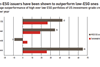

On the record: Is private equity lagging behind the ESG curve?

IPE asked three pension funds how private equity managers are progressing in terms of integrating responsible investment

-

Interviews

Strategically speaking: Scientific Beta

I am probably a little bit uncompromising,’’ says Noël Amenc, the founding CEO of Scientific Beta, the provider of factor indices and strategies. To those who know him that is an understatement.

-

Interviews

How we run our money: Pension Danmark

Torben Möger Pedersen , CEO of PensionDanmark, tells Carlo Svaluto Moreolo that he sees the Danish pension provider as part of an improved Scandinavian welfare system

-

Interviews

InterviewsHow we run our money: Amonis

Tom Mergaerts , CEO of Amonis, tells Carlo Svaluto Moreolo about the Belgian €2.1bn pension fund’s uncompromising investment philosophy

-

Special Report

Special ReportCredit Ratings: Good credit, bad behaviour?

Rating agencies and asset managers are starting to integrate ESG in bond portfolios

-

Interviews

InterviewsOn the record: Private credit

As the valuations of traditional credit assets look stretched, we asked two Danish institutions how they invest in alternative credit markets

-

Asset Class Reports

Asset Class ReportsCredit: In the eye of the storm

What are the prospects for the credit markets as central bank turn dovish and economic activity slows down?

-

Opinion Pieces

Opinion PiecesSystemic risk debate intensifies

The financial system is facing its greatest challenge since the 2018 financial crisis

-

Interviews

InterviewsStrategically speaking: Generali Investments

A year into Generali’s ambitious growth plan, it looks set to meet its promises

-

Special Report

Special ReportIndustry viewpoints: Research post-MiFID II

How has research consumption changed since the unbundling of sell-side research costs from brokerage fees?

-

Opinion Pieces

Opinion PiecesDo not let costs become an obsession

Our report this month on management and outsourcing discusses how pension funds must increasingly rely on external organisations to analyse their portfolios, particularly from a cost perspective.

-

Asset Class Reports

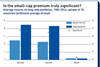

Asset Class ReportsThe small-cap conundrum

Academic studies have cast doubt on the existence of a premium for investing in small-cap stocks

-

Interviews

InterviewsHow we run our money: ZVK

Gregor Asshoff (pictured), board member of ZVK, the pension fund for Germany’s construction workers, talks to Carlo Svaluto Moreolo about upcoming asset allocation shifts