Fixed Income – Page 19

-

News

NewsSwiss corporates post over 20% drop in pension liabilities so far this year

The decrease in the two quarters was caused by rising discount rates and corporate bond yields, WTW explained

-

News

NewsAPK issues equity mandate worth up to $240m via IPE Quest

Plus: a pension fund in Switzerland and another in Germany tender more than €1.2bn in equities and bonds mandates

-

News

NewsValida introduces inflation-linked bonds with new strategy

Pensionskasse and Vorsorgekasse both increase its equity allocation but made cuts to euro zone government bonds, among other things

-

News

Bond volatility demands UK schemes prepare for urgent action, says Aon

The situation has arisen because the bond market has repriced rapidly

-

News

Top business school proves ESG does not harm corporate bond portfolios

Academic evidence can give comfort to bond investors, says Insight Investment RI chief

-

News

BT Pension Scheme unveils 25% carbon reduction targets

Reducing exposure to carbon emissions over time will improve the scheme’s stability and predictability of its investment outcomes

-

-

Features

FeaturesIPE-Quest Expectations Indicator commentary August 2022

The war in Ukraine has reached stalemate. Neither party is capable of a surprise win, but time works against Russia. Can Zelensky keep the army motivated to continue? A long, hot European summer

-

Features

FeaturesFixed income, rates & currency: inflation battle in full swing

As we reach the midpoint of the year, there is little sign that the second half of 2022 will be any less turbulent than the first. The conflict in Ukraine slogs on – a destructive war of attrition, pain and fear. The repercussions are huge, global and unpredictable, be they surging energy prices or impending, but acute, shortages of basic foodstuffs, or of semi-conductors, so vital to 21st century life.

-

Asset Class Reports

Asset Class ReportsCredit: Inflation and the bond markets

Risks look likely to be building in credit as central banks wreak collateral damage on economies in their bid to tame inflation

-

News

New thematic ETFs seen increasingly as active investment vehicles

Investors also keen to see more focus on social issues, according to poll

-

Opinion Pieces

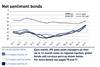

Opinion PiecesViewpoint: Where now for the stock/bond correlation?

This key portfolio parameter may be changing due to challenging market conditions

-

News

NewsItalian pension schemes continue to trim bond investments

COVIP report shows investments in government bonds decreased from 37.3% to 35.5%

-

Features

FeaturesIPE-Quest Expectations Indicator commentary June 2022

The longer Russia refuses to make concessions, the more it loses, both in territory and in ‘face’. The Russian army has suffered even more loss of face than the Russian government. Analysts believe Europe and the UK now run the most risk. Perhaps, but in a post-war environment, they stand to gain most from reconstruction works in the Ukraine as well as the energy transition speeding up at home.

-

Features

FeaturesFixed income, rates & currency: disappearing safe havens

Risk markets have been having a torrid time of late. ‘Risk-free’ government bond markets are not providing any safe havens in these storms, with curves steepening and considerable volatility in longer rates.

-

News

NewsMandate roundup: Benelux investor tenders €300m EM all-caps brief via Quest

ESG bond, commodities and Canadian equity mandates add to live tenders on IPE Quest

-

Opinion Pieces

Opinion PiecesViewpoint: Swap spreads at stress levels

Asset swap (ASW) spreads are currently trading at historically high levels as volatility in rates markets has remained high. We believe there is an opportunity for continental European pension funds to enter into Euribor receiver swaps and sell Bunds in their matching portfolio. Indeed, we expect that the peak in ...

-

News

Thermal coal mining bond in ESG ETF but now sold, data coverage rectified

Bond was issued by SPV that was initially not linked to the parent, Siberian Coal Energy JSC

-

News

BlackRock: Institutions to help drive global bond ETFs to $5trn by 2030

Asset manager upgrades forecast ‘despite the most challenging fixed income market in decades’

-

News

NewsMandate roundup: Swiss pension fund seeks manager for index strategies

Plus: Italian scheme signs up to BNP Paribas’ ESG platform; Mercer wins OCIO contract