The reduction of carbon emissions by Dutch pension funds between 2017 and 2020 has been mainly due to companies emitting fewer CO2. Less than half of emission reductions can be attributed to portfolio changes, according to a research paper published by the Dutch central bank DNB.

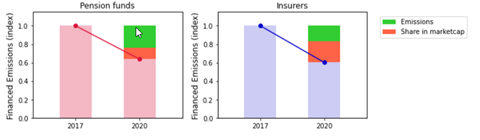

Over the research period, emissions of companies in which Dutch pension funds and insurance firms had invested came down by more than 30%.

The DNB researchers investigated to what extent this reduction was attributable to emission reductions by these firms and by divestment decisions of pension funds.

The paper concludes that emissions reductions by companies have been more material in reducing the carbon footprint of pension funds.

Looking at absolute emissions, they find that these have come down by 36% between 2017 and 2020. About two thirds of this is due to measures taken by companies, the authors concluded, with the remaining third attributable to investment decisions.

For the original article, go to Pensioen Pro