Paul Benson, head of efficient beta at Insight Investment, focuses on three key misconceptions of the high yield market, taking the view that institutional investors might potentially interpret the risk of default in the asset class as much greater than it really is

High yield credit is emerging as an asset class to watch for 2022. Debunking three persistent myths may potentially add to the market’s attractiveness in the current low-yield environment.

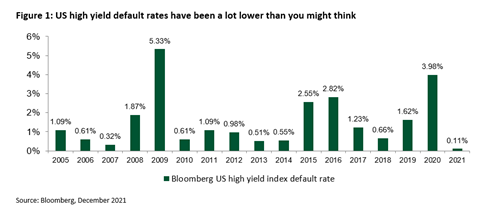

Myth 1: Default rates are 3% to 5%

Reality: Default rates have averaged 1.5% pa

If you ask savvy investment professionals what high yield default rates are, many will probably answer between 3% to 5%.

However, the average default rate has been only 1.5% pa for 15 years within the broad, investable US high yield corporate universe.

In fact, over this period, annual default rates have only exceeded 4% following the 2008 crisis, and recently even failed to breach that level at onset of the global pandemic (Figure 1).

Why the confusion? We believe it is in large part a result of highly publicised ratings agency default estimates.

For example, S&P Global’s latest US 12-month high yield default rate forecast is 2.5% for June 2022, down from 3.8% in June 2021. For Europe, the numbers are 3.25% and 4.7%, respectively.

However, these estimates are not based on popular high yield indices. They track a far wider universe, and thus have little relationship to the portfolios that most institutional investors hold.

Further, the rating agencies use an equal-weighted approach whereas investable bond indices are generally market-cap weighted. Nonetheless, these forecasts are widely shared, quoted and input into models.

In our view, it is akin to looking at average global temperature changes to estimate temperature changes in a specific region, like say, in the Arctic. While global temperature has been rising, it may be wholly inaccurate to assume the same change would apply uniformly to localized regions.

Arctic temperatures are rising twice as fast as the global average.

Of course, widespread misconceptions like these can help create investment mis-pricing opportunities.

Myth 2: Rising rates are bad for high yield

Reality: High yield has historically produced positive returns in periods of rising rate environments

Since 2005, there have been seven spells of rising yields. On average, US high yield markets returned close to 15% during these periods (Figure 2), or over 7% when excluding the outlier 2009.

We believe that high yield corporate credit is particularly resilient to rising rates.

High yield markets are relatively short dated, meaning they have limited interest rate (or ‘duration’) risk, particularly compared to the US Treasury market or to investment grade corporate credit.

Importantly, the total yield on high yield bonds is also mostly comprised of credit spread – to the tune of approximately 70% on average.

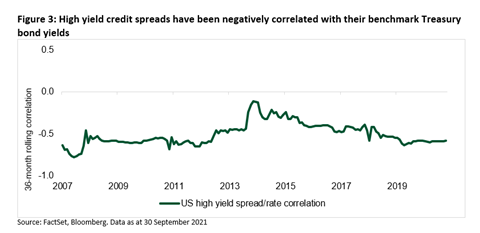

As such, changes in credit spreads, not interest rates, have tended to drive high yield returns. The good news is that credit spreads have historically tended to narrow when rates rise (Figure 3).

The reason for this negative correlation is that central banks tend to raise rates when the economy is improving (such as just after a recession). A growing economy typically means rising consumer spending, and thus growing corporate revenues and stronger corporate profitability.

As such, we believe high yield investors potentially stand to gain, rather than lose, from rising rates.

Myth 3: Liquidity is impossible to source

Reality: Abundant ‘hidden liquidity’ can be sourced within the ETF infrastructure

Since the 2008 global financial crisis, new banking sector regulations made it harder for market makers to hold bonds on their balance sheets. This resulted in rapidly declining two-way liquidity when trading single bonds.

However, another development since 2008 has helped increase liquidity for others: the fixed income ETF infrastructure developed rapidly. Skilled investors with knowledge of the ETF ecosystem can unlock ‘hidden liquidity’ within the system.

It has opened the door to trading large, customized baskets of bonds within hours for relatively low trading costs. In our experience, market makers even prefer trading diversified bond baskets because they can hedge them more efficiently and cost effectively.

In our view this type of trading can help investors target alpha within smaller and traditionally less liquid issuers. Investors can also aim to eliminate much of the drag on returns imposed by high transaction costs when looking to implement a beta allocation.

High yield – the asset class to watch for 2022?

As the global economy transitions from the rapid ‘early cycle’ rebound phase to a more moderate ‘mid cycle’ trajectory, in our view, shifting some exposure from equities into high yield may become increasingly compelling.

Those able to fully understand the risks inherent in the market and overcome liquidity challenges will potentially have the greatest latitude to extract the market’s full value.