Currency – Page 6

-

News

NewsDenmark gives pension stats higher profile as sector grows

Pension and insurance assets now amount to 213% of GDP

-

Features

FeaturesFixed income, rates, currencies: Clouded by uncertainty

It was predictable that risk markets should have reacted positively to the news of an agreement in principle in the US-China trade negotiations. Although assuredly better than a seemingly relentless stream of bad will between the protagonists, the provisional agreement is in no way a solution to the conflict. Another round of trade talks could be necessary just to reach a tentative accord. Investors would be wise to temper enthusiasm to extrapolate the ‘good news’ too far.

-

Features

FeaturesEverything is still possible

Markets are on edge as a result of difficult economic and geopolitical forces. Risks are still skewed to the downside. Trade tensions have not abated, rather there is a possibility of further escalation in the future, which looks like reducing investment, and damaging already apprehensive outlooks.

-

Features

IPE Quest Expectations Indicator: September 2019

Market sentiment has split in two. For the euro-zone and the US, there was a correction that did not affect trends and equities are still favoured. In the UK and Japan, sentiment is moving towards favouring bonds

-

Features

Fixed income, rates, currencies: A bleak outcome

This year’s summer tensions in shallow markets have again been apparent. The fallout from the trade dispute between China and the US is having a global impact. Together with economic weakness almost everywhere, a global policy easing cycle could be imminent.

-

News

No-deal Brexit move is ‘tantamount to pursuing recession’, strategist warns

Investors react as UK prime minister suspends parliament with just weeks to go before Brexit deadline of 31 October

-

News

Chart of the Week: Analysing sterling’s volatility

Weak second-quarter growth figures added to the pressure on the UK currency after weeks of speculation about the nature of the country’s exit from the EU

-

News

Ex-regulator boss brings FX rigging lawsuit against five banks

Former chair of the Pensions Regulator Michael O’Higgins is leading efforts to secure compensation from five banks fined more than €1bn in May over two FX cartels

-

News

NewsPNO Media scheme credits alts, active management for investment gains

The creative sector pension fund is the latest to see returns wiped out by currency movements due to hedging position

-

Features

FeaturesIPE Quest Expectations Indicator: July 2019

Markets are still driven by political risk and growth prospects. It looks like the two risks are working in the same direction this month.

-

Features

FeaturesIPE Quest Expectations Indicator: August 2019

It looks like political risk is taking a back seat to growth this month, continuing last month’s trend.

-

Features

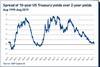

FeaturesFixed income, rates, currencies: Nervousness abounds

The weak US non-farm payroll (NFP) data for May, far below forecasts, sent rates falling and stocks rising, on the supposition that it raised the likelihood of interest rate cuts from the Federal Reserve. On the other hand, while risk markets cheered the prospect of easier money, the hardline approach taken by the US towards China, and China’s uncompromising responses are raising investor nervousness.

-

News

Achmea scheme’s booming Dutch property holdings deliver 24%

The Dutch insurer’s pension fund posted an overall loss of 1.6% for 2018 despite significant gains from its property and infrastructure investment portfolios

-

News

BpfBouw increases dollar hedge following currency loss

Construction sector scheme loses 2.1% on currency hedge chiefly due to appreciation of dollar in 2018

-

News

Dollar, yen appreciation behind Philips scheme’s 2.4% investment loss

Pension fund wants to maintain currency hedge but has halved the value of the position ‘for strategic reasons’

-

Features

FeaturesFixed income, rates, currencies: Politics remains the bellwether

Financial markets continue to be influenced by news, and tweets, about the US-China trade negotiations. While stock markets have sold off during the second quarter of 2019, and credit spreads have widened, this financial tightening is so far less than what happened over the last few months of 2018.

-

News

NewsFive banks hit with €1bn in fines after ‘banana split’ FX cartel uncovered

Barclays, the Royal Bank of Scotland, Citigroup, JPMorgan, UBS and MUFG Bank fined by European Commission over ‘Banana Split’ and ‘Essex Express’ cartels

-

News

Mandate roundup: Ircantec awards five mandates worth €2.8bn [updated]

Plus: German church fund awards currency overlay mandate to Metzler; Italian education workers’ scheme shakes up manager line-up; Hampshire hires JP Morgan

-

News

NewsNorwegian sovereign fund boasts €76bn Q1 gain despite currency drag

CEO Yngve Slyngstad hails best quarterly performance ever in local currency terms as Norwegian krone rises against major currencies

-

News

ATP backs ethical currency trading code

Denmark’s largest pension fund is one of the first schemes to sign up to new code run by BIS, after “irregularities” in currency markets