Fixed Income – Page 18

-

Asset Class Reports

Asset Class ReportsEmerging market debt report

This year has seen hefty losses on the main emerging market debt indices, in both hard and local currency denominated bonds. Investors are left assessing whether these price moves are justified. Or has the market overreacted to US rate rises and the war in Ukraine, leaving markets as a whole underpriced?

-

Interviews

InterviewsOn the record: Emerging market debt

At a time of high volatility in interest rates, currencies and GDP, two seasoned investors in emerging market debt discuss their approaches

-

Special Report

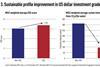

Special ReportWhy investors use sustainable fixed income ETFs

Sustainable fixed income investing is growing at a rapid rate as investors increasingly seek to address climate risks, meet new regulations, and adapt to new investment preferences. The majority of investors who are choosing indexed exposures to build their sustainable portfolios are currently following SRI indices, with 93% of AUM in sustainable fixed income UCITS ETFs tracking such indices.

-

Special Report

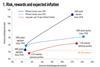

Special ReportInflation: expectations … and reality

In 2022, inflation surprised only on the upside, and surrounding economic conditions became increasingly uncertain. As short-term inflationary pressure has moderately spilled into inflation expectations – 10-year German inflation breakevens rose from 0.5% to more than 2% in 24 months1 – our DWS Long View capital market expectations for the next decade remain below historical averages.

-

Features

FeaturesMarket overview: German institutional investors manage uncertainty

At mid-year 2022, the volume of Spezialfonds – the German vehicle for professional investors – administered on Universal Investment’s platform was €498bn, a rise of around 5% year on year. On a six-month basis, however, and compared with the end of the booming stock year 2021, asset volumes were down around 3%.

-

Analysis

AnalysisAnalysis: Goodbye, LDI? Too early to say

The sudden and unprecedented rise in Gilt yields, caused by the UK government massive fiscal stimulus announcement, tested the risk management strategies of UK DB schemes

-

News

Mandate roundup: Swiss scheme tenders CHF2.6bn in equities, bonds

Plus: APK seeks manager for CHF240m small, mid-cap equity mandate; Swiss Investor issues $150m infrastructure brief

-

News

NewsBank of England intervention eases pressure on DB schemes facing margin calls

Pension funds should proactively look for ways to shore up liquidity, says consultancy

-

News

Consultants call on UK trustees to study impact of borrowing costs

‘Rising borrowing costs are bad news for corporate Britain,’ says LCP

-

News

Publica in talks with large pension funds for co-investments in infrastructure

Publica’s board decided to reduce its fixed income allocation as part of its new strategy

-

News

Corporate pension fund tenders mandates over €500m

Plus: Insurer in The Netherlands seeks EM manager for €250m brief

-

News

Inarcassa shifts to corporate bonds with higher ESG rating

This summer the scheme recorded returns of -7% amid increased volatility in financial markets

-

News

Dutch pension funds sell €88bn in assets in rebalancing exercise

It is the biggest asset sale by pension funds in the country in any six-month period

-

News

APK issues corporate bonds mandates worth €750m

Also: institutional investor based in Switzerland seeks manager for AUD290m fixed income brief

-

Features

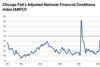

FeaturesFixed income, rates & currency: defying historical norms

Another US jobs report comes in significantly above consensus. Its across-the-board strength, upward revisions to previous reports, and an unemployment rate at the lowest level since 1963, may indicate that the economy is not quite as near recession as previously surmised. And with inflation still rising, albeit slightly less fast than expected, the outlook remains cloudy.

-

News

Dutch agri fund sells lower-rated govvies

By reducing or eliminating its allocation to countries such as France and Italy, BPL Pensioen wants to prevent excessive exposure to highly indebted countries

-

News

FTSE Russell launches sustainable investment fixed income indices

The indices are designed for investors seeking to integrate their sustainable investment strategy into their fixed income investments

-

News

NewsFondazione Enasarco to invest €500m in Italian bonds

One of the goals of the new strategy was is to cut real estate and increase exposure to liquid asset classes such as bonds and equities

-

News

AXA Switzerland issues $200m leveraged loans tender

Plus: Corporate scheme seeks manager for large-cap equity

-

News

Cometa picks AXA, Amundi as new asset managers in overhaul worth €11bn

The move follows a review of its investment policy leading to an increase of the risk profile of its three sub-funds while maintaining a prudent approach