Currency – Page 5

-

News

Mandate roundup: Swiss investor issues IPE Quest searches for $1bn

Plus: Manco issues RFI for transfer agency, registrar services

-

Features

FeaturesFixed Income, Rates, Currencies: Same again in 2021?

The relief from the farewells to 2020, and welcoming a Brexit trade deal, has waned in the face of rising COVID-19 infection rates. There have also been further lockdowns across swathes of Northern Europe as well as in Japan, Thailand, and South Africa to name a few. The vaccine-generated light at the end of the tunnel which appeared last year, seems rather distant, and possibly dimmer too.

-

Features

FeaturesFixed Income, Rates, Currencies: A very different recovery

Amongst the remarkable happenings in 2020, from startling news of a pandemic to viable vaccine and beyond, has been the speed and scale of interventions from central banks and governments.

-

Features

FeaturesFixed Income, Rates, Currencies: Vaccine boosts bullish markets

The swings in outcome predictions as the vote counting began in the US election were large. From the realisation that there was no blue wave of Democrat success, to a possible re-election for Donald Trump, to a Joe Biden win but with a Republican Senate, it was tricky to comprehend the investment implications.

-

Features

FeaturesAhead of the curve: Gold all set to shine during uncertain times

Which asset has no cash flow or yield, has a volatility similar to equities even though its long-term performance lags behind equities, and which has also had long periods of negative returns? Gold.

-

Features

FeaturesFixed Income, Rates, Currencies: Economy reaches tipping point

The global reflation trade, and with it the outlook for further dollar weakness, seems paused as speculation on the outcome of the imminent US presidential election diverts attention and has many retreating to neutral positions.

-

Features

FeaturesFixed income, rates, currencies: Reality gap widens

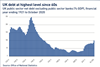

August 2020 saw the US Treasury market post one of its worst monthly performances since November 2016, while global equities, led by the US, reached new highs.

-

Features

FeaturesFixed income, rates, currencies: Still facing anxious times

Developed market government bond yields have spent the summer drifting lower as risk assets traded better. However, this benign climate has not lifted the fog of confusion caused by COVID-19.

-

Features

FeaturesFixed income, rates, currencies: Dismay sets in

As lockdowns ease, particularly in the northern hemisphere and the Antipodes, economic recoveries get underway. Given the exceptional circumstances, economic forecasts and predictions may show little consensus, or potentially be wrong, the puzzling US payroll announcements for May being a vivid example.

-

Features

FeaturesThe Renminbi: A matter of trust

Only a few years ago, there was much hype about the renminbi becoming the next significant reserve currency and potentially even threatening the dominance of the dollar.

-

Features

FeaturesFixed income, rates, currencies: Unprecedented times

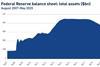

According to a Wall Street Journal blog, the word “unprecedented” was used in 395 of the publication’s articles in the past three months. Also popular were massive, enormous, staggering and eye-popping

-

Analysis

AnalysisFixed income, rates, currencies: Thinking on one’s feet

The enormous scale of national lockdowns has made it hard to keep abreast of all the extraordinary monetary interventions and fiscal support packages worldwide.

-

Features

FeaturesFixed Income & Credit: Potential for adventures

Emerging-market local-currency corporate debt is under-explored by global investors

-

Features

FeaturesFixed income, rates, currencies: Global economy under pressure

At the end of February, after a week that saw stock markets around the world plummet, US Federal Reserve chair Jerome Powell sought to calm fears, saying that the Fed would “act as appropriate” to support growth.

-

Features

FeaturesDollar/sterling: The road ahead for cable

The twisting path of the dollar/sterling relationship over 2020 will provide ongoing theatre, punctuated by moments of intensity

-

Analysis

AnalysisFixed income, rates, currencies: China’s woe hits rest of world

While the speed and breadth of the spread of infection was unknown, it was apparent that the outbreak of the new coronavirus, named COVID-19 by the World Health Organization (WHO), would cause considerable disruption to economic activity in China.

-

Features

FeaturesEmerging market outlook

Emerging markets have a knack for being in the headlines for the wrong reasons. They also stand out as sources of growth for investors who face low interest rates and muted economic performance in the developed world

-

Features

FeaturesAre cryptocurrencies an asset class for institutional investors?

Cryptocurrencies are sweeping the world in terms of news headlines but how should institutional investors react?

-

Features

FeaturesFixed income, rates, currencies: A confident start to the year

Undoubtedly a good year for financial assets, 2019 ended on a bright note with the broad, and relieved, consensus that the China/US trade conflict might be de-escalating

-

Features

FeaturesFixed income, rates, currencies: Better than expected

Although packed with geopolitical surprises 2019 turned out to be better than expected for financial assets. Equities and bonds rallied together reversing last year’s ‘unusual occurrence’ of both performing badly.