Currency – Page 2

-

Features

FeaturesFixed income, rates, currencies: All eyes on Trump’s return

With the Republican Party now in control of both Senate and House, the leeway that President-elect Donald Trump will have to enact his pre-election policies could be considerable.

-

Features

FeaturesSoft landing likely again for US economy

It has been more than a year since the attacks by Hamas in Israel and tensions in the Middle East remain high, with a rising impact on financial market sentiment.

-

Features

FeaturesFixed income, rates, currencies: All eyes are on US elections

With so many important elections taking place this year, politics were likely to have an outsized influence on financial markets.

-

Asset Class Reports

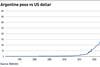

Asset Class ReportsLocal currency debt markets now more compelling

Bond yields are now more attractive because local central banks hiked interest rates sooner than their developed market counterparts

-

Interviews

InterviewsPension funds on euro fixed income: navigating the rate cycle

We asked pension funds in Spain, Germany and Finland about their current views on European fixed income and credit as the ECB looks carefully at the timing and sequence of its rate cuts

-

Features

FeaturesFears grow of US slowdown

US president Joe Biden’s decision to step aside was much murmured about following his disastrous performance in a debate with Donald Trump, but it was still a surprise when he announced his decision. However, market reactions were relatively muted, despite shaking pollsters’ predictions on who might now win the election.

-

Features

FeaturesAnalysts push back on rate cuts

Federal Reserve chair Jerome Powell’s June press conference was, like most careful central bank-speak, open to interpretation. It was possibly slightly dovish with a hint of hawk. However, in the aftermath of the press conference, and following a few busy days of US economic data releases, many analysts have pushed back their forecasts for the number of interest rate cuts this year.

-

Features

FeaturesMarket predicts US soft landing - June 2024

A combination of Federal Reserve chair Jerome Powell’s press conference and a slightly weaker-than-expected US April non-farm payrolls outcome succeeded in flipping the market back to a soft-landing narrative for the US economy. US Treasury bonds rallied sharply, taking other markets with them, while the yen weakened significantly against the dollar before recovering.

-

Features

FeaturesUS economy continues to surprise

The resilience of the US economy continues to confound observers. The Federal Reserve’s 11 hikes in interest rates over the course of 2022 and 2023 were implemented to rein in economic strength and to stifle inflation. Scroll forward to the second quarter of 2024 and both inflation and economic activity are still higher than expected.

-

Features

FeaturesReluctance to drop interest rates disappoints the markets

US rates markets entered the year enthusiastically pricing in over 160 basis points of cuts through 2024, and have since had to push back hard on both the timing and magnitude of interest rate cuts now expected by year-end.

-

News

NewsSwiss pension fund seeks FX hedging currency provider for CHF1.7bn

Interested managers have until 13 March to participate and the pension fund is looking to start implementation from September

-

Features

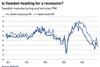

FeaturesContrasting global economic growth fortunes

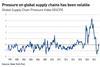

Economic growth patterns across the world paint a picture of contrasts, ranging from surprisingly robust in the US to soft and struggling in China, with the stagnant euro area narrowly avoiding a technical recession after posting zero GDP growth in the fourth quarter of 2023, following a 0.1% decline the previous quarter.

-

Features

FeaturesConflict and elections set to dominate the investor landscape

Middle Eastern tensions are running high, with violence flaring up across the wider region. Combined with the ongoing attritional destruction in Ukraine, this is impacting world trade, and it seems certain that international conflict will continue to be a source of great concern in 2024.

-

Features

FeaturesWill delayed economic bad news hit the market this year?

Global economic growth was below potential in 2023, but still markedly stronger than the forecasts had been indicating at the start of the year, with the US leading the way and even the likes of Europe and the UK, though hardly stellar performers, posting better than expected economic activity.

-

Features

FeaturesIs the US economy finally heading for a soft landing?

Having come to terms with the higher-for-longer mantra, markets are grappling with ‘higher-for-even-longer’, as US economic resilience continues to challenge expectations of weakness while reducing the prospects for earlier interest rate cuts from the Federal Reserve.

-

Features

FeaturesFixed income, rates & currency: interest rates the big question

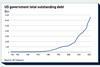

In August, when Fitch Ratings downgraded US debt from AAA to AA+, it cited an “erosion of governance” as one of the key reasons for its decision. September’s US government shutdown chaos will probably not have improved perceptions of US lawmakers’ proficiency to govern.

-

Asset Class Reports

Asset Class ReportsLocal currency emerging market bonds are back in the spotlight

Partly thanks to the weakening of the US dollar, local currency emerging market sovereigns are now offering healthy yields, and should continue to perform well

-

Features

FeaturesFixed income, rates & currency: Lean times to follow good summer?

The macro-economic news in the third quarter has been good, with better growth than expected and better inflation data than feared. In the final few months of the year, however, markets may have to deal with the potential for some softer economic news and possibly more negative inflation data, and not just from seasonal factors.

-

Features

FeaturesThe US dollar’s declining status as a global reserve currency

The recent US debt ceiling negotiations have brought into question the viability of the US dollar’s status as a global reserve currency. Long-term investors have been reviewing their strategic asset allocation away from the currency, seeking to diversify their exposure and to take advantage of long-term investment opportunities.

-

Features

FeaturesFixed income, rates & currency: Uncertainty persists

As the major central banks in developed markets reach, or at least near, the end of their hiking cycles, markets, rather than identifying when policy rates will peak, focus is now on the conundrum of just how long these policy peaks will be maintained.