All articles by Carlo Svaluto Moreolo – Page 3

-

Interviews

InterviewsSEI Investments seeks new partnership approach

SEI Investments, the Pennsylvania-based technology and investment firm, was a vocal advocate for independent fiduciary management in the UK pension industry.

-

Interviews

InterviewsCassa Nazionale del Notariato: Megatrend investor

Stella Giovannoli, CIO and CFO at Italy’s Cassa Nazionale del Notariato, talks to Carlo Svaluto Moreolo about the efforts to modernise the fund

-

Opinion Pieces

Opinion PiecesInstitutional investors shouldn't be so concerned about equity market concentration

Before the August 2024 equity sell-off, the rising level of concentration in global equity markets had many investors worried for some time, and concentration may well continue to be a feature of equity markets in the near future.

-

Asset Class Reports

Asset Class ReportsEquities: Active investors keep their eye on the prize

As equity markets enter a new phase after the August 2024 sell-off, institutions are sticking to their long-term active equity approaches

-

Special Report

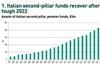

Special ReportItaly: Policymakers focus on first pillar

Despite recent growth, second-pillar pensions have never been a priority for the Italian government

-

Opinion Pieces

Opinion PiecesItaly needs a serious debate about pensions

Italian policymakers are bent on indulging the relatively small but influential minority of Italians that is nearing retirement, but lament that the statutory retirement age of 67 is too high. The reform efforts of past years have been towards reducing the retirement age or increasing flexibility in retirement. The resources employed towards supporting second-pillar pensions have been next to none.

-

Interviews

InterviewsATP's long game in investment strategy

Christian Kjaer, head of liquid markets at Denmark’s ATP, talks to Carlo Svaluto Moreolo about the institution’s liquid assets portfolio and his knack for game theory.

-

Asset Class Reports

Asset Class ReportsPrivate credit: How banks are joining forces with managers

As the private credit market grows, banks are looking to partner with private credit managers rather than compete with them

-

Country Report

Country ReportSlow growth for Italy's second-pillar pensions

Despite the urgency of increasing second-pillar coverage, policymakers continue to focus reform efforts on public pensions

-

Opinion Pieces

Opinion PiecesDespite their differences, pension funds should continue to act as bold corporate stewards

This year’s voting season leaves questions about the benefits of engaging with companies in the sectors that are slowest to embrace the climate transition.

-

Special Report

Special ReportEurope’s pension policy roundtable: Challenges for the next Commission

The experts weigh in on the future of the European Union’s pensions policy

-

Interviews

InterviewsSweden’s AP3 pension fund and its quest for alpha

Jonas Thulin, recently appointed CIO of Sweden’s Tredje AP-Fonden (AP3), talks to Carlo Svaluto Moreolo about his approach to asset allocation and portfolio management

-

Country Report

Country ReportMercer’s upbeat vision for UK pension funds and their investment advisers

James Lewis, UK CIO at Mercer, is optimistic about the future of the UK’s DB and DC industries

-

Interviews

InterviewsThematics Asset Management’s CIO on themes and investment challenges

Out of the 19 boutiques businesses belonging to the Natixis Investment Management franchise, Thematics Asset Management is by no means the smallest, but it is not exactly a juggernaut, managing €3.3bn of assets at the end of last year. Yet, it is actively contributing to what could be a crucial evolutionary step for global investors.

-

Opinion Pieces

Opinion PiecesDefence is the new ESG question

Earlier this year, the European Commission launched its ambitious European Defence Industrial Strategy (EDIS). The main goals of the strategy are reducing fragmentation within the €70bn European defence industry and lowering weapons imports, thus increasing the EU’s military readiness. The success of the strategy would also contribute to economic growth.

-

Asset Class Reports

Asset Class ReportsEmerging market equities: investors grapple with peak political risk

As billions of people head to the polls in 2024, how will politics influence flows to emerging market equities?

-

Opinion Pieces

Opinion PiecesA new era for pension fund liquidity management

With inflation past its peak and central banks signalling monetary easing, investors can look forward to a prolonged period when interest rates will be at normal levels – barring any surprise decline in economic growth or other kinds of shocks.

-

Special Report

Special ReportManager selection: Solving the pension liquidity puzzle

Advisers and fiduciary managers are working as hard as ever to meet the liquidity needs of pension funds

-

Interviews

InterviewsMuzinich’s Tatjana Greil Castro on credit fundamentals

In one of the meeting rooms of the London office of Muzinich & Co are displayed a series of bond certificates from the past.

-

Features

FeaturesSecuritised credit keeps on shining

For a market with a difficult past, some could even say an image-problem, securitised credit has been performing remarkably well in recent years.