ETFs – Page 3

-

Special Report

Special ReportActive ETFs: mixed fortunes

Tax efficiency and regulatory change have been the key drivers of the development of active exchange-traded funds in the US. As there are no similar tax benefits nor regulatory change in Europe, growth in this region has been limited.

-

Special Report

Special ReportAdding to the biodiversity protection toolbox

Biodiversity is intricately linked with economic growth and development. Since the industrial revolution ecosystems have been under constant threat with the advent of large towns, cities and industrial complexes. The rate of deterioration has accelerated over time and we are now destroying natural capital at an unprecedented rate, which will have long-term consequences for economies, societies and the planet.

-

Special Report

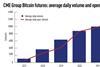

Special ReportCrypto ETFs: exploring the keys to mass adoption

The ProShares Bitcoin Strategy ETF (BITO) made history last October as one of the strongest ever ETF launches, amassing more than $1bn (€1bn) in assets in just two days.

-

Special Report

Special ReportTo Paris and beyond: capturing energy transition and climate investment opportunities with ETFs

The climate emergency is arguably the greatest challenge of our lifetimes. We must use every tool at our disposal – including financial – to stand any chance of success. Thankfully, investors are ever more aware that incorporating climate in their portfolios can help them manage asset-specific risk, access opportunities from the shift to clean energy and achieve something meaningful with their money. And they are ever more aware they can do it in flexible, cost-effective ways.

-

Special Report

Special ReportNew kids on the ETF block

Inflows into exchange-traded funds (ETFs) may have taken a hit in the latest bout of market turmoil, but this is not expected to deter new entrants from joining the fray. It is always challenging to break into a new market, especially one dominated by a handful of firms but, those players with innovative, specialised solutions and strategies are expected to make their mark.

-

Special Report

Special ReportFrom seed investor to prospective investor: the case for ETFs

Investor & manager trends

-

Special Report

Legal and regulatory developments: EU plays catch-up

While the European framework for establishing ETFs has not changed substantially in recent times, developments within the legislative bodies of the EU present a number of current and potential hurdles for ETFs in the short to medium term. This article will look at each legal development in turn. It is also important to note that the COVID-19 pandemic has highlighted a number of areas that need to be strengthened.

-

Special Report

Special ReportHow green are green derivatives?

On 6 April 2022 the European Commission announced that derivatives, including futures, swaps and many other instruments routinely used by ETF providers, cannot be classified as ESG or sustainable or green in investment fund reports.

-

Special Report

RFQ platforms and the institutional ETF trading revolution

What do ETFs, RFQ and ESG all have in common? Aside from being some of the most popular acronyms in the history of financial services, the three-letter abbreviations for exchange-traded funds (ETF), electronic request-for-quote (RFQ) trading, and environmental, social and governance (ESG) driven investing, have all come together at the centre of a revolution in asset management.

-

Special Report

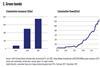

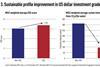

Special ReportWhy investors use sustainable fixed income ETFs

Sustainable fixed income investing is growing at a rapid rate as investors increasingly seek to address climate risks, meet new regulations, and adapt to new investment preferences. The majority of investors who are choosing indexed exposures to build their sustainable portfolios are currently following SRI indices, with 93% of AUM in sustainable fixed income UCITS ETFs tracking such indices.

-

Special Report

Special ReportETFs offer a firmer footing in shifting sands

The ETF market has experienced a sea change over the past few months. While net inflows of $463.8bn (€463.8bn) into ETFs and ETPs listed globally during the first half of 2022 are the second highest on record, the total value of assets in these products fell from $10.3trn at end-2021 to $8.9trn at the end of June 2022, according to research firm and consultancy ETFGI. There was a 6.4% fall in value during May alone.

-

Special Report

Special ReportPost-Brexit flux in Europe

Although Brexit has changed the dynamics of the European asset management landscape, the checklist for choosing a location for an exchange-traded fund (ETF) has not altered: a solid legislative foundation, requisite skillsets, favourable tax treatment and cross-border distribution acumen.

-

Special Report

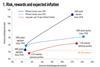

Special ReportInflation: expectations … and reality

In 2022, inflation surprised only on the upside, and surrounding economic conditions became increasingly uncertain. As short-term inflationary pressure has moderately spilled into inflation expectations – 10-year German inflation breakevens rose from 0.5% to more than 2% in 24 months1 – our DWS Long View capital market expectations for the next decade remain below historical averages.

-

Special Report

Special ReportTransparency: getting it taped

It’s much harder for European ETF investors to get detailed information on liquidity, volumes and best execution than it is for their US counterparts. That’s because this data isn’t aggregated into a consolidated tape as it is on the other side of the Atlantic.

-

News

New thematic ETFs seen increasingly as active investment vehicles

Investors also keen to see more focus on social issues, according to poll

-

News

Thermal coal mining bond in ESG ETF but now sold, data coverage rectified

Bond was issued by SPV that was initially not linked to the parent, Siberian Coal Energy JSC

-

News

BlackRock: Institutions to help drive global bond ETFs to $5trn by 2030

Asset manager upgrades forecast ‘despite the most challenging fixed income market in decades’

-

News

Varma gains €300m exposure to low-emission Japanese stocks via tailored ETF

Finnish pensions firm seeds Nomura-run exchange-traded fund amid low availability of ESG ETFs in Japan

-

News

Amundi sets out post-Lyxor acquisition AUM aims

Lyxor is now a subsidiary of Amundi and in a second phase will be merged into Amundi

-

Special Report

Special ReportFrom fixed weights to all-weather: rethinking the 60/30/10 portfolio

In the current environment of low interest rates, policy uncertainty, large dispersion of global growth outlooks and gyrating equity markets, asset allocation is one of the foremost considerations for investors. Fixed weight portfolios such as the 60/40 portfolio (ie, 60% equities and 40% fixed income) have been widely used – the main benefits being their conceptual simplicity, ease of implementation and, historically, the diversification benefits across equity and fixed income returns.