Defined benefit – Page 23

-

Opinion Pieces

Opinion PiecesViewpoint: Fee transparency – it’s good for managers too, but they probably won’t believe it

Asset managers are still not properly able to represent the true and comparative value-for-money they provide

-

News

NewsPLSA pinpoints UK investment potential for pension funds

The association expects the scale and distribution of assets across the pensions sector to alter substantially over the next decade

-

News

NewsFTSE 350 DB pensions schemes shift £5bn deficit to £38bn surplus

But ’there is every chance that 2022 will be a last hurrah for cash injections into DB schemes’, says WTW

-

News

NewsNew PPF proposals would represent ‘seismic changes’ to UK pensions landscape

Plans would mean ‘struggling’ DB schemes could choose to opt-in to the Pension Protection Fund

-

News

NewsNorway moves ahead with flexible buffer rules for legacy DB

Pension funds, insurance companies divided on issue of proposed ceiling on buffer fund

-

News

NewsLCP sets up climate risk tool for pension scheme stakeholders

The firm is urging trustees to carefully analyse company business plans and forecasts

-

News

NewsUK roundup: British Steel Pension Scheme in £2.7bn buy-in deal

Plus: DWP opens auto-enrolment consultation for defined benefit schemes; Direct Line Group Pension Trustee picks LifeSight as master trust provider

-

News

NewsPensions regulator calls on DB trustees to brush up on employers’ financial positions

A high level of debt among businesses can risk their ability to support DB pension schemes

-

News

NewsUK travel pension fund secures £900m buy-in deal with Aviva

The buy-in and eventual buyout with Aviva will ultimately result in a better outcome for the vast majority of members

-

Opinion Pieces

Opinion PiecesViewpoint: Differentiation – the future of professional pension trusteeship

When purchasing professional services, choice is good. Differentiated choice is even better.

-

News

NewsAon lauds BoE sparking ‘robust debate’ on wisdom of UK buyout surge

Consultancy responds to warning from UK central bank about risks of insurers rushing to offer bulk annuities to now-healthier DB schemes

-

Country Report

Country ReportUK: Beware the unintended consequences of the DB funding code

Laura McLaren highlights the unintended consequences of TPR’s proposed code, and what can be done to mitigate the risks

-

Opinion Pieces

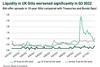

Opinion PiecesBlame will not solve the issues raised by the LDI crisis

The chain of events that led to the UK’s liability-driven investment (LDI) crisis, a high-profile inquiry by the UK Parliament, and a time of anxiety and introspection in the country’s pension industry, started well before then prime minister Liz Truss’s government and its somewhat reckless ‘growth plan’.

-

Country Report

Country ReportUK: A review of the LDI debacle

The UK Parliamentary inquiry into the LDI crisis has shed light on its causes, but the debate over the lessons learned for the UK DB industry is far from over

-

News

NewsThe Pensions Regulator pushes trustees on long-term funding targets

TPR’s Annual Funding Statement explains how pension funds will need to reset funding and investment strategies

-

News

News‘Potential renaissance’ of UK DB pensions mooted amid parliamentary probe

Work and Pensions Committee’s inquiry into defined benefit pension schemes ends today

-

News

NewsBuy-in roundup: Safeway completes £1.4bn deal with Rothesay

Plus: Ibstock Pension Scheme’s £190m buy-in with Just Group; Market volatility pushes buy-in/buyout volumes

-

News

NewsPensionsEurope Conference: Risk management in time of transition

The move from DB to DC schemes, and a renewed emphasis on ESG, lead to a rethink in governance and investments

-

News

NewsFuture of UK pensions ‘looks risky’, says IFS as Pensions Review is launched

The Pensions Review will produce a series of detailed reports over the next two years on these challenges facing future generations of pensioners

-

News

NewsUK parliamentarians call for greater accountability of regulators

RRG recommends forming a new cross-parliamentary committee to oversee the performance of regulators