Fixed Income – Page 17

-

Features

FeaturesFixed income, rates & currency: Recessions - but when?

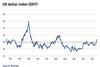

With the fourth consecutive 75bps hike in rates delivered in November, US Federal Reserve chair Jerome Powell suggested that the pace of the hikes might be slowed in the coming months (so slightly dovish), but then said that the terminal rate and how long it would be held was more important than the speed of tightening (back to hawkish). The initial dollar sell-off was unwound by the end of the press conference.

-

News

Norway liquidates crisis bond fund despite resurgence of high rates

Folketrygdfondet announces gradual shutdown of Government Bond Fund, set up in 2020 to help lockdown-hit Norwegian companies

-

Opinion Pieces

Opinion PiecesViewpoint: Asset allocation – factoring inflation

As inflation keeps beating records, real incomes remain under pressure and the standard approaches to diversification are challenged

-

Features

FeaturesUK sovereign debt in turbulent waters as challenges remain

The buttoned-up Gilts market has never seen or done anything like it. Trusty stalwart of liability matching for defined benefit (DB) pension schemes, the blue-chip security has already poleaxed a British chancellor of the exchequer just a month in office, and has effectively done the same to prime minister Liz Truss.

-

Features

FeaturesFixed income, rates & currency: The return of extreme volatility

The emergency measures swiftly enacted by policymakers and central banks in March 2020, as we locked our communities, schools and businesses down, unsurprisingly created huge volatility in financial markets.

-

Opinion Pieces

Opinion PiecesAn uncertain outlook for UK pension journey plans

Following the Bank of England’s (BoE) emergency intervention announced on 28 September to stem the sell-off of long-dated UK government bonds, UK defined benefit (DB) pension funds were kept busy, as falling Gilt prices over the past weeks caused mark-to-market losses in liability-driven investment (LDI) strategies.

-

News

NewsUK pensions committee launches inquiry into DB schemes with LDI

Inquiry will focus on impact of recent volatility in Gilt yields on DB schemes with LDI strategies and their regulation and governance

-

News

UK pensions industry to keep vigilant despite stable bond yields following ‘mini budget’ u-turn

The near-term technical picture is not a positive one, says Hymans Robertson

-

News

Danish PFs: UK LDI fright shows need for stress tests, central clearing rethink

Sampension, PFA CIOs say UK-style crisis less likely in Denmark because of larger, more liquid euro market

-

News

DB pension schemes ‘are not at risk of collapse’, says TPR

Regulator’s CEO says ‘it is absolutely clear that there have been liquidity issues in some of the funds’

-

News

NewsPPF’s 7800 index October update shows increase in aggregate surplus

An improved funding position has made insurance more affordable, opening up new opportunities for schemes to pursue derisking activity, says Standard Life

-

News

Swiss Federal Council keeps interest rate on pension assets at 1% as bond yields rise

The increase of yields on Swiss bonds played an essential role in the decision

-

News

NewsBank of England keeps tight grip on Gilts market

The purpose of these operations is to enable LDI funds to address risks to their resilience from volatility in the long-dated Gilt market

-

News

NewsScottish Widows backs BlackRock’s ESG bond fund with £500m

This is the second fund that BlackRock has built in consultation with Scottish Widows

-

News

Bank of England launches additional measures to help LDI market

LDI will continue to play a role in pension fund strategies despite market turmoil

-

News

NewsCCLA launches global company mental health benchmark

Plus: Federated Hermes appointed for pair of fixed income mandates

-

News

NewsSustainable finance roundup: Redington’s research on climate-related commitment

Plus: Smart Pension and AXA IM in biodiversity partnership; Finnfund creates framework for sustainability bond issuance; German sustainable finance committee sets up priorities

-

Features

FeaturesFixed income, rates & currency: Central banks act tough

This year’s Jackson Hole Symposium, an annual high-level event sponsored by the Reserve Bank of Kansas, yielded relatively little policy news. But the fighting talk from the US Federal Reserve and others was striking. Fed chair Jerome Powell’s speech was markedly more hawkish than expected, while Isabel Schnabel, board member of the European Central Bank, referred to the need for central banks to act ‘forcefully’ because “both the likelihood and the cost of current high inflation becoming entrenched in expectations are uncomfortably high”.

-

Asset Class Reports

Asset Class ReportsEmerging market debt: China government bonds

The outlook for Chinese government debt is looking less attractive

-

Asset Class Reports

Asset Class ReportsEmerging market debt: managers face choppy waters

Some see opportunities as investors have exited the asset class but emerging economies continue to face divergent trajectories