A recent study investigated the potential stabilising role of pension funds in financial markets in the European Union from 2001 to 2017

Key points

- Pension funds provide significant stability to financial markets in both crisis and non-crisis times

- They exert an overall stabilising effect on financial markets in countries with strong governance

- Automatic enrolment programmes can support financial stability in EU

Over the last two decades, pension funds have become dominant and fast-growing actors in global financial markets, driven by the significant shift from public pay-as-you-go plans to privately funded schemes.

Their assets under management reached about $60trn (€56trn) by the end of 2021, representing 60% of global asset owners, according to WTW. Though more than half of pension funds’ assets worldwide are held in the US, their size has grown significantly in Europe. During the last two decades, pension scheme assets as a proportion of GDP has almost doubled from 14% to 27% in European Union countries, despite the 2008 global financial crisis and the 2011 European debt crisis.

Since the financial crisis, emerging market countries, including European ones, experienced about $150bn in non-resident portfolio outflows, resulting in the destabilisation of financial markets. At this point, domestic and long-term providers of financial capital may offset the liquidated positions of foreigners by purchasing these assets at fire sale prices. Given their major importance and distinctive characteristics, pension funds have gained considerable attention for addressing the stability of financial markets in European countries.

Pension fund advantage

The advantage of pension funds over other institutional investors derives from the fact that their liabilities are long term – they fund their investments from contributions of pensioners. Since they also have predictable cash outflows, they are unlikely to face unanticipated short-term liquidity needs. These characteristics allow funds to behave like investors with deep pockets. They can buy assets when prices have dropped and can benefit from the price increases. Moreover, the patient capital of pension funds encourages countercyclical investment strategies, especially in times of crisis.

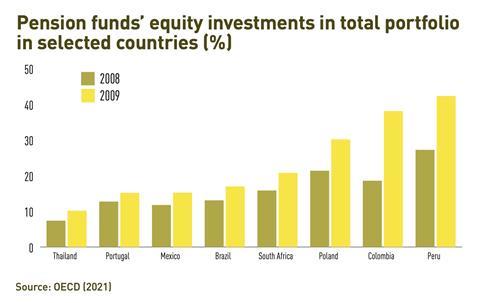

They finance their investments with contributions and are not leveraged. Funds are major providers of liquidity and collateral to the financial system, even in times of market stress. Anecdotal evidence by the Organisation for Economic Co-operation and Development (OECD) suggests that pension funds in several countries, including Portugal, Brazil, Poland and Colombia, followed a countercyclical approach during the financial crisis by increasing their exposure to equity investments (see chart). As a consequence of this buy-low and sell-high strategy, pension funds can bring asset prices closer to their fundamental values and thereby stabilise markets.

From a policy perspective, the positive impact of pension funds on financial stability is supportive of recent initiatives, such as automatic enrolment, that aim to increase the size of private pensions. In the last decade, auto-enrolment has been introduced at the national level in three EU countries – UK (2012), Poland (2019) and Lithuania (2019). Based on our findings, other EU countries may also consider implementing this policy, further supporting the stability of financial markets.

How the methodology led to the findings

In investigating the impact of pension funds on financial stability for 25 EU countries over the period 2001-17, we first set out to determine whether the relationship differs across crisis and non-crisis times. As a proxy for financial stability, we used the Country-Level Index of Financial Stress (CLIFS), which captures the level of financial stress in equity, bond and currency markets. To measure the importance of pension funds, we used the ratio of total pension fund assets to GDP. We also used financial and macroeconomic variables to control for other potential determinants that may affect financial stability. Overall, the results indicate a positive relationship between pension funds and financial stability both in crisis and non-crisis times.

In the second part of the analysis, we focused on the effect of pension funds governed by the prudent-man rule on the financial stability of countries with strong and weak governance. The rule “stipulates that investments should be made in such a way that they are considered to be handled prudently, as someone would do in the conduct of his or her own affairs”. It ensures diversification, protecting the beneficiaries against insolvency of the sponsor and investment risks. Consequently, the prudent man-rule approach can encourage countercyclical behaviour in financial markets.

We came to two main conclusions: first, that pension funds exert an overall stabilising effect on financial markets only in countries with strong governance. Second, while pension funds following the prudent-man rule provide additional stability to financial markets in countries with strong governance, they undermine it in countries where governance is weak.

Seda Peksevim is founder and managing director at Pensión Research & Consulting. This is a summary of her report, ‘Do pension funds provide financial stability? Evidence from European Union countries’, published in the Journal of Financial Services Research in 2023.