All Equities articles – Page 13

-

News

NewsAvon Pension Fund backs small caps as outperformance expected

Small caps will outperform S&P in the next 20 years, according to head of pensions at the Avon scheme

-

News

NewsDenmark’s IPD slams EU red tape as pensions money picks US over EU

Allocations to US equities now three times the size of EU ex Denmark weightings for Danish pension funds

-

News

NewsAP7 divests €100m of largely Chinese oil and coal stocks

Swedish premium pension default provider says coal phase-out is ‘single most important measure to curb climate change’

-

News

NewsDanish doctors’ pension fund votes down climate-failing bank majors

Lægernes Pension boasts 2024 climate targets achieved ahead of schedule, largely through exclusions

-

Features

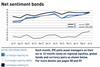

FeaturesIPE Quest Expectations Indicator - June 2024

Trump and Biden are both losing to undecided voters, a group that is now unusually large and may be sensitive to Trump’s legal troubles. Biden’s approval rate is below his score in presidential polls, while Trump’s score is the same in presidential polls and those measuring voters’ opinion of him. In the UK, the Conservatives took another drubbing in the local elections.

-

Asset Class Reports

Asset Class ReportsSmall-cap equities struggle as giants surge ahead

Small caps are finding it difficult to make inroads in a world dominated by the Magnificent Seven

-

Asset Class Reports

Asset Class ReportsMagnificent seven stocks suck up capital from other sectors

Concentration of US equity markets around a handful of names remains an intractable issue

-

Country Report

Country ReportSolvency rules continue to hamper Finland’s private pension funds

The Finnish retirement industry hopes that a relaxation of regulations will allow schemes to increase equity allocations

-

Asset Class Reports

Asset Class ReportsEquities: a return to passive safe havens

In an effort to counterbalance an uncertain economic outlook and geopolitical tensions, many institutional investors are avoiding active management

-

News

NewsNBIM backs simpler targets to achieve long-term sustainable investments

NBIM climate lead said the fund’s long term views enables it to step out of certain ‘highly politicised discussions’.

-

News

NewsPKBS drops ExxonMobil, Chevron, Glencore following oil and gas expansion deals

The pension fund has decided to implement an ESG index for investments in Swiss equities

-

News

NewsDemand for equities double but infrastructure mandates fall, report finds

Infrastructure mandates for institutional investors saw a 15% fall in the last year

-

Features

FeaturesIPE Quest Expectations Indicator - May 2024

EU parliamentary elections are approaching fast. Current polls predict a shift to the right, with the current centrist parties remaining dominant and the extremist right overtaking the Eurosceptics. US President Donald Trump is still liable to be convicted in a criminal case, but his poll figures are rising.

-

Interviews

InterviewsThematics Asset Management’s CIO on themes and investment challenges

Out of the 19 boutiques businesses belonging to the Natixis Investment Management franchise, Thematics Asset Management is by no means the smallest, but it is not exactly a juggernaut, managing €3.3bn of assets at the end of last year. Yet, it is actively contributing to what could be a crucial evolutionary step for global investors.

-

News

NewsDenmark’s PFA offloads €160m Shell holding after goal weakening

Bessing says still believes Shell better positioned for green transition than vast majority of oil and gas companies

-

News

NewsFondo Gomma Plastica to create equity mandate investing in Italy

The scheme is working on the equity mandate with other pension funds joining as part of a consortium

-

News

NewsFinland’s Elo cites hedge funds, listed equities as Q1 drivers

Pensions insurer makes 6.5% return on hedge funds as weighting increases in portfolio

-

News

NewsCassa Forense seeks asset managers for investment vehicles worth €4bn

The lawyers scheme is creating the two vehicles to streamline investments and administration of its assets

-

News

NewsNBIM misses benchmark in Q1 on drag from real estate

Tangen boasts biggest-ever quarterly gain in kroner for the Norwegian sovereign wealth fund

-

News

NewsItalian pension schemes reap benefits of banks’ equity investments

The Bank of Italy has distributed dividends to shareholders, including pension funds, for a total amount of €340m