Currency – Page 4

-

Features

FeaturesFixed income, rates & currencies: War and inflation dominate

While we watch horrible scenes of towns and cities under bombardment, their bewildered and bloodied citizens desperately searching for safety, the huge shockwaves generated by the Russian invasion of Ukraine are spreading rapidly far beyond both countries’ borders.

-

Features

FeaturesFixed income, rates, currencies: Inflation spotlight on central banks

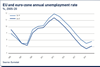

Not often far from the action, central banks have been centre stage in 2022 as one after another in the developed markets reveal their hawkish intents. The speed and synchronicity with which they have shifted has been pretty remarkable, with only the Bank of Japan not yet joining other main central banks.

-

Features

FeaturesAhead of the curve: The rise of altcoins and potential institutional adoption

It is interesting to sit between traditional investors and the crypto-native communities: one has just started on the Bitcoin adoption curve while the other might already consider Bitcoin to be a ‘boomer coin’.

-

Features

FeaturesFixed income, rates, currencies: COVID starts to lose grip on GDP

COVID’s huge influence on all our lives, whether through disruption of global supply chains or threats of lockdowns in the face of soaring infection rates, was reasonably constant throughout 2021. However, it now appears that GDP numbers have become generally less sensitive to COVID infection rates than they were, say, 18 months ago, with high vaccination rates (certainly across developed markets), and an awareness from politicians that the public’s willingness to comply with lockdowns may be waning fast.

-

Features

FeaturesFixed income, rates, currencies: Economies at a sensitive juncture

Another new year and we are still in a COVID pandemic, as we were a year ago, although this time with economic grow-th looking pretty robust across the world. But, despite the best efforts of healthcare workers, scientists and politicians, the virus continues to exert an unnervingly strong influence on all our lives.

-

Opinion Pieces

Opinion PiecesLetter from US: Crypto currencies gain a toe-hold in America’s 401(k) retirement plans

Crypto investing is not going to become mainstream any time soon in 401(k) plans. But the US retirement market is becoming more and more sophisticated – investors are becoming interested in digital assets, and asset managers, platform providers and consultants are all developing digital products and services.

-

Features

FeaturesFixed income, rates, currencies: Policy normalisation kicks in

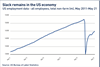

Although several emerging market (EM) central banks have been hiking rates for a few months already this year, particularly in Latin America, it was only in the third quarter of 2021 that the global share of central banks raising official rates moved above 50%. This is the first time in three years that this has been the case, as several developed market central banks joined emerging market counterparts to tighten rates.

-

Features

FeaturesFixed income, rates, currencies: Simmering tensions bubble up

After a reasonably peaceful summer – relative to the many previous volatile ones for capital markets, that is – simmering tensions are bubbling over, affecting many financial asset classes.

-

Features

FeaturesFixed income, rates, currencies: Not quite back to normal

As the world struggles to get back to pre-pandemic conditions, with schools and offices open, economic forecasting seems even less predictable than ever. Take August’s US payrolls report, which again confounded most forecasters. Analysts scrambled to explain why the headline job gains were so weak, particularly after the huge (forecast-beating) gains the previous month.

-

Features

FeaturesFixed income, rates, currencies: Market signals cloud the picture

From preliminary data, Europe’s second-quarter growth appears to have been surprisingly strong, seemingly led by services, such as strong retail sales. Supply-side problems are still constraining the goods sector generally, hitting the German economy especially, with industrial production falling more than one percentage point over the second quarter.

-

Features

FeaturesBriefing: Central bank digital currencies take shape

Central bank digital currencies (CBDCs), also sometimes called govcoins, have suddenly become a subject of public discussion. Until recently the topic was mainly the preserve of a coterie of technical experts working for central banks and niche technology firms. But now there seems to be immense excitement about their potential to transform finance. There are even some who suggest the new technology could allow the renminbi to overtake the dollar as the world’s leading cross-border currency.

-

Features

FeaturesBriefing: Bonds on the blockchain

Bitcoin’s wild ride has been hard to ignore this past year. However, it has mainly attracted its stalwart audience of retail investors, family offices and hedge funds. Institutional investors mostly sat on the sidelines, although interest has been piqued. Digital assets, most notably bonds and not cryptocurrencies, are likely to garner the inflows owing to the comfort of regulation and established market infrastructure.

-

Features

FeaturesFixed Income, Rates, Currencies: Trickier than usual

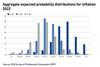

Amongst the myriad of investment conundrums facing investors, one of the more pressing today is whether – or not – the US economy will overheat. Though the Federal Reserve has done a good job assuring the markets that while (US) inflation data may indeed print higher than “target”, Chair Jerome Powell will be “looking through” any rises. They have argued that these should be temporary and a dovish outlook will remain.

-

Features

FeaturesAhead of the curve: Crypto assets

It is no longer prudent to ignore the potential of crypto assets

-

Opinion Pieces

Opinion PiecesLetter from US: The rise of the new alternatives

Pension funds and other institutional investors used to invest in hedge funds aspiring to outperform public stock and bond benchmarks. Now, after years of disappointing performances, they have changed their attitude. They still invest in hedge funds, but the new expectation is simply to get a few percentage points above the return on zero risk investments.

-

Features

FeaturesFixed income, rates, currencies: Still missing the target

Most would agree that one data release from an important but volatile dataset – employment figures – should be read with caveats. However, the scale of the forecasting ‘miss’ for April’s US job numbers was hard to dismiss as just noise.

-

Features

FeaturesFixed Income, Rates, Currencies: A false start

While we may be approaching that ‘exit from pandemic’ moment, the exceptional monetary and fiscal responses from policymakers ensure COVID-19’s economic legacy will be felt globally for years to come.

-

Features

FeaturesFixed Income, Rates, Currencies: Rising yields signal reflation

The Federal Reserve has not hinted at its future plans to unwind quantitative easing (QE). However, markets are looking to 2013’s ‘taper tantrum’ for an explanation of the dramatic US-led bond market sell-offs.

-

News

Swiss investor issues up to $500m in IPE Quest search

Plus: Benelux-based fund launches nine ‘Discoveries’ worth a combined €143.5m

-

Features

FeaturesFixed Income, Rates, Currencies: Priming the pump

Although COVID-19 infection rates are falling across many regions, the ‘success’ is more a reflection of lockdown restrictions keeping opportunities for virus spread low.