ESG Special Reports – Page 5

-

Special Report

Special ReportSpecial Report – Natural capital

Incorporating nature risk into financial analysis remains the - for now elusive - goal for investors, but this is hard given the lack of consensus on what information should be collected and how it should be presented. Such questions are the domain of the Taskforce for Nature-related Financial Disclosures (TNFD), the group founded in 2021. As well as striving for transparency and consistency in data disclosure, asset owners are also keen to deter inflated and exaggerated claims by asset managers on biodiversity impacts.

-

Special Report

Special ReportNatural capital: Industry turns its gaze on biodiversity

Taskforce on Nature-related Financial Disclosures sets out to create a framework to help financial institutions and companies report their dependencies and impacts on nature

-

Special Report

Special ReportNatural capital: Investors press for impact

The focus is starting to shift from pure risk reporting to ensure that investments have a positive effect on declining biodiversity

-

Special Report

Special ReportNatural capital: Asset owners start to engage

Two new global initiatives are under way to help investors focus on issues such as deforestation, while some managers have been on track for a while

-

Special Report

Special ReportNatural capital: KLP hopes for a nature-positive economy

The asset manager’s head of responsible investments speaks to Sophie Robinson-Tillett about her optimism that the COP15 agreement will lead to regulatory change

-

Special Report

Special ReportNatural capital: New nature fund aims to halt loss of flora and fauna

Global Biodiversity Framework fund is targeting $200bn per year by 2030, but there is uncertainty about private sector participation

-

Special Report

Natural capital: First nature benchmark shows the time to act is now

Investors can contribute to a nature-positive world now by understanding their portfolio company impacts on nature and prioritising action

-

Special Report

Special ReportDC Pensions: Australians exercise pension choice

While the default MySuper dominates the superannuation industry, Australia’s defined contribution system offers a complex and wide range of options for retirement

-

Special Report

Special ReportSpecial Report – Prospects 2023

The past year will be remembered as one of the most challenging for institutional investors ever. The outlook for 2023 is brighter, if anything because valuations of major asset classes have come back to historical levels.

-

Special Report

Special ReportProspects 2023: How important are the carbon markets?

Carbon pricing is key to investment in green technology

-

Special Report

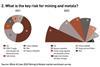

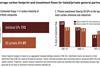

Special ReportProspects 2023: ESG-driven divestments threaten energy transition

Investor support for miners is crucial to ensure a sufficient supply of metals for renewable technology

-

Special Report

Special ReportESG: Joined up thinking required

At last year’s Conference of the Parties, COP26, the financial sector stole the show.

-

Special Report

Special ReportSpecial Report – ESG

Our report looks at the ESG through the prism of private markets, with coverage of SFDR and an interview with Anner Follèr, head of sustainability at Sweden’s national private equity investor AP6

-

Special Report

Special ReportESG: Dirty asset divestment

There is growing focus on public companies that are under pressure to sell high-carbon assets to unlisted companies or private equity

-

Special Report

Special ReportESG: Prepping the next generation of listed companies on ESG

Investors are helping private companies understand their expectations before they go public

-

Special Report

Special ReportESG: Private equity faces disclosure scrutiny

The CSRD will see a fourfold increase the number of corporates subject to sustainability reporting requirements, placing increased demands on private equity firms

-

Special Report

Special ReportESG: Taking a lead on private market ESG

Anna Follèr believes there is no asset class better suited to tackle ESG and sustainability than private equity.

-

Special Report

Special ReportESG: Leading viewpoint - private equity GPs are stepping up to the plate

Private equity firms can be a powerhouse for responsible investment

-

Special Report

Special ReportESG: Leading viewpoint - venture capital is embracing ESG - and SFDR is a major driver

Venture capital funds opting in to responsible investing

-

Special Report

Special ReportESG: Interview - ShareAction’s Catherine Howarth on the cost of living crisis

“There’s going to be a good deal more scrutiny on the way the private sector behaves,” says the CEO of ShareAction, a London-based non-profit that coordinates investors and lenders on sustainability issues.