Elisabeth Jeffries

Contact info

- Email:

- liam.kennedy@ipe.com

News

NewsEU sustainable finance advisers unveil capital flows monitoring proposal

Time is seen as ripe for tracking extent to which capital flows are actually being redirected towards sustainable investments

News

NewsThink tank offers up ‘representative deforestation credit portfolio’

AFII developed open access product ’as a prod and and poke’ for investors to get started on deforestation risk

Features

FeaturesAvoided emissions: measuring carbon that didn’t enter the atmosphere

A few years ago, a footwear producer’s claim that it was reducing carbon emissions in the economy because its customers walked rather than took the car provoked amusement among investment managers. It wanted to prove its product was healthier and greener than competing transport modes by claiming credit for emissions prevented from petrol use. This autumn, assessments of the role played by individual low-carbon products in replacing fossil fuels are again under scrutiny in the finance sector.

Special Report

Special ReportNatural capital and biodiversity: betting on disclosure for nature

The Taskforce on Nature-related Financial Disclosures (TNFD) has taken a pragmatic approach to developing its final recommendations

Special Report

Special ReportCorporate reporting: UK pivots to a forward-looking view on climate transition plans

The Transition Plan Taskforce has given its final recommendations for climate transition plans. If adopted by the FCA they will lead to a step-change in reporting by financial institutions

News

NewsTNFD launches final disclosure recommendations

TNFD activities coincide with legislation on nature-related disclosures mooted in some countries

Country Report

Country ReportFrance moves ahead with innovative climate reporting rules

A new French law could compel companies to disclose their climate plans

News

NewsFrance’s lower house votes for mandatory Say on Climate

FIR, a French sustainable investment lobby group, says that only nine companies published climate resolutions so far out of 795 on the Euronext Paris stock exchange

Asset Class Reports

Asset Class ReportsFixed income & credit – Resilience bonds

Resilience bonds aim to encourage climate investment characterised by a more forward-thinking, preventative outlook

Features

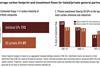

FeaturesTCFD reporting for pension funds in the UK: a progress report

Some 18 months from the introduction of mandatory reporting of climate data by large UK pension funds, evidence shows that the policy has not brought about greater orientation towards green investments

Special Report

Special ReportNatural capital: New nature fund aims to halt loss of flora and fauna

Global Biodiversity Framework fund is targeting $200bn per year by 2030, but there is uncertainty about private sector participation

- News

New directive quadruples companies disclosing on ESG issues

Promoters of the directive draw particular attention to the integration of non-EU entities such as the subsidiaries of US firms, which is rare in the EU statute

Special Report

Special ReportESG: Private equity faces disclosure scrutiny

The CSRD will see a fourfold increase the number of corporates subject to sustainability reporting requirements, placing increased demands on private equity firms

Special Report

Special ReportESG: Central banks nudge lenders to produce climate data

Lenders face a variety of challenges when measuring the environmental impact of their balance-sheet exposure

Country Report

Country ReportFrance: The biodiversity reporting enigma

France’s financial institutions must report on biodiversity impacts but face a lack of corporate data push from pension reforms

Asset Class Reports

Asset Class ReportsEquities – Are Paris-aligned benchmarks a climate gamechanger?

Inflexible annual carbon reduction targets and weak data can lead to flawed decision-making

News

NewsAsset owners are more proactive once signed up to UK Stewardship Code

The code is making a separate impact from other stewardship or ESG policies

Features

FeaturesEmissions reporting: taking stock of indirect emissions in Scope 3

Disclosure proposals by the US Securities and Exchange Commission (SEC) in March could guide the regulatory searchlight beyond companies’ direct and indirect C02 emissions (Scope 1 and 2) and towards upstream and downstream (Scope 3) emissions.

News

NewsBoE test suggests net-zero transition ‘absorbable’ for banks, insurers

Climate stress test points to profit reductions but no ‘worrying direct impact’ on solvency

- Special Report

UK Stewardship Code: a platform for impact

Investors and specialist managers could use the UK’s revised Stewardship Code to showcase intentionality and impact