China – Page 2

-

Features

FeaturesMarket looks to Xi Jinping for a plan to boost China’s economy

When the Chinese government announced a package of measures designed to revitalise the domestic economy in late September, the country’s stock markets responded positively, and many breathed a sigh of relief.

-

Opinion Pieces

Opinion PiecesSocial Security – the one thing Harris and Trump agree on

On one thing US presidential candidates Kamala Harris and Donald Trump agree: their new administration will not cut the Social Security benefits that are paid as pensions by the US Treasury’s retirement programme.

-

Opinion Pieces

Opinion PiecesInvestors must work together to improve AI stewardship

While perhaps the same cannot be said about climate change, there seems to be a consensus about artificial intelligence (AI) in the United Nations General Assembly.

-

Features

FeaturesFixed income, rates, currencies: All eyes are on US elections

With so many important elections taking place this year, politics were likely to have an outsized influence on financial markets.

-

Opinion Pieces

Opinion PiecesThe Red Emperor: Xi Jinping and his new China

Visiting China in the late 1990s and early 2000s was an exhilarating experience for any business traveller. There was a sense that the country was opening and moving forward

-

Opinion Pieces

Opinion PiecesViewpoint: Lessons for Europe from China

The gradual approach adopted by the Chinese government is both pragmatic and considerate

-

News

NewsAP7 divests €100m of largely Chinese oil and coal stocks

Swedish premium pension default provider says coal phase-out is ‘single most important measure to curb climate change’

-

News

NewsNorwegian oil fund drops $400m of stocks on war-linked grounds

NBIM follows advice from its Council on Ethics, and banishes L3Harris, Adani unit and Weichai Power, divesting nearly $400m

-

Interviews

InterviewsPension funds revisit allocations to China

European pension funds have reduced their allocations to China as the outlook for the country’s economy becomes more uncertain

-

Asset Class Reports

Asset Class ReportsIs India’s equity market now the new China in investors’ eyes?

Better governance and a clear economic path may put India in the lead

-

Opinion Pieces

Opinion PiecesUS pension plans wrestle with China private market exposure

After a horrible 2023, Chinese stocks look cheap and attractive. But most US pension funds do not seem interested in investing in the Chinese stock market. On the contrary, they have reduced their holdings since 2020 and some are exiting entirely, according to Bloomberg analysis.

-

Asset Class Reports

Asset Class ReportsEmerging market equities: investors grapple with peak political risk

As billions of people head to the polls in 2024, how will politics influence flows to emerging market equities?

-

News

NewsP+ divests 10 Chinese stocks on solar cell forced labour risk

“Solar cell production is one of the industries where the risk of links to forced labour is very high,” says pension fund’s responsible investments chief

-

News

NewsAPG closes Beijing office

APG had anticipated greater interest in local currency bond strategy it ran from the office in partnership with local asset manager E-Fund Management

-

Features

FeaturesThe great desyncronisation age in global financial markets

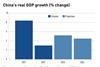

Investors are witnesses to the end of an era of synchronised global growth, when China could be counted on for outsized expansion that provided a broad cross-border lift for economies, industries and asset classes.

-

Features

FeaturesIs the US economy finally heading for a soft landing?

Having come to terms with the higher-for-longer mantra, markets are grappling with ‘higher-for-even-longer’, as US economic resilience continues to challenge expectations of weakness while reducing the prospects for earlier interest rate cuts from the Federal Reserve.

-

News

NewsKLP flies to China to overcome mining company brush-offs

If mining companies don’t take responsibility, KLP may exclude them from the portfolio, says Kiran Aziz

-

Opinion Pieces

Opinion PiecesNBIM’s Shanghai exit: more than ‘operational’ adjustment’

When Norway’s sovereign wealth fund announced in September it was shutting down its only office in China, the move was bound to be seen as symbolic of the deteriorating relationship between China and the US and its allies. It also came at a low-point for investment in China, with foreigners having sold off a record CNY90bn (€11.5bn) of Chinese stocks in August, amid fears over China’s tensions with the West, its property crisis and weak post-COVID economic recovery.

-

Asset Class Reports

Asset Class ReportsLocal currency emerging market bonds are back in the spotlight

Partly thanks to the weakening of the US dollar, local currency emerging market sovereigns are now offering healthy yields, and should continue to perform well

-

Asset Class Reports

Asset Class ReportsCorporate borrowers in emerging markets put to the test

Many emerging market companies have healthy balance sheets and weathered the COVID crisis well. How will they fare if global growth slows?