All ETFs Guide articles – Page 6

-

Special Report

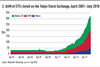

Special ReportMarkets & regions: The dynamic market in Japanese equity ETFs

Opinions of Japan as a market tend to be quite polarised and the country has looked cheap on a valuation basis for quite some time, both historically and relatively

-

Special Report

New frontiers: Esoteric ETFs – egregious or genius?

From companies capitalising on cannabis decriminalisation to the streaming of Quincy Jones’s music, you can almost guarantee there is an ETF available to enable you to invest in it

-

Special Report

Markets & regions: Spotlight on US equities

US equities have proven overwhelmingly popular with investors desperate for signs of economic growth

-

Special Report

Special ReportThe market: Understanding the ETF landscape and flows in Europe

April 2018 marked the 18th anniversary of the listing of the first ETF in Europe. Although no longer a new product, their growth rate continues to be impressive

-

Special Report

Special ReportFixed income: The growing world of fixed income ETFs

The fixed income ETFs market has experienced rapid growth in recent years as more investors are now finding a role for them in their portfolios

-

Special Report

Markets & regions: Using ETFs to position for a US–China trade war

Many media and market commentators believe that the potential US-China trade war could be one of the largest risks facing the global economy

-

Special Report

The market: Transatlantic invasion

The Americans are coming! But unlike the US cavalry providing an 11th-hour rescue in the last reel of an old-time Western, these Americans are moving in on what they hope will be a lucrative European ETF market

-

Special Report

Regulation: Spotlight on liquidity, transparency and viability

ETFs may represent a tiny speck on the overall investment landscape but they are one of the fastest-growing products in the investment industry

-

Special Report

The market: Tools in tune with the zeitgeist

2018 marks the year that exchange-traded funds (ETFs) dedicated to tracking environmental, social and governance (ESG) issues truly became mainstream

-

Special Report

Active ETFs’ disclosure challenge

Active ETFs are still getting off the ground, representing just over 1% of the worldwide ETF market. Nevertheless, they are the focus of intense interest

-

Special Report

Global regulators take another look at ETFs

The rapid growth of ETFs globally means that we are seeing increased official scrutiny of the sector

-

Special Report

Attractiveness of local currency emerging market debt

Emerging market debt has become a core part of many investors’portfolios. Yet this asset class has also evolved rapidly

-

Special Report

How big can the ETF market become?

Assets worldwide in exchange-traded funds (ETFs) are on a seemingly unstoppable growth path. Can anything halt ETFs’ progress?

-

Special Report

What makes the best ETF?

What makes the best ETF for one investor will be very different for another

-

Special Report

Creating value through smart beta ETFs: myth or reality?

Smart beta ETFs can allow investors to benefit from the many positive attributes of both traditional passive and active strategies

-

Special Report

How to crack the big three in European ETFs

Both the US and European ETF markets are dominated by a few key providers

-

Special Report

The next generation bond market

Fixed-income markets have undergone significant structural changes since the 2008 financial crisis. These seismic shifts are forcing investors to adapt to a new market paradigm

-

Special Report

Special ReportETFs: The test is yet to come

With assets already surpassing the $4trn mark, ETFs are an undoubted success in the constellation of asset management products

-

Special Report

Will ETF issuers create their own indices?

ETF providers are becoming attracted to the idea of developing bespoke indices and saving on licence fees

-

Special Report

How cyclical are your factor indices?

The composition and weight of stocks in factor indices can differ significantly from one index provider to another