All articles by Dewi John – Page 2

-

Features

FeaturesCLO supply outstrips demand

Do reports of a growing wariness over collateralised loan obligations (CLOs) mean that the good times are over for the investment vehicle?

-

Asset Class Reports

Asset Class ReportsLeveraged loans: Applying leverage

Leveraged loans have performed well recently but regulators are expressing concerns about risks

-

Special Report

Asset Allocation: Bumpy roads ahead

Investors see the outlook for the asset class as positive in the medium term but riskier in the short term

-

Features

Benchmarking: Redefining investment classes

A major GICS index methodology change seeks to reflect underlying market economics

-

Special Report

Special ReportSpecial Report Asia: Game-changer

China’s growing clout in Asia is influencing investment strategies across the region

-

Asset Class Reports

Government Bonds: Attractions on both sides of the pond

US Treasuries have slumped in value but still have the allure of a safe haven

-

Features

Selection is key in EMD

Anxiety is growing about emerging market debt. US rate rises and the potential for a stronger dollar mean that EMD may be heading for turbulent times

-

Features

UK Equities: The pariah asset

No one wants UK equities. The influential global fund manager survey published by Bank of America Merrill Lynch reported that they were the most unpopular asset in April

-

Asset Class Reports

US Economy: Where big is beautiful

The new economy in the US is dominated by large tech firms that are still growing

-

Features

Briefing: Commodity super cycle

The internet can in some ways be said to define globalisation.

-

Special Report

The private equity Pac-Man

Technology is becoming a game changer in the private equity world

-

Features

The Dollar: The greenback quandary

The US economy is growing, as are inflation expectations. The Federal Reserve’s response has been to embark on the most aggressive rate-tightening cycle in the developed world

-

Asset Class Reports

European Equities: Catching up with global growth

European equities look set to catch up with other developed markets this year after recent underperformance

-

Special Report

Special ReportIlliquid investment: Investors resist the illiquid plunge

European defined contribution schemes have lagged the trend to illiquid investments

-

Features

Briefing: The return of carry

The carry trade may be making a comeback, after a decade in the doldrums, laid low by the global financial crisis

-

Asset Class Reports

Nordic investors: Keeping faith

Nordic investors still think hedge funds have a place in their portfolios despite concerns about underperformance and high fees

-

Features

Active investment rebounds

After a period of underperformance, active investment strategies are on the up – for now at least

-

Special Report

Investor Strategy: Looking over the hedge

Currency strategy should move up the agenda as global policy divergence continues

-

Asset Class Reports

Inflation-linked bonds: Inflationary trends stoke linker demand

Inflation-linked government bonds are back in demand as investors seek protection against rising inflation

-

Special Report

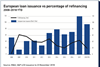

Private debt: Time to get picky

After years of strong performance the sector could be due a shake-out

- Previous Page

- Page1

- Page2

- Page3

- Next Page