Currency

In-depth reporting on currency investing for our pension fund and asset management readers from IPE’s award-winning journalists.

-

Country Report

Country ReportPensions in Switzerland report 2026: Swiss franc strength forces domestic pension funds to adopt costly hedging strategies

The Swiss franc is seen as a safe haven in times of trouble, but its strength causes problems for the country’s pension funds

-

Analysis

AnalysisMacro focus: debasement and fiscal dominance

The price of gold and other precious metals will continue to soar next year, as investors shift focus away from currencies

-

Special Report

Special ReportTrends to watch in 2026: As stocks defy gravity, bubble fever speculation grows

Stocks seemed to have defied gravity this year, but the latest Bank of America (BofA) Securities Global Fund Managers survey shows that a record 60% of money managers canvassed believe global equities, including the US, are overvalued.

-

Analysis

AnalysisFixed income, rates, currencies: Global economies slow despite increasing tariffs clarity

The global fixed income outlook remains mixed, with strong economic headwinds despite fading fears of the AI bubble bursting

-

Asset Class Reports

Asset Class ReportsEmerging market debt attracts the attention of institutional investors

Poised to benefit from US decline Reforms, prudent policymaking and the end of US exceptionalism have changed the nature of lending to emerging markets

-

Analysis

Fixed income, rates, currencies: US heads for soft-landing

The US economy is on course to avoid a recession, thanks to the Fed’s clever tactics, but the effects of tariffs have yet to feed through

-

Asset Class Reports

Asset Class ReportsEmerging market debt investor profile: PGIM Fixed Income

Tight spreads show the maturity of EMD. Cathy Hepworth at PGIM Fixed Income says EMD offers something for every investor

-

Features

FeaturesIPE Quest Expectations Indicator – August 2025

Trump’s attempts to undermine international trade and the US Federal Reserve are turning analysts against US assets, while good news out of Europe reinforce the case for appreciation of European assets

-

Features

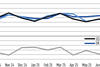

FeaturesUS Dollar slide set to continue amid ongoing geopolitical turbulence

The US dollar (USD) index tumbled 10% in the first six months of the year, marking the worst performance since 1973 when Richard Nixon was the US president and the greenback broke its connection with gold.

-

Features

FeaturesFixed income, rates, currencies: Questions over US economic policy dominate global concerns

As ever, the US dominates the global economic landscape. While there is still considerable uncertainty around possible tariffs emanating from the US – despite deals struck by the UK, China and Vietnam – the levels are still expected to be markedly lower than those trumpeted on 2 April.

-

Analysis

AnalysisFixed income, rates, currencies: Questions over US economic policy dominate global investor concerns

The likelihood of a full-scale global trade war has decreased, and the outlook for the global economy has improved as a result, but new tariff announcements by the US administration could cause this scenario to change once more

-

Interviews

InterviewsPenSam CIO Claus Jørgensen on the fund's focus on low-risk, high-quality pensions

Claus Jørgensen, CIO at PenSam, talks to Carlo Svaluto Moreolo about the Danish pension fund’s efforts to maximise pension payouts

-

Features

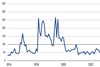

Fixed income, rates, currencies: Fickle US policy shakes global investor confidence

The hugely unpredictable policy announcements from those in charge of the world’s largest developed economy are market events more usually associated with goings-on in a newer EM economy

-

Analysis

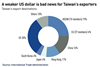

AnalysisShould pension funds increase their dollar hedge now?

US dollar’s downside risks have greatly increased under Trump’s second presidency. For Dutch schemes, upping protection is extra urgent during a time of transition to DC-based pension arrangements

-

Features

FeaturesFixed income, rates, currencies: Trump’s tariff announcements weigh on sentiment

As tariff announcements garner huge amounts of media attention, financial market reactions have been muted. Participants are trying to beat off tariff fatigue and assess the best path through all the smoke and mirrors.

-

Features

FeaturesCentral banks and cryptocurrency reserve: set for a breakthrough?

After courting the crypto community during his presidential campaign, Donald Trump issued an executive order in early March to create a US strategic bitcoin reserve, as well as a national digital assets stockpile of tokens other than bitcoin.

-

Features

FeaturesFixed income, rates, currencies: Markets rocked by Trump’s sweeping tariffs plan

The world’s economy enters a new phase as the US administration escalates towards a global trade war, raising the prospect of a US recession and crashing global financial markets

-

Features

FeaturesFixed income, rates, currencies: Uncertainty reigns as Trump 2.0 takes office

Now that Donald Trump has been installed as US president, there should be more clarity around some of the timings of his probable new policies.

-

Features

FeaturesFixed income, rates, currencies: Trump 2.0 sends global markets out of sync

Trump’s re-election prompted a rally in US assets, but elsewhere in global markets investors did not react positively

-

Features

FeaturesIPE Quest Expectations Indicator - December 2024

Bond expectations falling, equity mostly flat