All articles by Caroline Hay – Page 3

-

Special Report

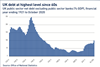

Special ReportUK green Gilts: UK joins the green party

A late-comer to green bond issuance, the UK plans to issue its first green Gilt this year

-

Features

FeaturesFixed Income, Rates, Currencies: Same again in 2021?

The relief from the farewells to 2020, and welcoming a Brexit trade deal, has waned in the face of rising COVID-19 infection rates. There have also been further lockdowns across swathes of Northern Europe as well as in Japan, Thailand, and South Africa to name a few. The vaccine-generated light at the end of the tunnel which appeared last year, seems rather distant, and possibly dimmer too.

-

Features

FeaturesFixed Income, Rates, Currencies: A very different recovery

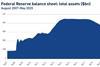

Amongst the remarkable happenings in 2020, from startling news of a pandemic to viable vaccine and beyond, has been the speed and scale of interventions from central banks and governments.

-

Features

FeaturesFixed Income, Rates, Currencies: Vaccine boosts bullish markets

The swings in outcome predictions as the vote counting began in the US election were large. From the realisation that there was no blue wave of Democrat success, to a possible re-election for Donald Trump, to a Joe Biden win but with a Republican Senate, it was tricky to comprehend the investment implications.

-

Features

FeaturesFixed Income, Rates, Currencies: Economy reaches tipping point

The global reflation trade, and with it the outlook for further dollar weakness, seems paused as speculation on the outcome of the imminent US presidential election diverts attention and has many retreating to neutral positions.

-

Features

FeaturesFixed income, rates, currencies: Reality gap widens

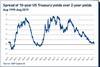

August 2020 saw the US Treasury market post one of its worst monthly performances since November 2016, while global equities, led by the US, reached new highs.

-

Features

FeaturesFixed income, rates, currencies: Still facing anxious times

Developed market government bond yields have spent the summer drifting lower as risk assets traded better. However, this benign climate has not lifted the fog of confusion caused by COVID-19.

-

Features

FeaturesFixed income, rates, currencies: Dismay sets in

As lockdowns ease, particularly in the northern hemisphere and the Antipodes, economic recoveries get underway. Given the exceptional circumstances, economic forecasts and predictions may show little consensus, or potentially be wrong, the puzzling US payroll announcements for May being a vivid example.

-

Features

FeaturesFixed income, rates, currencies: Unprecedented times

According to a Wall Street Journal blog, the word “unprecedented” was used in 395 of the publication’s articles in the past three months. Also popular were massive, enormous, staggering and eye-popping

-

Analysis

AnalysisFixed income, rates, currencies: Thinking on one’s feet

The enormous scale of national lockdowns has made it hard to keep abreast of all the extraordinary monetary interventions and fiscal support packages worldwide.

-

Features

FeaturesFixed income, rates, currencies: Global economy under pressure

At the end of February, after a week that saw stock markets around the world plummet, US Federal Reserve chair Jerome Powell sought to calm fears, saying that the Fed would “act as appropriate” to support growth.

-

Analysis

AnalysisFixed income, rates, currencies: China’s woe hits rest of world

While the speed and breadth of the spread of infection was unknown, it was apparent that the outbreak of the new coronavirus, named COVID-19 by the World Health Organization (WHO), would cause considerable disruption to economic activity in China.

-

Features

FeaturesFixed income, rates, currencies: A confident start to the year

Undoubtedly a good year for financial assets, 2019 ended on a bright note with the broad, and relieved, consensus that the China/US trade conflict might be de-escalating

-

Features

FeaturesFixed income, rates, currencies: Better than expected

Although packed with geopolitical surprises 2019 turned out to be better than expected for financial assets. Equities and bonds rallied together reversing last year’s ‘unusual occurrence’ of both performing badly.

-

Features

FeaturesAsset Allocation: Good news buoys risk markets

Several factors have given risk markets a boost and propelled risk-free rates higher. These include diminishing fears of an economic slowdown, a potential rapprochement in trade negotiations and a reduced risk of a ‘no-deal’ Brexit.

-

Features

FeaturesFixed income, rates, currencies: Clouded by uncertainty

It was predictable that risk markets should have reacted positively to the news of an agreement in principle in the US-China trade negotiations. Although assuredly better than a seemingly relentless stream of bad will between the protagonists, the provisional agreement is in no way a solution to the conflict. Another round of trade talks could be necessary just to reach a tentative accord. Investors would be wise to temper enthusiasm to extrapolate the ‘good news’ too far.

-

Features

FeaturesEverything is still possible

Markets are on edge as a result of difficult economic and geopolitical forces. Risks are still skewed to the downside. Trade tensions have not abated, rather there is a possibility of further escalation in the future, which looks like reducing investment, and damaging already apprehensive outlooks.

-

Features

Fixed income, rates, currencies: A bleak outcome

This year’s summer tensions in shallow markets have again been apparent. The fallout from the trade dispute between China and the US is having a global impact. Together with economic weakness almost everywhere, a global policy easing cycle could be imminent.

-

Features

FeaturesFixed income, rates, currencies: Nervousness abounds

The weak US non-farm payroll (NFP) data for May, far below forecasts, sent rates falling and stocks rising, on the supposition that it raised the likelihood of interest rate cuts from the Federal Reserve. On the other hand, while risk markets cheered the prospect of easier money, the hardline approach taken by the US towards China, and China’s uncompromising responses are raising investor nervousness.

-

Features

FeaturesFixed income, rates, currencies: Politics remains the bellwether

Financial markets continue to be influenced by news, and tweets, about the US-China trade negotiations. While stock markets have sold off during the second quarter of 2019, and credit spreads have widened, this financial tightening is so far less than what happened over the last few months of 2018.