With the continuing proliferation of managers, strategies and funds, wouldn’t it be wonderful if there was one simple metric that could help determine which to back (and which to avoid)? The good news: there is. The bad news: you’re probably not using it.

Internal rate of return (IRR) has long been the measure of choice for describing returns in private equity and other private markets strategies. The problem is, it’s just not up to the task.

From a calculation perspective, it overweighs the contribution of cashflows in the early life of the fund and underplays the impact of later deals and exits. This is compounded by IRR’s inability to accurately deal with the gradual investment and return cycle exhibited by private equity funds.

Monies returned early in a fund’s life (but not actually reinvested into the fund) are assumed to be working hard to continue to earn the same rate of return in a parallel hypothetical investment programme. These imaginary returns bias the actual returns delivered by their non-imaginary counterpart.

Setting aside these issues, IRR is also easy to manipulate. Because it bases its calculations on cashflows from and to the investor, it ignores the mind-boggling array of financing available to general partners (GPs) at the deal, fund and GP level, effectively permitting a GP to temporarily substitute investor cash with debt, cutting the “real” investment period and potentially supercharging the IRR.

Yes, capital call facilities allow managers to act more quickly and help investors deal with drawdowns more comfortably, but they also distort the IRR – even if they are being used with the best intentions.

Further, IRR has a perspective problem. As a measure purely designed to assess absolute returns, it is only concerned with what returns were generated by the fund, ignoring the often-significant influence of the economic environment in which they were generated. If we accept, all else being equal, that the most skilful manager will deliver the best return, we should be troubled by IRR’s focus on the “how much” rather than the “how” of value creation.

As a fund selector, you need to spot the difference between luck and talent, and IRR will not, cannot, help you.

So, then, if we were to abandon IRR, how should we hope to select the right fund? The qualitative aspects of manager selection, whilst important, are not the whole story.

Investment decisions will rightly include opinion, they must also consider the facts. And, whilst every prospectus, every pitchbook, dutifully declares that “past performance is not indicative of future results”, this provides little useful input for a fund selector.

In practice, the quantitative aspects of a manager search can only have the past as their source. The challenge is to identify which aspects of a manager’s track record are pertinent and how to generate a fair comparison between it and its peers.

There is a way of doing this: a form of assessment which we call PERACS Alpha. This measure sidesteps the pitfalls of IRR and concentrates, instead, on what really matters: the annualised performance of a fund, expressed relative to broader market returns; and measured over the fund’s entire duration.

With the MSCI World Index as our default investment option (and hence the “opportunity cost” of having money in private equity), we begin by discounting all of the fund’s cash flows back to the date of the first cash flow of the fund, leaving us with present-value versions of each inflow and outflow.

Using these, we can generate a present-value total return multiple (TVPI or MOIC), by calculating the ratio of all inflows over all outflows. This is called the PERACS Multiple. Based on the present value of the fund’s cash flows, we then derive the duration of the fund as the time period between the capital weighted average date of all drawdowns and the capital weighted average date of all distributions.

Finally, we deduce the PERACS Alpha by annualising the PERACS Multiple over the fund’s duration:

PERACS Alpha = (PERACS Multiple^(1/duration)) -1

If we accept that this methodology provides a truer picture of performance, stripping away the imbalances and biases of IRR, surely it must find fault with the IRR quartile classification of private equity funds. Indeed, it does, and emphatically.

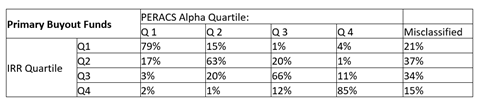

Comparing 650 funds grouped in a traditional IRR-based quartile classification to the same funds, sorted by their performance according to PERACS Alpha, we find that, across all vintages, 21% of the funds that seemed to be top quartile, according to IRR, fall out of the real PERACS top quartile category. This means that more than one-fifth of managers proclaiming their funds “top quartile” are (accidentally) misleading investors.

Extending our gaze to include all quartiles, 26% of all funds were found to be misclassified by IRR. The table below shows the degree and the direction of misclassification for all quartiles.

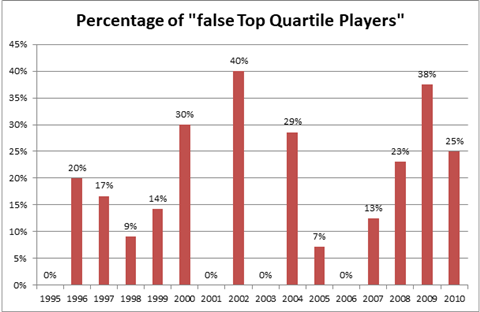

Interestingly, the degree of misclassification varies across vintage years and can be as high as 40%.

The implications of these results are as simple as they are important. The IRR measure punishes substantial parts of the GP community, and fund-of-funds in particular, by wrongly putting them in a quartile category that inaccurately understates their true performance.

And LPs should eschew IRR in favour of more accurate methods, lest they find themselves backing a GP that seems to be top quartile, but is actually benefitting from a measure that distorts its true performance.