France Investment and Pensions

France spends 14% of GDP on public pensions, while its debt burden is 113%, the third highest in the EU. But recent pension reforms are not enough to enable sustainability. The threat of further riots and no confidence votes in parliament make effective measures difficult. Parliamentary debate on the 2026 budget this autumn is likely to bring matters to a head. Nevertheless, France is now the fourth-largest in Europe in terms of IORP assets.

Pension Funds in France - Country Report

France country report 2025: The rise – and rise – of the French IORP

France’s approach to the IORP framework introduced in 2019 has propelled it into fourth place in size in Europe

TOP FRENCH PENSION FUNDS 2025

Pension fund/entity | Assets (€’000)

- Agirc-Arrco | 85,600,000

- ERAFP | 50,757,000

- La Mondiale Retraite Supplémentaire | 29,470,000

- CNP Retraite | 21,000,000

- Fonds de Réserve pour les Retraites (FRR) | 20,400,000

©IPE Research; View the Top 1000 European Pensions Funds 2025 for a comprehensive market overview

ERAFP brings forward end date for qualified fossil-fuel debt financing

The French fund’s announcement of a tighter fossil fuel policy comes after FRR updates its exclusions for unconventional hydrocarbons and thermal coal

Germany, France target European venture capital platform funded by pension capital

An expert panel led by former French central bank governor, Christian Noyer, and former German finance minister, Jörg Kukies, has delivered recommendations to scale up European venture capital market

FRR seeks managers for Paris-aligned equity index mandates

Indices to be customised in advance by FRR’s providers and the asset owner will then allocate the indices among selected managers

Nuclear energy: French investor body assesses state-of-play for ESG integration

Af2i calls for ‘coordinated update of ESG frameworks and analysis tools’

Ilmarinen CEO: Mindset shift needed before pension age hits 70

Rise in pension age proposed in general debate in Finland to bolster public finances and respond to rising life expectancy

TOP MANAGERS: FRENCH INSTITUTIONAL ASSETS

Company | Assets (€m)

- Amundi | 768,216

- Natixis Investment Managers | 424,468

- Ostrum Asset Management | 324,671

- AXA Investment Managers | 257,828*

- BNP Paribas Asset Management | 209,608

- Ofi Invest | 169,439**

- Groupama Asset Management | 69,915***

- Allianz Global Investors | 57,114

- Swiss Life Asset Management | 49,642**

- La Française | 45,216**

As at 31.3.25, *31.3.24, **31.12.24, ***30.4.25

©IPE Research; Sign up to IPE Profesional to see all the data in the latest country report

Interviews

- Previous

- Next

ERAFP brings forward end date for qualified fossil-fuel debt financing

The French fund’s announcement of a tighter fossil fuel policy comes after FRR updates its exclusions for unconventional hydrocarbons and thermal coal

Germany, France target European venture capital platform funded by pension capital

An expert panel led by former French central bank governor, Christian Noyer, and former German finance minister, Jörg Kukies, has delivered recommendations to scale up European venture capital market

FRR seeks managers for Paris-aligned equity index mandates

Indices to be customised in advance by FRR’s providers and the asset owner will then allocate the indices among selected managers

Nuclear energy: French investor body assesses state-of-play for ESG integration

Af2i calls for ‘coordinated update of ESG frameworks and analysis tools’

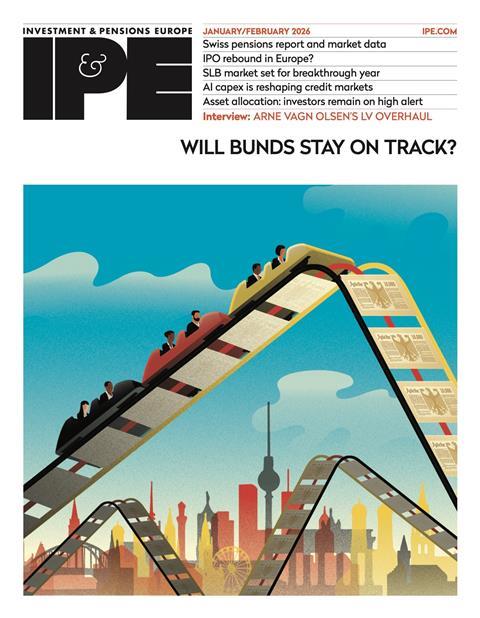

French turmoil sparks havoc in government bond markets

As France battles more upheaval, and with yields on 10-year French govvies spiking, institutional investors have adopted a wait-and-see attitude

Ilmarinen CEO: Mindset shift needed before pension age hits 70

Rise in pension age proposed in general debate in Finland to bolster public finances and respond to rising life expectancy

Amundi deputy CEO Jean-Jacques Barbéris outlines the firm's institutional pipeline

Amundi’s Jean-Jacques Barbéris tells Liam Kennedy about opportunities in liquid markets and ESG staying power

FRR seeks managers for €600m private debt investment, picks funds

The total amount allocated across the private debt mandates could rise to €800m

France: No well-intentioned pension reform goes unpunished

The collapse of France’s government has thrown the latest round of pension reforms into question – but second-pillar assets continue to grow

French pension reserve fund to invest up to €200m in securitisation

Decision comes as European Commission embarks on reform drive to revitalise the securitisation market

IPE BEST PENSION FUND IN FRANCE AWARD WINNERS

- 2024 - AG2R La Mondiale

- 2023 - ERAFP

- 2022 - AG2R La Mondiale

- 2021 - ERAFP

- 2020 - AG2R La Mondiale