All Equities articles – Page 18

-

News

NewsMandate roundup: Cushon picks Ninety One’s credit fund

Plus: Swiss pension funds seeks managers for European small-cap, private credit/debt

-

News

NewsIlmarinen anchors new Amundi climate-focused Europe ETF with €580m

Finnish pensions major edges closer to having all its passive equities tracking MSCI’s Climate Action indices

-

Analysis

AnalysisAnalysis: German states realign €30bn pension fund assets to stricter ESG standards

Four German states have recently revised their sustainable investment strategies, sticking to stricter ESG rules

-

News

NewsVelliv divests BP, TotalEnergies, Shell in climate strategy rethink

Danish pension provider divests DKK3.4bn of upstream oil and gas stocks and bonds

-

News

NewsIlmarinen steps up ETF collaborations, anchoring €2.75bn of BlackRock launch

Finnish pensions insurer makes latest index investment as it shifts passive equities into climate-focused funds

-

News

NewsLGPS funds allocate £455m to Osmosis’s core equity strategy

Osmosis will build the strategies, while UBS Asset Management will act as investment manager, under the current LGPS Framework for Passive Investment Management Services

-

News

NewsAlecta to diversify equities, cut non-Nordic exposure and add indexing

Swedish pensions heavyweight announces first steps in crisis-driven strategy overhaul

-

News

NewsFinnish pensions centre chief argues for 10-point rise in equity weightings

Paldanius says boosting equities allocations by a tenth could add 0.3 percentage points to Finnish workplace pension fund returns

-

Features

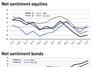

FeaturesIPE Quest Expectations Indicator: June 2023

Continued loud bickering between the Wagner Group and the Russian army is protecting Putin from both, worsening the outlook for peace, while there are multiple signs that military supplies are approaching exhaustion. The coalition supporting Ukraine is stronger than ever, showing increasing willingness to provide military aircraft. Yet the offensive expected in February has not started. In the US, Florida governor Ron DeSantis is damaging his position with an unproductive row with Disney, while Trump has moved closer to a prison term. Gas consumption in the EU is falling faster than expected, due to efficiencies like heat pumps, changeover to electricity and solar panels. Macron scored nicely by sponsoring the participation of Zelensky at the Hiroshima G7; Sunak failed to centre political attention on China.

-

Opinion Pieces

Opinion PiecesBetter the equity market devil you know?

Being a large equity investor in a relatively small domestic market can have advantages as well as drawbacks. Proximity to the market and its infrastructure, good knowledge of corporates and corporate leaders, and the ability to exercise strong influence as an owner, potentially a stable long-term one, all count among the advantages. The need to avoid concentration – in terms of position, sizing and overall allocations – and idiosyncratic sector exposure are among the challenges.

-

Opinion Pieces

Opinion PiecesDo not blame institutions for taking risks

Alecta, the SEK1.19trn (€105bn) institution that manages the Swedish ITP private-sector pension scheme, is being probed by Swedish regulators for the €1.9bn capital loss it experienced earlier this year, as the three US regional banks it invested in – Silicon Valley Bank, Signature Bank and First Republic Bank – collapsed. The institution reacted by firing its influential CEO Magnus Billing.

-

Special Report

Special ReportOutlook – Europe and the world: CIOs focus on bonds and quality stocks

With the prospect of weaker growth, volatility and higher inflation and rates, strategists argue for more selectivity in investments

-

Asset Class Reports

Asset Class ReportsEquities – Does location matter in the corporate listings debate?

The number of listed companies have fallen dramatically, but London remains a preferred global financial centre

-

Asset Class Reports

Asset Class ReportsEquities – Testing times for high-conviction equity strategies

Today’s environment may favour stock picking, but investors continue to face pressures to justify the added risks

-

Asset Class Reports

Asset Class ReportsPortfolio strategy – Equities

Our report shines a light on investors’ thought processes when it comes to choosing active, passive or a combination of the two. We surveyed CIOs and senior portfolio managers to get an insight into how they construct their equity portfolios. Our report also features an investigation into the fall in listings on the UK equity market, at a time when listing domicile is increasingly consequential aspect of portfolio construction.

-

News

NewsAP7 hands LGIM large active climate-transition equities mandate

Swedish pensions giant says new partnership is first time it has combined a focus on firms able to transition with active ownership

-

News

NewsATP’s CIO bemoans weak due diligence behind IPO prospectuses

‘Crucial that everyone plays by the same rules,’ say Svenstrup and Krüger Andersen

-

News

NewsSwedish Fund Selection Agency unveils draft fund agreement

Plus: Swiss occupational scheme issues CHF300m mandate; Pension fund in Central Europe seeks infrastructure manager

-

News

NewsInarcassa increases investments in Italian private banks to €200m

For 2023 the pension fund plans to increase investments in private markets and real estate

-

News

NewsSweden’s premium pension tenders to kick off with European large-cap equity

Fund Selection Agency announces asset category of first tender, says deadline will be end of August