Credit – Page 4

-

News

Top business school proves ESG does not harm corporate bond portfolios

Academic evidence can give comfort to bond investors, says Insight Investment RI chief

-

Asset Class Reports

Asset Class ReportsCredit: Inflation and the bond markets

Risks look likely to be building in credit as central banks wreak collateral damage on economies in their bid to tame inflation

-

News

NewsVervoer commits $300m to SDG-focused private credit fund

The ILX strategy will enable the scheme to access a diversified pool of investments across emerging markets

-

Asset Class Reports

Asset Class ReportsCredit: Anthropocene fixed income

Former credit portfolio manager Ulf Erlandsson is on a mission to shake up the bond markets’ climate-change credentials

-

Asset Class Reports

Credit: EU raises the green bond stakes

The EU is considering making its Green Bond Standard mandatory

-

Asset Class Reports

Asset Class ReportsCredit: Investors cautious over Ukraine war

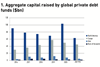

Despite geopolitical tensions, inflation and rising costs, private debt market remains optimistic after a record 2021

-

Opinion Pieces

News Notes: Private investing ‘levels up’ playing field

The UK’s recent government white paper – ‘Levelling up the United Kingdom’ – forcefully pushes for private investing. In it, Prime Minister Boris Johnson claims he is determined to “break that link between geography and destiny, so that it makes good business sense for the private sector to invest in areas that have for too long felt left behind”.

-

News

Alecta sees current volatility creating good credit opportunities

Swedish pension fund reports 24% return for 2021; thanks rising stock markets, strong property market and own work to find fixed income returns

-

News

NewsMandate roundup: LGPS pool launches alternative credit fund

Plus: Swiss consultant seeks infrastructure manager for pension funds; AP7 picks PPCmetrics

-

News

NewsAkademikerPension dumps €269m fossil-fuel corporate bonds

CIO sees tendency that fossil fuel bonds, like fossil fuel shares, are starting to price in stranded-asset risks

-

News

APG invests $750m in new SDG-focused EM private credit fund

The money will be invested in loans originated and structured by international development banks, with a focus on financing sustainable projects

-

News

PFA admits losing €400m on loan to troubled Irish aircraft lessor

NAC announced it is to file for US Chapter 11 bankruptcy after struggling amid pandemic

-

Asset Class Reports

Asset Class ReportsABS stages a comeback

‘Punitive’ regulations and onerous policies in the wake of the financial crisis saw the ABS market shrink dramatically. But complexity and an illiquidity premium offer opportunities for pension funds

-

Features

FeaturesStrategically speaking – AlbaCore Capital: Alternative credit with pension fund roots

AlbaCore Capital, a Europe-based alternative credit specialist with North American roots, is a fairly rare example of an asset management company that was spun off from a pension fund. David Allen, founder and CIO, established the company in 2016, with a team of European alternative credit specialists that he led from within the $542bn (€366bn) Canada Pension Plan Investment Board (CPPIB).

-

Asset Class Reports

Asset Class ReportsUS banks lead a boom in debt issuance

Capital requirements and locking in cheap funding have prompted banks to issue more bonds, but Europe lags behind

-

News

Detailhandel launches SDG benchmark for credit portfolio

The Dutch scheme for the retail industry is focusing its credit investments on four SDGs

-

News

NewsMandate roundup: FRR awards corporate bond mandates

Plus: Border to Coast launches £3.7bn multi-asset credit fund

-

Features

FeaturesAhead of the curve: The future of quant credit

The past several decades have seen quantitative strategies established as an important feature of global equity markets. In 2019, less than one quarter of the more than $30trn (€25trn) of US equities was held by human-managed funds.

-

Asset Class Reports

Asset Class ReportsThe next frontier for private credit

Global managers are making a strong case for investment in private credit issued by emerging market companies

-

News

NewsAsset management roundup: Cheyne Strategic Value Credit raises €1bn

Plus: Managers partner to accelerate development of Iceberg Data Lab