ESG Special Reports – Page 7

-

Special Report

Special ReportTop 500 Asset Managers 2022

The emergence of persistent higher inflation, China’s zero-COVID policy, stress on global supply chains, and Russia’s Ukraine war all suggest that the asset total of this year’s IPE Top 500 Asset Managers Guide represents a high water mark.

-

Special Report

Outlook: Can investors act alone on energy policy?

It may be up to governments to set the rules of engagement to achieve net zero

-

Special Report

Special ReportOutlook: Future of hydrocarbons

The OECD remains critically dependent on Russian oil and gas – and finding alternative sources will be very hard

-

Special Report

Special ReportFour challenges for asset managers

Leading figures respond to key questions on ● Investment strategy ● ESG

-

Special Report

Special ReportDriving change as the debate on impact evolves

It’s hard to believe, but this is IPE’s fifth annual special report dedicated to investing for impact: our first impact investing report was in 2018. What has changed since then? In some ways not much. We still have a debate about the credibility of claiming impact in public markets, where the narrative is all about stewardship in the form of engagement and voting, and we discuss the effectiveness of engagement versus divestment.

-

Special Report

Special ReportStrategy: The search for integrity and effectiveness

Investors are increasingly seeking real-world impact, but understanding of what that means and how it can best be achieved is still evolving.

-

Special Report

Special ReportCorporate lobbying comes under the spotlight

Companies are starting to respond to investors’ demands for transparent and consistent lobbying.

-

Special Report

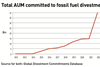

Special ReportConsigning fossil fuels to the past

How are asset managers supporting the shift away from fossil fuels in energy intensive sectors?

-

Special Report

UK Stewardship Code: a platform for impact

Investors and specialist managers could use the UK’s revised Stewardship Code to showcase intentionality and impact

-

Special Report

Special ReportTowards a sustainable portfolio theory

Applying monetary values to impacts would allow investors to direct capital better and assess opportunities for improved long-term returns

-

Special Report

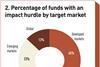

Special ReportData: focus on impact hurdles

An increasing number of impact funds link carried interest to impact goals. Asset owners can help by encouraging this trend

-

Special Report

Special ReportSpecial Report – Manager selection

With COVID-19 now under control, the business of selecting managers no longer has to deal with severe restrictions on travel and face-to-face interactions. However, the pandemic has taught investors and manager selection advisers some important lessons.

-

Special Report

Special ReportManager selection: Market trends

Manager selection consultants are helping investors navigate the next stages of ESG integration

-

Special Report

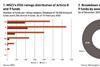

Special ReportSpecial Report - Regulation

Europe’s flagship SFDR regime for ESG was never intended to become a fund-labelling framework. So as Susanna Rust also writes in this issue, it is a relief that the EU is now consulting on minimum requirements for Article 8 funds. In this Special Report, we look in some depth at how asset managers have embraced SFDR, taking in the broad reclassification exercise that has taken place to relabel existing funds, and the short-term risks of greenwashing. In the longer term, the hope is for much more standardisation and there are signs that this is already happening.

-

Special Report

Special ReportRegulation: SFDR put to the test

One year in and the verdict on the EU’s Sustainable Finance Disclosure Regulation (SFDR) is mixed

-

Special Report

Special ReportMiFID II: A threat to European sustainability?

MiFID II is unintentionally jeopardising the long-term objectives of ESG investors

-

Special Report

Special ReportSpecial Report – Sustainability & reporting

Increasing levels of ESG investing require greater transparency across the value chain, not least from companies. Enter the International Sustainability Accounting Standards Board, which will take shape this year and which is currently recruiting 11 inaugural board members.

-

Special Report

Special ReportISSB: A new body for sustainability standards

As it comes to life, the new International Sustainability Standards Board faces a complex path towards harmonisation of fragmented frameworks

-

Special Report

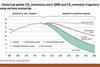

Special ReportEnergy: Are pension funds missing out in the rush to decarbonise?

As investors divest from fossil fuels, others are stepping in, and the result is not lower emissions from the hydrocarbon industry

-

Special Report

Special ReportTowards Net Zero: COP26 and Beyond for Institutional Investors

The term Net Zero is becoming entrenched in political and business life as governments, banks, insurers, asset owners and, not least, corporates sign up to demanding pledges to reduce carbon emissions in the service of limiting global temperature rises to within 1.5C. Our extensive Special Report looks at Net Zero through an institutional lens, talking to leading pension funds about their climate related commitments, but covering also areas like carbon pricing, portfolio transition, blended finance and the latest investment research