All articles by Carlo Svaluto Moreolo – Page 8

-

Interviews

InterviewsPension funds on the record: Seeking protection in private markets

Unlisted assets are the safe haven for investors searching for safety in choppy markets

-

Opinion Pieces

Opinion PiecesShareholder action to curb corporate lobbying is urgent

Corporate lobbying has always existed, but only in recent times have investors concerned with sustainability started to monitor the impact of the lobbying activities of their investee companies.

-

Country Report

Country ReportUK: Interview with Sally Bridgeland

Sally Bridgeland, chair of Local Pensions Partnership Investments, discusses the institution’s net-zero carbon emission and cost-reduction strategies

-

Special Report

Special ReportCorporate lobbying comes under the spotlight

Companies are starting to respond to investors’ demands for transparent and consistent lobbying.

-

Asset Class Reports

Asset Class ReportsEmerging markets: Global or local?

For emerging market strategies, it is difficult to establish a clear link between performance and local presence

-

Interviews

InterviewsIlmarinen: The making of a Finnish pensions legend

Mikko Mursula (pictured), CIO of Finland’s Ilmarinen, talks to Carlo Svaluto Moreolo about equities and the organisation’s 2035 net-zero commitment

-

Features

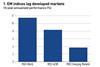

FeaturesUkraine & Russia: Asset allocation and investing in a time of war

It is a well-known fact that geopolitical events have no lasting impact on financial markets. However, Russian president Vladimir Putin’s decision to wage war on Ukraine has forced institutional investors to reassess their strategies. While stock market indices tend to recover fairly soon after the initial shock of a geopolitical event, the conflict between Russia and Ukraine has potentially wide-ranging consequences beyond a sudden spike in volatility.

-

Opinion Pieces

Opinion PiecesViewpoint: Invasion reactions show pension funds are more than investors

Before the Russian government’s decision to invade Ukraine at the end of February, the exposure of European pension funds to Russian assets was relatively low, and in some cases non-existent. Nevertheless, those funds that did invest in Russia acted quickly to reassess their exposure and divest from Russia entirely when possible, given the treacherous market conditions.

-

Special Report

Special ReportManager selection: Market trends

Manager selection consultants are helping investors navigate the next stages of ESG integration

-

Interviews

InterviewsUkraine & Russia: War-proofing portfolios

Investors react to outbreak of hostilities and reflect on asset allocation in the months ahead

-

Features

FeaturesPerspective – Liability-driven investing: DIY LDI

A multi-decade trend of falling interest rates, the increased complexity of financial markets and the growing burden of regulation have conspired to turn pension provision into an extremely sophisticated activity. This is especially true for defined benefit pension funds, which may be facing a gradual decline in number, but remain a key source of retirement income.

-

Interviews

InterviewsOn the record: Emerging markets

Despite the current volatility and geopolitical tensions, European pension funds continue to actively seek returns from emerging market investments.

-

Special Report

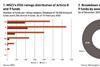

Special ReportRegulation: SFDR put to the test

One year in and the verdict on the EU’s Sustainable Finance Disclosure Regulation (SFDR) is mixed

-

Interviews

InterviewsOn the record: Hedging all bets

We asked three European pension funds about their hedge fund portfolios, as the volatile market environment provides opportunities for absolute-return managers

-

Interviews

InterviewsHow we run our money: Apoteket Pensionsstiftelse

Gustav Karner (pictured), CEO and CIO of Apoteket’s pension foundation, talks to Carlo Svaluto Moreolo about the institution’s renewed strategy

-

Features

FeaturesPerspective: La dolce pensione

Italy may be on the verge of overhauling its pension system, but there are signs the reform project lacks ambition

-

Features

FeaturesStrategically speaking: Eyes on the next frontier

“Riddle me this,” asks Yves Choueifaty, founder, president and CIO of French asset manager TOBAM. “Why would 70 people who are not TOBAM employees be at our Paris headquarters today?”

-

Special Report

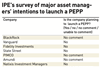

Special ReportPEPP: Few players on the starting line

In March, the European Union’s Pan-European Personal Pension Product (PEPP) framework comes into effect, amid doubts about the take-up by providers

-

Special Report

Special ReportThe jury is still out on PEPP: industry views

IPE asked some of the leading voices in the European pension industry to comment on the likelihood of success for the PEPP

-

Features

FeaturesStrategically speaking – AlbaCore Capital: Alternative credit with pension fund roots

AlbaCore Capital, a Europe-based alternative credit specialist with North American roots, is a fairly rare example of an asset management company that was spun off from a pension fund. David Allen, founder and CIO, established the company in 2016, with a team of European alternative credit specialists that he led from within the $542bn (€366bn) Canada Pension Plan Investment Board (CPPIB).