Fixed Income – Page 15

-

Asset Class Reports

Asset Class ReportsFixed income – New beginning for bond investors

A painful 2022 for fixed income means attractive opportunities and a possible normalisation in risk and return

-

Asset Class Reports

Asset Class ReportsFixed income – Convertible bonds return to favour

After a long period in the wilderness, convertible bond issuance is coming back to life

-

Features

FeaturesFixed income, rates & currency: Chill winds prompt caution

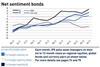

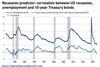

Although 2022 was a remarkably bad year for bonds and equities, any hopes that 2023 might illuminate a brighter path have already been dispelled as rapidly changing narratives – from recession to boom to fears of a banking crisis – all tossed and turned stock and rates markets. The result was a remarkably turbulent first quarter.

-

Asset Class Reports

Asset Class ReportsFixed income – Europe's investment-grade market makes a comeback

Investors are showing tentative signs of interest as spreads tighten

-

Asset Class Reports

Asset Class ReportsPortfolio strategy – Fixed income

Last year ushered in a new era for global fixed income and credit markets. It was the worst, in terms of returns, for bond investors in years, but it signalled a regime change. Investors need to be prepared for structurally higher inflation and rates, as well as higher volatility. But for fixed income managers, this is an environment where value is easier to find. Our report looks at this new beginning for fixed income investors, and at how selectivity has become key in the high yield and loan markets.

-

Asset Class Reports

Asset Class ReportsFixed income – A year for selectivity in high yield and loans

Patience might prove the be the watchword for the rest of 2023 in high yield

-

News

NewsEvonik pension scheme to hike fixed income investments

The scheme plans a 10% increase in bond investments to 30%

-

News

NewsInvestors appeal against FINMA’s order to write down AT1 bonds in Credit Suisse/UBS deal

The formal complaint was filed before the St-Gallen-based Federal Administrative Court on 18 April by law firm Quinn Emanuel Urquhart & Sullivan

-

Features

FeaturesIPE Quest Expectations Indicator April 2023

With new, superior equipment, the Ukrainian military is set to start an offensive soon. Meanwhile, Yevgeny Prigozhin, leader of the Wagner Group, is jockeying to become Russia’s next kleptocrat on the back of the Russian army. Donald Trump’s candidacy is increasingly beleaguered by defeats in court. The trade agreement on Northern Ireland between the EU and the UK is a significant boon for both as well as for Prime Minister Rishi Sunak, not because the trade flows are so important but because the issue blocked co-operation in many other fields. While the winter has been mild and beneficial, there are early signs of a dry spring, quite possible in view of climate change setting in. If that materialises, harvests, therefore food prices, will be affected in autumn.

-

Features

FeaturesAhead of the curve: Introducing the concept of a carbon risk-free curve

As global investors and companies progress towards their net-zero emissions targets, the concept of a carbon risk-free curve becomes increasingly relevant within the fixed-income market. In our view, this curve should provide a reference for evaluating the risk levels of bonds in relation to their issuers’ CO₂-equivalent (CO₂e) emissions and can therefore help investors to assess the impact of changes in CO₂e emissions on the yield spread of fixed-income bonds.

-

Opinion Pieces

Opinion PiecesAustralia: Super funds shift to fixed income

With fear of recession in Australia and globally, superannuation funds have gone into defensive mode. Cash and liquidity are two key considerations for CIOs, and some are waiting to take advantage of attractive market opportunities.

-

Features

FeaturesFixed income, rates & currency: Optimism fades on mixed data

January’s market optimism has been subsiding, as forecasts for inflation and US Federal Reserve policy shift the outlook further to the hawkish side. However, the macro picture is not clear. Markets hang on to every new piece of data to clarify the outlook, be it non-farm payrolls, the consumer price index (CPI) or the US Job Openings and Labor Turnover Survey (JOLTS).

-

News

NewsPension funds consider suing FINMA for AT1 bonds write down

Investors have the legal right to challenge FINMA in court within 30 days from the day the Swiss financial market supervisory authority took the decision

-

News

NewsMigros Pensionskasse takes CHF100m loss from Credit Suisse AT1 bonds

MPK is examining the possibility of taking legal action for the losses resulting from FINMA’s decision

-

News

NewsEmergency rules trigger AT1 bonds write down in UBS/Credit Suisse deal

Pension funds holding AT1 bonds, also referred to as CoCo bonds, can suffer losses as a consequence of the decision taken by FINMA

-

News

NewsDutch pension fund tenders €1bn mandate via IPE Quest

Plus: A pension fund based in Switzerland is looking for an investment product that invests in long maturity Swiss non-government bonds

-

Opinion Pieces

Opinion PiecesViewpoint: The power of prioritisation

When you can’t decide on return and risk, you think of the window of light

-

Features

FeaturesIPE Quest Expectations Indicator March 2023

The next Ukrainian offensive will be in April at the earliest, as modern tanks will have arrived by then. US Republican pushback of ESG and climate-related investments are a new bone of contention in relations with the EU, already strained by the Trump presidency, and a bad sign for US-EU co-operation on China policy, an issue Japan seems to be ducking successfully. Aided by a soft winter, EU energy concerns have become quite manageable.

-

Asset Class Reports

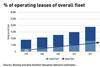

Asset Class ReportsPrivate debt: Leases make plane sense after COVID

With plenty of pent-up demand for air travel, aeroplane operating leases may be an attractive investment option

-

Asset Class Reports

Private debt: European markets try to power ahead

Private debt in Europe is still feeling the impact of the war in Ukraine and the surge in inflation, but there are reasons for optimism