Credit – Page 8

-

Special Report

Special ReportMarket Trends: Critical point

Private market lending now faces an important turning point

-

Special Report

Special ReportManager selection: Facing a difficult test

The resilience of private debt funds will be tested in the forthcoming downturn

-

Special Report

Trade Finance: Funding tradewinds

Trade finance can offer an illiquid position in a volatile market, but its idiosyncratic nature can dissuade investors

-

Special Report

Special ReportMulti-asset strategies: New tools

Quantitative easing has distorted the fixed-income markets, resulting in an increased need to manage liquidity within credit strategies

-

Asset Class Reports

Asset Class ReportsInvestment Grade Credit: Veering between extremes

Capital markets are fluctuating between optimism and pessimism

-

Asset Class Reports

Asset Class ReportsRatings: When corporates can trump sovereigns

Several factors can place corporate credit ratings higher than that of the domicile country

-

Asset Class Reports

Asset Class ReportsIssuance: Down but not out

The huge growth of BBB-rated credits in the investment-grade sector has raised some concern but there are opportunities for investors

-

News

NewsFitch launches ESG credit rating ‘relevance’ scores

Data published to enable investors to ‘agree or disagree’ with impact of ESG issues on credit ratings

-

News

2019 Outlook: Preparing for the downside, part 2

IPE analyses fixed income outlooks from JP Morgan Asset Management, Janus Henderson, Fidelity, and Pictet

-

News

Scheme consolidator secures £225m funding from credit specialist

TPG Sixth Street Partners to invest in Clara-Pensions, with backing set to rise to £500m

-

Features

Credit allocations: Time for a re-balancing act

Investors are ignoring indicators that should encourage a more selective approach to credit

-

News

Private credit market to hit $1trn by 2020, survey says

German investors dominate European allocators to unlisted debt instruments

-

News

NewsMandate roundup: UK pension pool confirms £1bn smart beta allocation

Plus: Family office hunts securitised credit investor; Danish foundation wants EM manager; German state appoints Hermes EOS

-

Special Report

Convertible Bonds: Just the ticket

US convertible bonds have come into their own in the low-interest-rate environment

-

Special Report

Multi-Asset Credit: Buyers’ guide to multi-asset credit

A checklist for investors looking to tap into multi-asset credit

-

Special Report

Private Debt: Careful selection is key

Present market conditions have generated many opportunities in private debt but the challenge is finding the right deals

-

Special Report

Case Study: First State Super

Early mover in alternative debt financing has ambitions to expand into direct lending

-

Special Report

Factor Investing: Factors to consider

There are many complexities to negotiate in applying factor-investing strategies to credit markets

-

Special Report

Credit: Reading the cycle

The complex prevailing economic and political environment makes it difficult to predict how long the current credit cycle will continue

-

Special Report

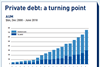

Private Debt: Still going strong

The private debt market continues to grow in size and attractiveness