Currency – Page 7

-

Asset Class Reports

Asset Class ReportsCryptocurrencies: A match made in heaven – or hell

Cryptocurrencies could offer handsome returns to hedge funds. Or they could be a disaster

-

Features

FeaturesFixed Income: Markets take nervous turn

Almost every asset class did well in the first quarter of 2019

-

Features

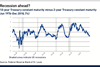

FeaturesFixed income, rates, currencies: Markets take nervous turn

The reaction and aftermath to the US Federal Reserve’s dovish pivot appears to be more focused on the monetary policy news itself and the ‘fuel’ of easy money.

-

News

‘Attractive entry point’ for cryptocurrencies following price crash

Institutional investors should consider an allocation to cryptocurrencies, according to Cambridge Associates

-

Features

FeaturesIPE Quest Expectations Indicator: March 2019

When uncertainty hangs over the financial markets, indices tend to converge. That is true for net sentiment of equities

-

Special Report

Special ReportEuro: Many factors to take into account

Euro-zone investors are not immune to global currency vagaries

-

Special Report

Special ReportStrategy: Pension funds confront FX risk

Investors are paying more attention to currency hedging strategies in the face of increased global risk

-

Features

FeaturesFixed income, rates, currencies: Global economic discomfort

Fed’s wait-and-see approach to monetary policy adds to contradictary signals

-

Special Report

Special ReportSterling scenarios

Sterling will remain mired in uncertainty as long as the conflict over Brexit is unresolved

-

News

Brexit: Nordic pension funds reveal their approaches to UK assets

SPK, Veritas and Apteekkien Eläkekassa explain their approaches to political risk in the EU

-

News

NewsAP3 records positive 2018 return after gains on unlisted assets, FX

Swedish buffer fund posts 0.6% return and adds SEK6.8bn to state pension system

-

Features

FeaturesIPE Expectation Indicator: February 2019

The end of 2018 saw expectations shift meaningfully in certain markets, and then pause. It also saw trends accelerate, then pause. For most of us, the pauses were welcome, because the shifts were related to broad market plans

-

Features

FeaturesFixed income, rates, currencies: Clouds to darken further

Markets have pulled back from US rate hike forecasts; Euro credit looks set to be most vulnerable to quantative tightening; The European elections in May look set to see a surge in support for populist parties

-

News

Brexit: Derivatives trade exodus ‘to start with currency contracts’

Asset manager expects derivatives trade through London only to remain unchanged if Brexit is cancelled

-

News

Swiss pension fund tenders $4bn currency overlay mandate

A Swiss pension fund is seeking ideas for a potential $4bn (€3.5bn) currency overlay mandate via IPE Quest. Search QN-2506 is for an global overlay mandate with Swiss francs as the base currency. The main currencies the investor wants to hedge are the euro, the US, Australian and Canadian dollars, ...

-

Features

FeaturesFixed income, rates, currencies: Hope but also fears for 2019

US domestic investors hold healthy stock market profits after a decade-long bull run Geopolitics on many fronts point to tumultuous times ahead

-

Features

Fixed income, rates, currencies: Challenges still lie ahead

While the US mid-term elections saw the Democrats regain the House of Representatives, trade policy remains in the hands of the White House. Trade tensions, between the US and China in particular, will remain to the fore. President Trump’s aggressive trade policy is already having a global impact with declining purchasing manager indices indicating corporate hesitation in future plans.

-

Features

Macro Matters: Currency returns to the fore

Global tension means exchange rates will again become a key mover of investor decisions

-

News

MiFID II has shrunk fixed income research market, research indicates

ICMA survey finds asset managers using fewer providers as availability of research declines – but quality ‘has not changed’

-

News

Chart of the Week: Sterling struggles as Brexit deal teeters on the brink

The UK currency has fallen versus the dollar and the euro in the immediate aftermath of a draft agreement emerging